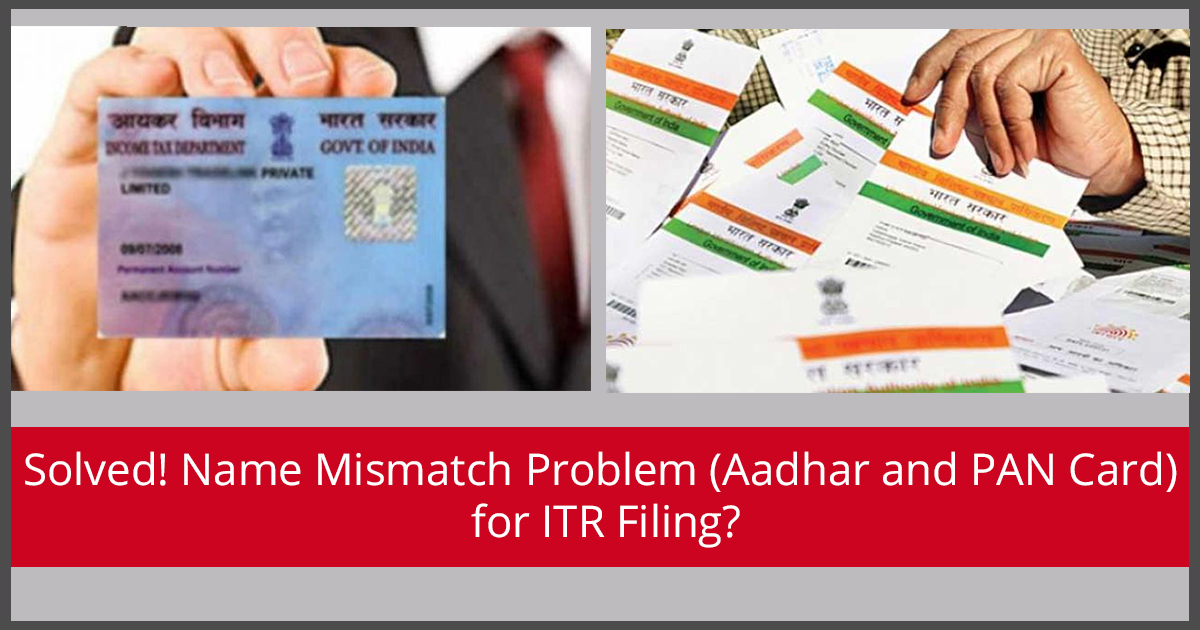

A general issue regarding the mismatch in names occurring in the PAN card and Aadhaar card has been surging day by day as in the common process to link the Aadhaar card to the tax return file, the issue of name mismatch recurs in every taxpayer application.

As the government has mandated the linking of Aadhaar cards while filing income tax returns, the issue has been stagnant if you are unable to link PAN with Aadhaar for a while and to revoke the issue, the government has summed up solutions regarding the name mismatch problem and has ordered that if any name mismatch occurrence persists, the taxpayer can have the option to attach a scanned copy of his her PAN card with the file.

Latest Update

- Individual PAN registration on the official e-filing portal is now mandatory, with Aadhaar-based OTP verification. View more

- The income tax department issued a reminder notification regarding linking PAN with Aadhaar by May 31, 2024, to taxpayers who have not yet done so. Consequences of not linking PAN with Aadhaar within 31st May 2024 lead to the deduction of TCS/TDS at a higher rate under Sections 206AA and 206CC of the Income Tax Act due to having an inoperative PAN for the transaction done before 31 March 2024.

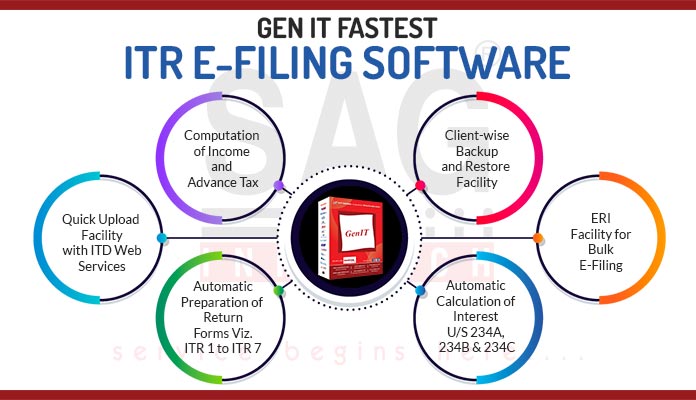

Free Demo for Best ITR Filing Software

These are the following Important Steps to Link Aadhaar with PAN Card

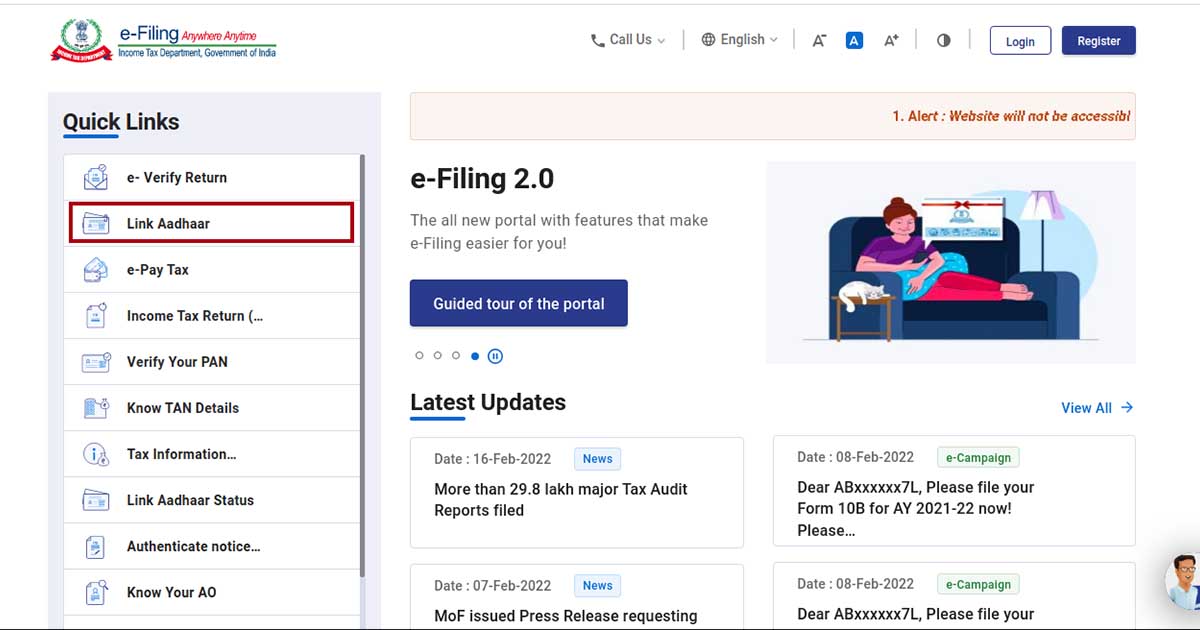

The Income Tax Department has disclosed how to Link PAN with Aadhaar in just simple steps. In fact, it doesn’t require login or registration at the e-filing website. Anyone can avail of this facility and link their Aadhaar with their PAN. Just follow the simple steps given below and link your Aadhaar with your PAN:-

Step 1: Visit www.incometaxindiaefiling.gov.in and click on the left-hand side of the website under the Services menu> Link Aadhaar.

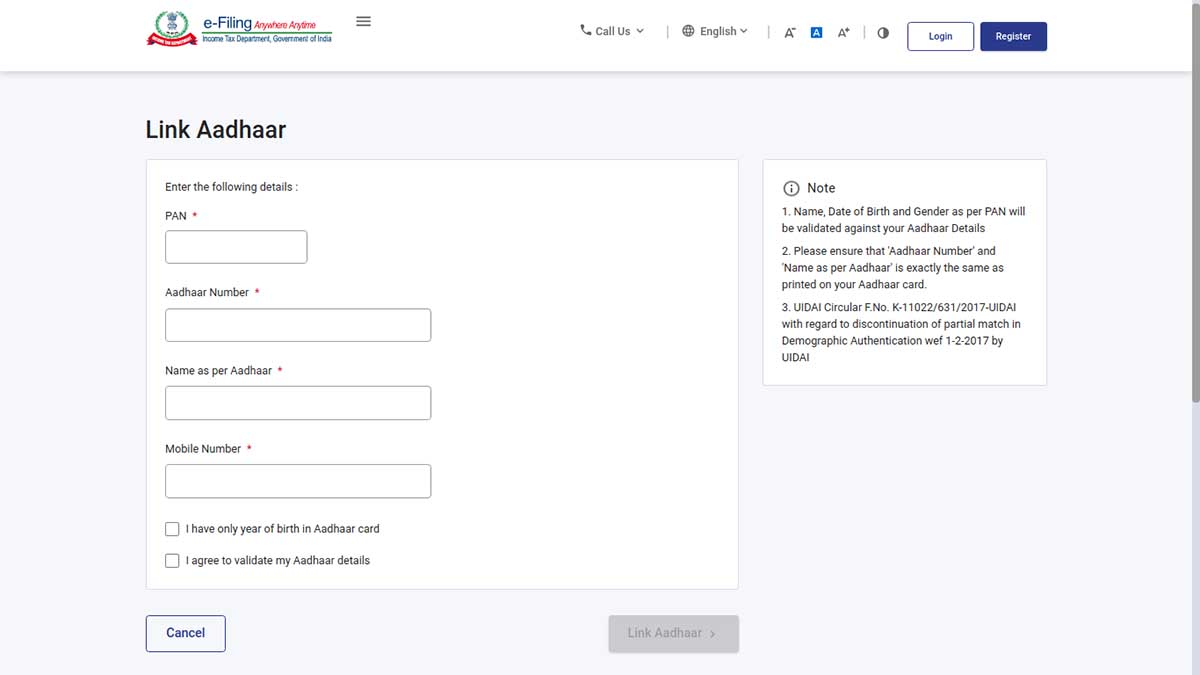

Step 2: Mentioned the required details, PAN number, Aadhaar number, and name, must ensure that you have to ENTER NAME EXACTLY AS GIVEN IN AADHAAR CARD (avoid spelling mistakes) and submit.

UIDAI is the government website for Aadhaar. After the verification from UIDAI, the linking will automatically be confirmed.

Step 3: If in a case there is any slight difference between the Aadhaar name provided by the taxpayer as compared to the actual name in Aadhaar. A One-Time Password (Aadhaar OTP) will be sent to the registered mobile number with Aadhaar. Taxpayers or candidates must be sure that the date of birth and gender in PAN and Aadhaar are exactly the same.

If in a case, the Aadhaar name must ensure that you have ENTER NAME EXACTLY AS GIVEN IN AADHAAR CARD (avoid spelling mistakes) and submit.

Apart from this, the government authority has also proposed to include a column on the official website of the tax department in which a link will be provided to link the Aadhaar card by which an OTP will be generated in any name mismatch scenario occurs.

The OTP will come through the text message on the registered mobile number of the taxpayer and after entering the received OTP on the portal, the linking will be established between the Aadhaar card and the PAN card. The only condition which will fulfil this service is that the birth date must be the same on both cards in order to finalise the linking process.

Step 4: After filling out all the details and the Aadhaar number, the system will show the message if in case your Aadhaar is linked with the PAN.

Read Also: Simple Steps for Filling New PAN Card Application Online

The name mismatch issue was persistent after the union minister Arun Jaitley proposed in the financial bills of GST to mandate the linking of Aadhaar cards in every filing of tax returns. Some of the common issues regarding the linking of the PAN card to the Aadhar card are, special character recognition, in which the Aadhaar card is unable to recognize any special while on the same side PAN card is able to recognize special characters.

The second issue in the row comes as the initial recognition in which the Aadhaar card is unable to recognize the initials whereas the PAN card takes the initials. Finally, the point of the middle name is also prevalent in the mismatch issue, as the Indian community changes the surname after marriage especially females, which in turn gives rise to the name mismatch.

One must remember, that the linking of both an Aadhaar card and a PAN card is only eligible in the case of name mismatch, which is when the birth date of the individual is mentioned the same on both government IDs. This has been mandated by the government as it will help in identifying the taxpayer’s identity on a firm basis.

Who all are Exempted from Linking Aadhaar Card and PAN

According to the central government and supreme court orders, there is a necessity for the linking of Aadhaar and PAN as also notified in the income tax department rules and regulations. Section 139AA was held by the court while the central board of Excise and Customs also released a notification mentioning all the exempted entities for the linking.

The following list specifies the exempted individuals on which section 139AA is not applicable:

- Those categorised as Non-resident Indians as per the Income Tax Laws

- Not a citizen of India

- Is of age 80 years or more at any time during the tax year

- Residents of the states of Assam, Meghalaya and Jammu and Kashmir

Most Important Reasons to Link Your PAN Card with Aadhaar

The Government of India has made it mandatory to link your Aadhaar with your other identities. Taxpayers who do not link their PAN card with their Aadhaar will be liable for all penalties under the Act for failing to link their PAN, and their PAN will no longer be valid after that.

But the thought may have struck your mind that you have been using your PAN card and suddenly need to link it with your Aadhaar. Well, here are the top 10 reasons why you should link your PAN with your Aadhaar.

Abide by the Law

The Government of India has made it mandatory to link your PAN card with an Aadhaar card under Section 139AA of the Income Tax Act, 1961.

Avoid Tax Penalties

If you do not link your Permanent Account Number (PAN) card with an Aadhaar card, you may be imposed with several charges and penalties like deactivation of your PAN card and a penalty of up to Rs. 1,000.

Makes the Verification Process Easy

Aadhaar is every Indian citizen’s unique identity, and it is accepted at all government portals. Tax authorities can easily verify the authenticity of the taxpayer if his or her PAN is linked with Aadhaar.

Helps Authorities Stop Tax Evasion

Having taxpayers’ PAN cards linked with their Aadhaar cards helps authorities prevent tax evasion by evaders. It makes certain that all taxpayers have their unique identification number, and it will be easy for them to track who is not paying the tax.

Speed up Your KYC Process

KYC is mandatory to avail of various financial services, like online transactions, UPI transactions, or personal loans. Linking your PAN with your Aadhaar makes the process of KYC updation easy and fast.

Make Tax Filing Easy

Linking your PAN card with an Aadhar card can ease the process of tax filing for you. Because it will pre-file your details in the Income Tax Return form or fetch details automatically.

Avail Various Governmental Services Easily

Government schemes and services require an Aadhar card to avail. It may make it necessary for all other services to have your PAN card linked with your Aadhaar card down the line. If you meet this prerequisite by linking your PAN card with your Aadhaar card, you can easily access various government services.

Easy to Make All Financial Transactions

After linking your PAN card with your Aadhaar, you can easily carry out various financial transactions. You are always asked to provide your PAN card when opening a bank account, making investments, and applying for loans.

Helps in Authenticating Identity

You can authenticate your identity easily, and you can also prevent identity theft by linking your PAN card with your Aadhar card.

Avoiding Duplication

It has happened so many times that a PAN with the same details has been mistakenly provided to two individuals. It’s a common problem brought on by many people possessing duplicate PAN cards. The misuse can be prevented by linking your PAN card to your Aadhar card.