The industry is supporting the passive enforcement of new goods and services tax return (GSTR) system. These simplified returns are planned to come into effect at the starting of next Fiscal year.

Considering the complaints regarding the complexity of current return systems, to buckle down the issue, the GST council came up new GSTR filing system and easier returns which were to be implemented from October, this year.

Businesses have given their feedback to the government, seeking the permanence of a four-digit harmonized system of nomenclature (HSN) code. Under the new return system, one main form — GST RET-1 would replace the two forms GSTR-1 and GSTR-3B, which are currently used under the existing GST return mechanism.

One crucial form GST RET-1 will be an all-inclusive form with details about all the supplies made, taxes paid and ITC claimed. This return will contain dual annexures, namely, GST ANX-1 and GST ANX-2

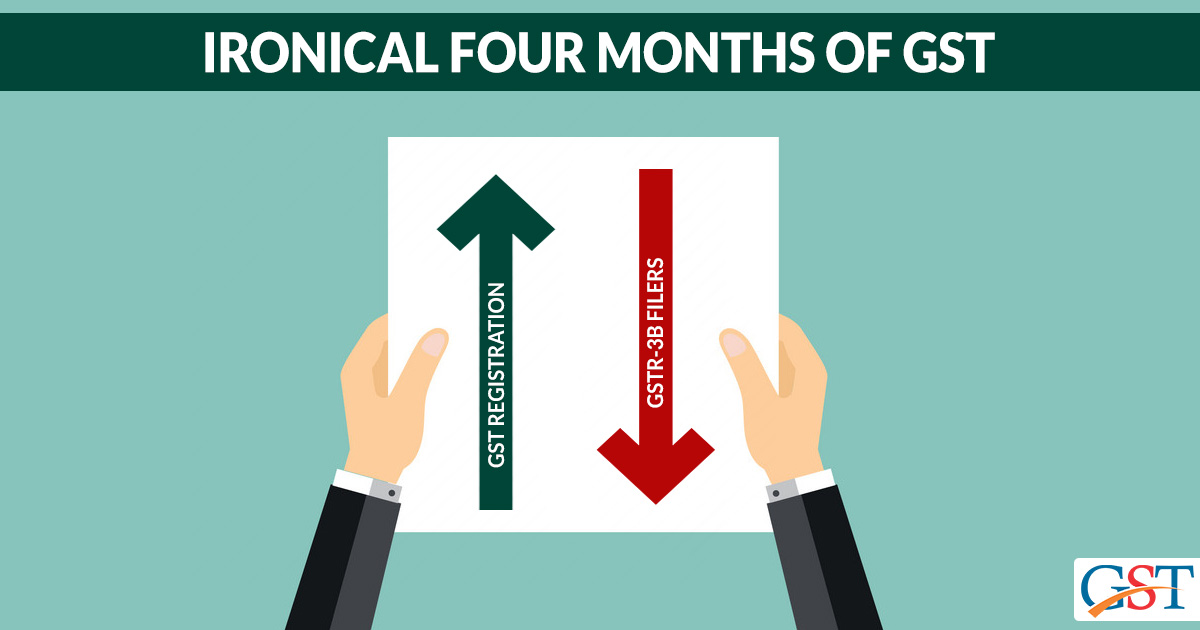

Under the current system, two GST returns are there which reflects all such details. Where GSTR-1 encompasses the details of all outward supplies, GSTR-3B which is a monthly return, reflects self-declaration of outward supplies, taxes paid and input tax credit claimed.

In the beginning, businessmen were worried about the stagnation of their cash flow because of the availability of Input Tax Credit on only those transactions whose invoices are uploaded by dealers and taxes are laid-off. the Government of India (GOI) resolved this problem by permitting businesses to claim the input tax credit (ITC) based on self-declarations in GSTR-3B

Industrialists are demanding the filing of ANX-1 and ANX-2 forms only at the initial level alongside GSTR-3B which is in use under the current system. According to them, RET-1 filing should be made mandatory once the industry is acclimated with the filing of ANX-1 and ANX-2 and GSTR-3B is snuffed out completely.

The New GST return filing system

According to Abhishek Jain, the tax partner at EY, the existing HSN code reporting system should be continued. Under the new HSN format, companies would have to revise the HSN code for all the goods and services and revamp their ERP configuration which is a time and effort consuming task.

“The taxpayers need to very quickly align their ERP and business processes to meet these requirements as the government proposes to introduce the new return format effective April one, 2020,” he stated.

Harpreet Singh, the partner at KPMG, shared his views on the issue of HSN based reporting of imports & exports. He proposed for the combined bill of entry based reporting without the details of HSN. He said this facility should be provided until the integration of the GSTN portal and Indian Customs Electronic Gateway (ICEGATE) takes place. ICEGATE is a customs department’s portal that provides e-filing services to the traders.

He also supported the existing practice in the form GSTR-1

The first two digits show the chapter number, the next two shows the heading number and the last two represent the product code.