Last four months from February to May have witnessed continuous drop-off in the number of return filings. The data count total decline of approx 8 lakh, i.e. 10% of the total GST return filed in India, in return filings in these months.

The total number of GSTR-3B filed in the month of May this year is around 75 lakh which is considerably lesser than the number of GSTR-3B required to be filed which is 1.03 crore. This apparently implies that around 1/4th of the business entities who were under obligation to file returns as per GST law didn’t do so.

When questioned by the Rajya Sabha about the measures that need tax officials to inspect the concerned business premises who failed to file GSTR, Anurag Thakur, minister of state for finance said: “The government is considering to put in place an extensive plan to hunt for these missing GST payers,”.

The total number of businesses registered under the GST is more than 1 crore, from which around 84 lakh business entities filed the returns in the month of February this year.

Read Also: Key Points About New GST Return Filing System

But in the march of the total number of GST return filers ((GSTR-3B) curtailed to 82.5 lakh. The downward trend continued in the month of April as well when the number of GST filers dwindled to 79 lakh business which further dropped over 75 lakh in the same month.

The gross GST collection by GOI (government of India) was undergoing the antrorse trend from February to April this year with the total collection of Rs 97,247 lakh crore, Rs 1,06,577 crore and the highest Rs 1,13,865 crore in the month of February, March and April respectively. But the month of May encountered sudden collapse with Rs 1,00,289 crore GST collection.

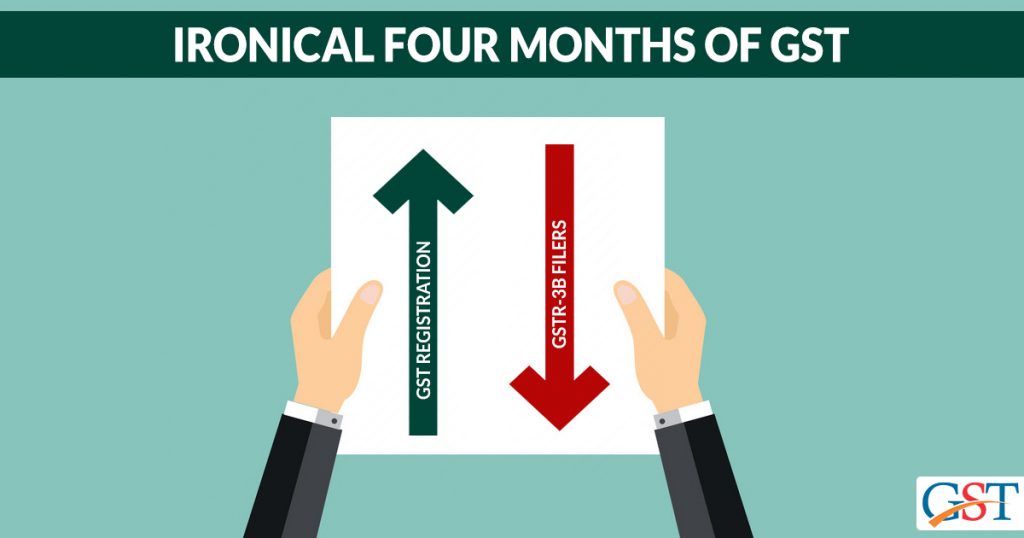

An incongruous scenario has emerged out when there is an increment by 23 lakhs in the number of businesses registered under the GST and the GST registered business gone up to 1.03 crore whereas, in the same period, the number of GSTR-3B filed decreased by more than 10% which means around 8 lakh corporate entities have been lackadaisical in filing GSTR-3B.

In such a paradoxical situation, minister of state for finance is stepping ahead with the measure to quest such defaulters of GSTR filing.