It was repeated by the Supreme Court that when a charitable trust registers u/s 12-AA of the Income Tax Act (“Act”) for income tax exemptions (under Sections 10 and 11), the tax authorities must validate if the charity’s proposed activities match its charitable goals, as expressed in the Ananda Social case.

The court cited that the only registration under section 12-AA shall not qualify for a charitable trust to claim for the exemption under sections 10 and 11 respectively of the Act, 1961, and the authorities could decline the grant of exemption if the produced materials via the trust does not appear persuading for the grant of exemption.

It was noted by the court that “When a return is filed by any trust claiming exemption it is for the assessing officer to look into all the materials and satisfy itself whether the exemption has been claimed genuinely or not. If the assessing officer is not convinced it is always open for him to decline the grant of exemption.”

Refusing the claim of the department that the authorities must regard the actual activities of the trust instead of its proposed activities when granting an exemption, the court declined to direct the Ananda Social verdict to a larger bench for reconsideration.

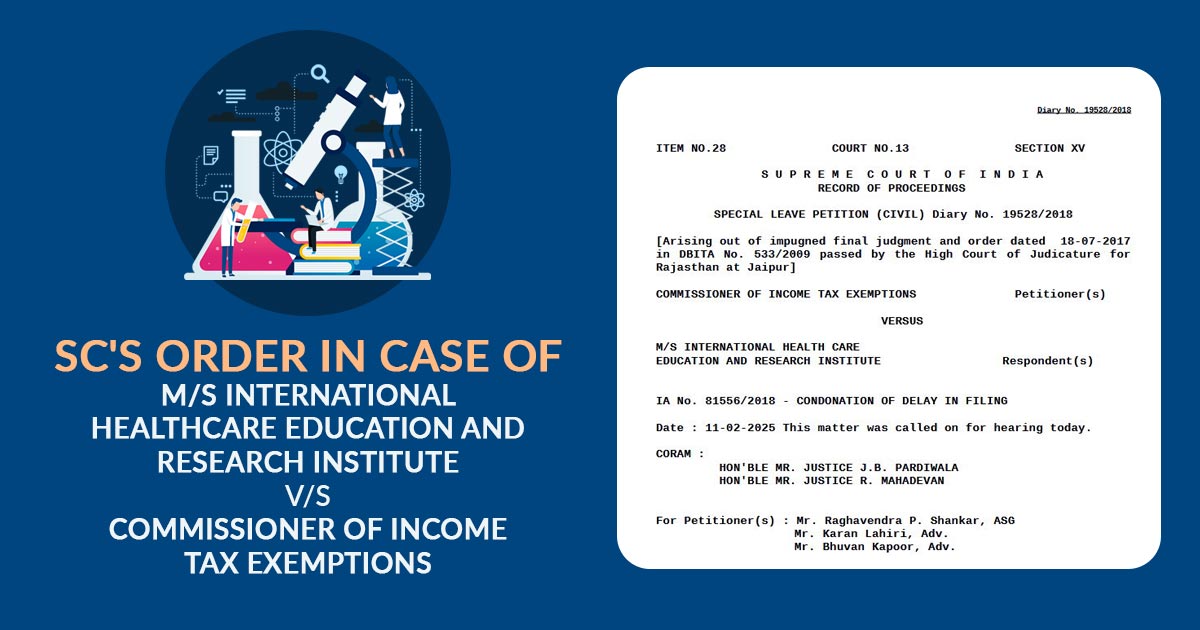

A bench of Justices JB Pardiwala and R Mahadevan heard the case where the Respondent, a charitable trust in activities like education, medical aid, etc. sought registration u/s 12-AA of the Act to pursue an exemption from income tax under Sections 10 and 11 of the Act.

The registration was refused by the commissioner specifying an absence of proof of actual charitable activities. The trust pleaded and the Appellate Tribunal reversed the Commissioner’s decision, directing registration.

The order of the Tribunal is been kept by the HC. Thereafter the commissioner submitted the special leave petition in the Apex court.

The problem related to the correct interpretation of section 12-AA of the act.

Section 12AA of the act deals with the registration process of Trust or Institutions to claim the advantage under sections 11 and 12 of the Act. It mandates the commissioner to satisfy himself for the objects of the trust or institution and the genuineness of its activities and grant a registration on the condition if he is pleased.

Cinnussuiber also needs to be pleased to ensure that the object of the trust and its activities are charitable. If it seems that the objects of the trust and its activities are not genuine then that is to say not charitable, the commissioner is qualified to deny and in fact, forced to deny such registration.

The revenue before the Apex court argued that the opinion opted in Ananda Social needs reconsideration via a larger bench as the Trust should cite cogent material to the satisfaction of the commissioner that the activities are genuinely charitable.

“We are of the view that it will be too much for this Court, to refer the matter to a larger bench doubting the correctness of the judgment in Ananda Social(supra),” the Court expressed.

The court validating the decision of the HC and denying to send the problem for reconsideration via a larger bench carried that the tax authorities were required to merely establish the offered activities of the trust before granting income tax exemption.

An option is been furnished by the court to the authority to refuse the grant of exemption on registration if discovered that the materials produced via the trust were not genuine or did not fulfill the needs for the grant of exemptions.

In Ananda Social, a three-judge bench comprising Justice SA Bobde, Justice BR Gavai and Justice Surya Kant noted:

“The purpose of section 12AA of the Act is to enable registration only of such trust or institution whose objects and activities are genuine. In other words, the Commissioner is bound to satisfy himself that the object of the Trust are genuine and that its activities are in furtherance of the objects of the Trust, that is equally genuine. Since section 12AA pertains to the registration of the Trust and not to assess of what a trust has actually done, we are of the view that the term ‘activities’ in the provision includes ‘proposed activities’. That is to say, a Commissioner is bound to consider whether the objects of the Trust are genuinely charitable in nature and whether the activities which the Trust proposed to carry on are genuine in the sense that they are in line with the objects of the Trust.”

| Case Title | M/s International Healthcare Education and Research Institute vs. Commissioner of Income Tax Exemptions |

| Citation | Special Leave Petition (Civil) Diary No. 19528/2018 |

| Date | 11.02.2025 |

| Appellant by | Mr Raghavendra P. Shankar, Mr Karan Lahiri, Mr Bhuvan Kapoor, Mr S.K. Singhania, Mr Nikhil Rohatgi, Mr Rukhmini Bobde, Mr Raj Bahadur, Mrs Anil Katiyar |

| Respondent by | Mr Ritesh Agrawal, Mr Sanjai Pathak, Mr Sunder Khatri, Ms Priyanshi Sharma, Mr Chirag Yogendra Mehta |

| Supreme Court Order | Read Order |