It was said by the Delhi High Court that if a Show Cause notice is quashed via a higher authority on one problem then it is not directed that the additional problems raised in the SCN are not obligated to be adjudicated.

The bench of Justices Prathiba M. Singh and Dharmesh Sharma observed a matter where the Show Cause Notice (SCN) was quashed via another division bench of the HC till now since the problems pertinent to the duty on free supply of materials were concerned. But, CESTAT moved to release the whole SCN.

The Court noted that “The SCN was quashed, but the Department was permitted to proceed by the decision in Era Infra Engineering Ltd. vs. Union of India (Supra) and exclude the value of free materials used by the Assessee. The liberty which was given to the Department in effect meant that the Court was conscious of the fact that there were various other components of demands which were raised by the Department and it is the admitted position that these components for eg., – in respect of short payment of Service Tax, education cess, treatment of secondary and higher education cess etc. have all not been adjudicated at all till date. All the other demands which are raised, accordingly, deserve to be adjudicated on facts and by law.”

The taxpayer in this was involved in a business pertinent to finishing buildings or civil structures. It had taken the CENVAT credit on inputs and input services directing to an SCN and forthcoming demand.

When the case arrived at the Apex court then it was decided in the taxpayer’s favour. It was ruled that the services which have been furnished free of cost or material shall not be comprised in the gross value for the objective of service tax.

After that, an order was passed via the adjudicating authority via which the SCN against the taxpayer was quashed, and the proceedings were dropped. Department contested the cited order though CESTAT agreed that the quashing of the SCN shall directed that the whole SCN is quashed.

Thereafter the revenue approached the High Court claiming that the SCN had different problems and demands for which were raised on distinct counts. Merely the problem pertinent to the free supply of materials was discussed in such rulings and none of the additional problems were even considered. As per that the adjudicating authority made an error in keeping that the proceedings could not carried on against the respondent.

It was furnished by the taxpayer’s counsel that if the SCN is quashed then no proceedings could proceed concerning SCN.

It was marked by the HC that the Division Bench order allowed the department to move as per the ruling (Era Infra Engineering Ltd. vs. Union of India (2016)) and exclude the value of free materials.

Read Also: GST Authorities Must Evaluate Pre-SCN Replies Before Issuing Tax Notices

As such, it carried “both the adjudicating authority and the CESTAT were incorrect in holding that the SCN having been quashed, none of the other demands would also be liable to be adjudicated” and asked that all other demands need to be adjudicated.

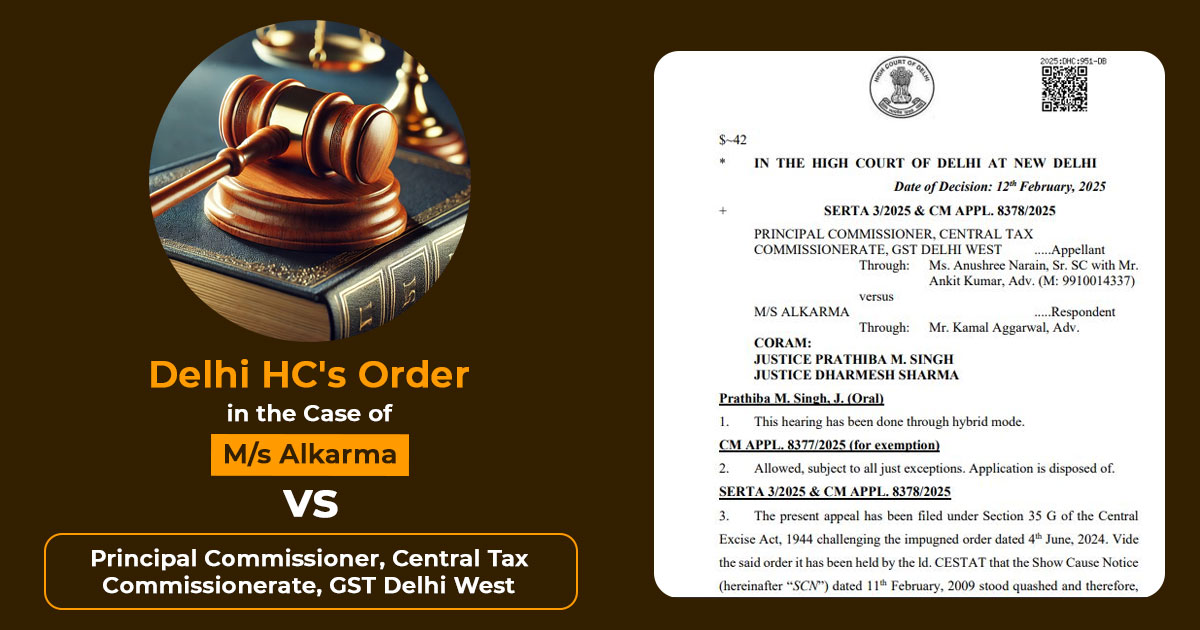

| Case Title | M/s Alkarma vs. Principal Commissioner, Central Tax Commissionerate, GST Delhi West |

| Citation | SERTA 3/2025 & CM APPL. 8378/2025 |

| Date | 12.02.2025 |

| Appellant by | Ms Anushree Narain, Mr Ankit Kumar |

| Respondent by | Mr Kamal Aggarwal |

| Delhi High Court | Read Order |