The Delhi High Court quashed an order cancelling the Goods and Services Tax (GST) registration of a business noting that these cancellations could not come into force on only allegations without furnishing sufficient reasoning and proof to the aggrieved business.

The decision was provided in a writ petition submitted via Rashid Proprietor of MS Enterprises post getting a Show cause notice (SCN) on 24th November 2023 alleging that he was not performing the business from the shown place and was engaged in passing on inadmissible input tax credit (ITC) without actual supply of goods and services.

The applicant has been provided with a prior SCN dated 18th August 2023 raising concerns for the suspicious purchases, though was plunged soon after the applicant issued their reply to the Department dated 21st August 2023.

Read Also: Delhi High Court: GST Registration Can Only Be Cancelled from the Date of SCN

The impugned Show cause notices raised grounds that the applicant does not operate any business from their notified place of business and that the related proprietorship firm was engaged in the passing on of inadmissible ITC without performing the actual supply of goods and services.

A short response has been furnished to the department that the firm was very much in business at the related premises and that they have not engaged in the passing on of inadmissible ITC without supplying goods and services, though was ineffective since the department proceeded to cancel the GST registration of the applicant.

The SCN does not tell any particular reasons for the cancellation and the physical verification report by the GST Inspector rejected the allegations raised in the SCN, claimed by Dipak Raj, Kuldeep Mishra, Garima Kumar, Deep Raj, and Ayushman appearing for the Petitioner.

While Piyush Beriwal, Sandip Munian, and Jyotsna Vyas appearing for the Government and Revenue retorted that the reply of the applicant was inadequate for the Department to decide otherwise.

The team of judges, Justice Prathiba M. Singh and Dharmesh Sharma, noticed that the letter about the Central Goods and Services Tax (CGST) dated November 22, 2023, used by the Department to support their notice was not given to the applicant before they cancelled the GST registration.

Under such an event the Bench set aside the cancellation of GST registration and ordered that the related letter be filed to the applicant within 4 weeks while asking that the applicant be provided the chance for a hearing before any order is passed.

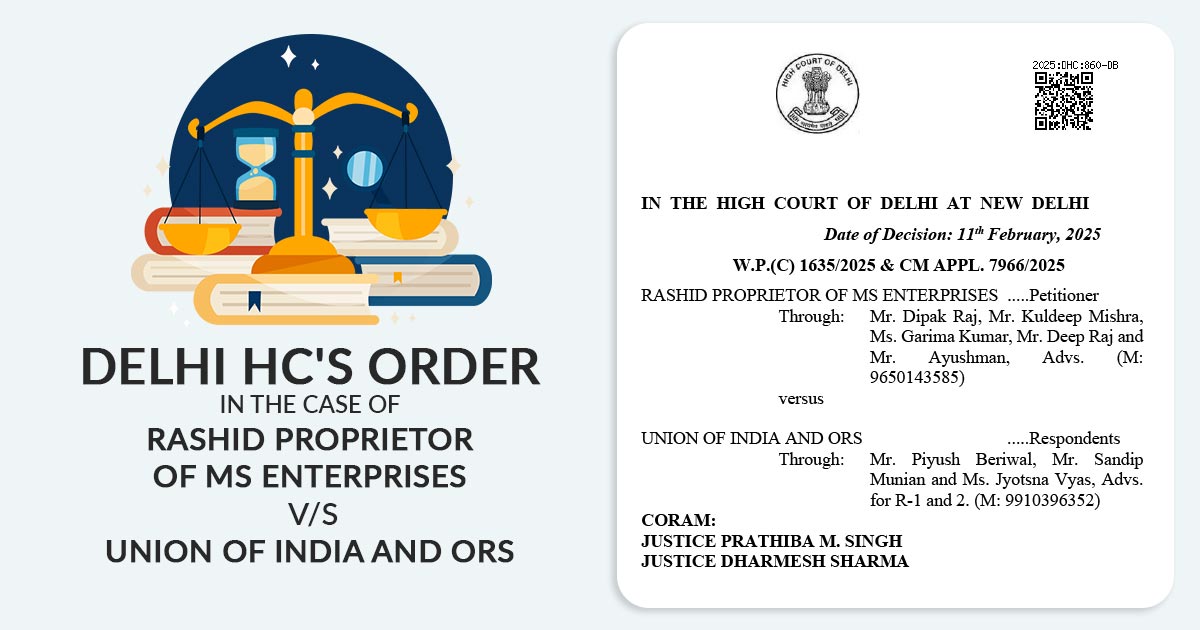

| Case Title | Rashid Proprietor of MS Enterprises vs. Union of India and ORS |

| Citation | W.P.(C) 1635/2025 & CM APPL. 7966/2025 |

| Date | 11.02.2025 |

| For the Petitioner By | Mr Dipak Raj, Mr Kuldeep Mishra, Ms Garima Kumar, Mr Deep Raj and Mr Ayushman |

| For the Respondents By | Mr. Piyush Beriwal, Mr. Sandip Munian and Ms. Jyotsna Vyas |

| Delhi High Court | Read Order |