Registering for becoming a GST practitioner is not a hard task but you should have complete knowledge of the required eligibility, major conditions and registration process on the GSTN portal.

Here, we can help you in getting you registered under the GST practitioner scheme offered by the central government. As the Indian government has given the opportunity to the unemployed person a chance to earn money and also provided a low-cost filing facility to small businessmen from nearby locations.

Many traders want to file GST but due to a lack of computer awareness, they have to hire lawyers and accountants at a higher cost which is the main cause of delay in filing returns. The government has decided to help such traders by appointing practitioners. These GST practitioners can be based on particular localities as well. They will provide services at a low cost in their respective areas. It will not only relieve the traders from filing GST returns but also will be helpful for many unemployed to get employment.

- Who is GST Practitioner?

- Eligibility Criteria

- Roles and Responsibilities

- Working Operation

- Major Conditions

- Registration Procedure Guide

- Accept or Reject GST Practitioner Role

Who is GST Practitioner?

A GST practitioner is a government whether central or state, appointed person to handle all the tax-related activities on behalf of the taxpayer and business firms. The person appoints is liable for fresh registration under GST and applying for any amendment and cancellation of registration.

He is liable to furnish all the monthly quarterly and annual returns of the firm and payment of the taxes on behalf of the taxpayer. He is totally credible as well as liable for any legal proceeding of the company to represent on all the matter.

Eligibility Criteria For GST Practitioners:

The eligibility criteria for GST practitioners are covered in rule number 24 of Return Rules which explains:

- The person must be a Citizen of India

- He/she should not be involved in any kind of crime cases

- He/she should be employed at the Commerce tax department, central product tax, and customs board and designated at the group B post for a minimum of two years and retired after that.

- The person should be registered under sales tax practitioners for 5 years

B.com and LLB-passed unemployed are required to fill out online forms in order to apply for this post. The person once registered will remain eligible until the registration is not annulled.

Roles and Responsibilities of a GST Practitioner

Once an applicant gets his license, they can perform the following tasks under the GST regime.

- File GST forms on behalf of clients

- Represent clients to the authorities

- Make deposits for credit in the e-ledger

- File refund claims, upon confirmation from clients

- File the application for changes (amendment) or cancellation of GST registration, upon request from clients

The practitioner registration is quite beneficial for those who are practising tax-related tasks in India.

Working Operation For GST Practitioners

Under GST provisions, GST practitioner will file inward and outward supplies details on behalf of a registered person, file monthly, quarterly, annual or last returns, deposit in an electronic cash ledger for credit, lodge claims for refunds, and file applications for amendment and correction in GST registration. For refund claims, amendments or corrections in GST registration, it is necessary for GST practitioners to take the permission of the taxpayer.

Syllabus for GST Practitioners

- CGST Act & Rules 2017

- IGST Act & Rules 2017

- SGST Act 2017

- UTGST Act & Rules 2017

- GST (Compensation to States) Act, 2017

- All SGST Rules 2017

- Notifications, Circulars and Orders Issued from Time to Time

Major Conditions for GST Practitioners

Any filling done by practitioners will be available online on the common portal. The information presented by GST practitioners will be sent by email and SMS. Before signing the form, it is the responsibility of the taxpayer to make sure that the information provided is correct. The authenticity of the filing will be based on the return presentation. The practitioners will be presenting all the information very carefully. There will be a digital signature of the GST practitioner and if he/she is found guilty, the registration of concerning practitioner will be cancelled.

Assistant Commissioner Ajit Kumar Shukla and joint commissioner Brajesh Mishra at trade tax said that practitioners can get a notice in case of misconduct asking the reason under GST format and PCT-3.

Registration Procedure to Become a GST Practitioner in India

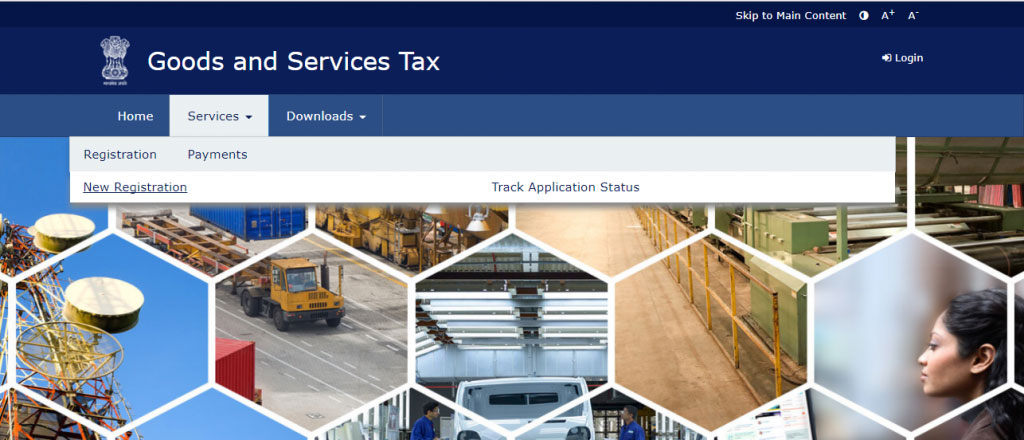

Step 1 – Visit the official website of the GSTN portal, https://www.gst.gov.in

Step 2 – Click on Services – Registration. Click on ‘New Registration’

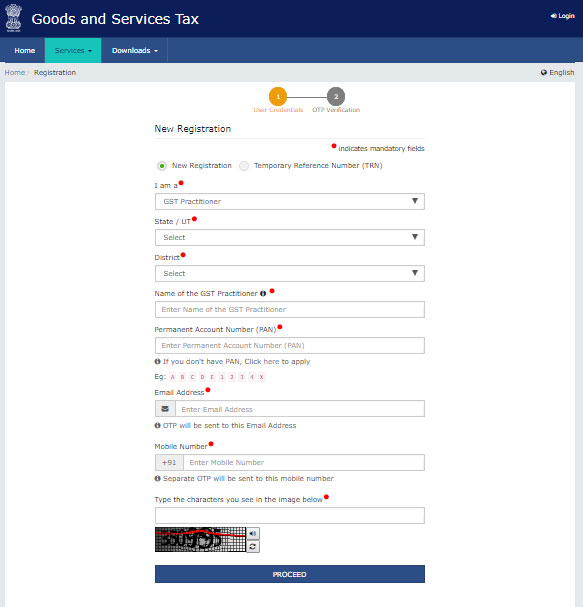

Step 3 – It will open a new registration page

- Click on New Registration

- In the dropdown list where ‘I am a’ given, select GST Practitioner

- Select your State and District from the dropdown list

- Enter Name, PAN, Email Address and Mobile Number

- Enter the captcha code

- Click on ‘Proceed’

After the completion of validation, it will be redirected to the OTP verification page

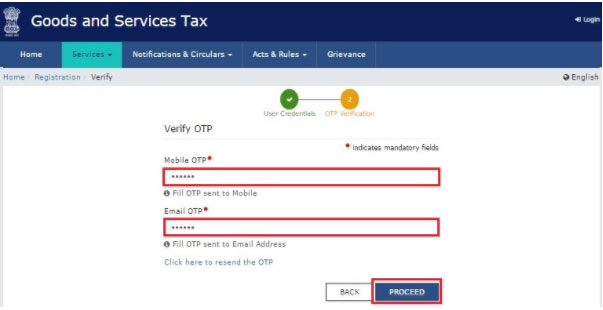

Step 4 – Enter both OTPs which are received by e-mail and mobile number. Click on ‘Proceed’

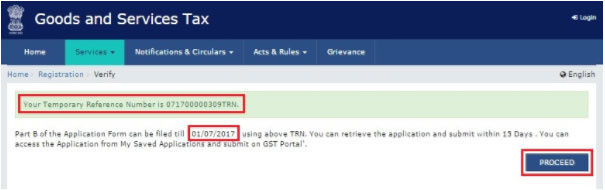

Step 5 – After which a TRN will be generated, click on proceed

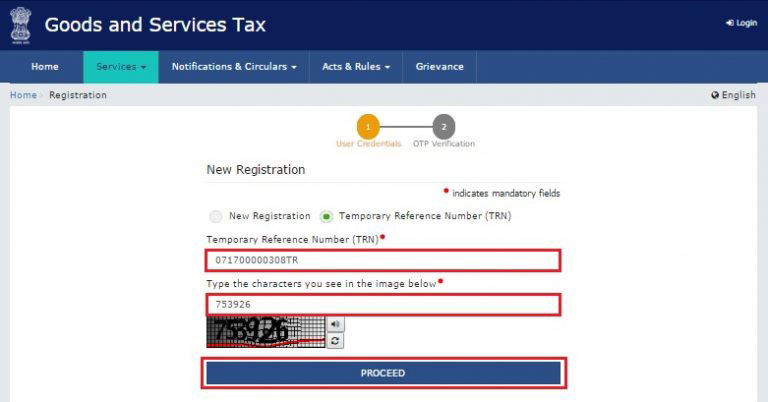

Step 6 – Enter TRN and Captcha. Click on ‘Proceed’

Step 7 – Enter the OTP received on the registered mobile number and click on ‘Proceed’

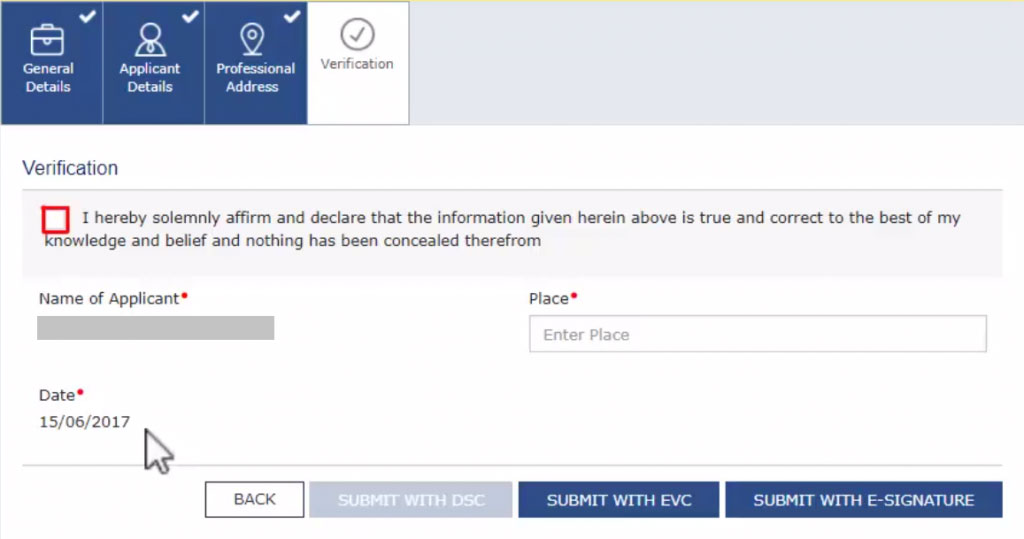

Step 8 – Enter complete details required and upload documents in .pdf and .jpeg format. Click on ‘Submit’ on the Verification page

2 ways in which the application can be submitted:

- DSC – In this, the application can be submitted by the DSC token. Please be aware that the emSigner (from eMudra) must be installed on your computer and the DSC is registered on the website

- EVC and E-signature – There will be OTPs assigned to both mobile and email addresses, both of them must be entered and then submit the application.

Following this, a success message will be displayed and an acknowledgement email will be received on your mail id within 15 days.

Accept or Reject GST Practitioner Role

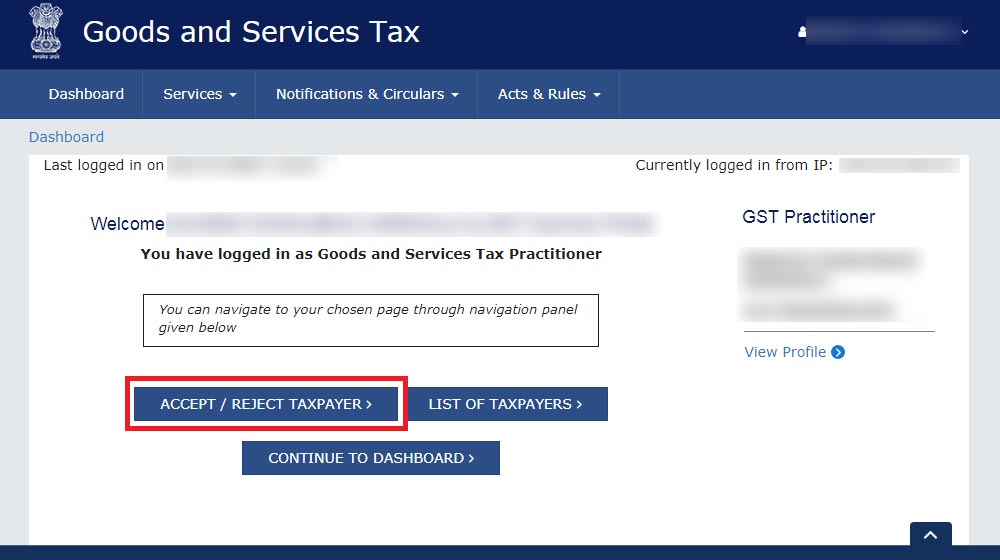

If you have been offered the opportunity to work as a GST practitioner, we have outlined the process for accepting or rejecting the offer below. The following steps will guide you in making the decision and ensure that you make the right choice for you

Step 1: Visit a GST official Portal

Step 2: Move a cursor on ‘Services’ select the ‘User Services’ and click the “Accept / Reject Taxpayer” option

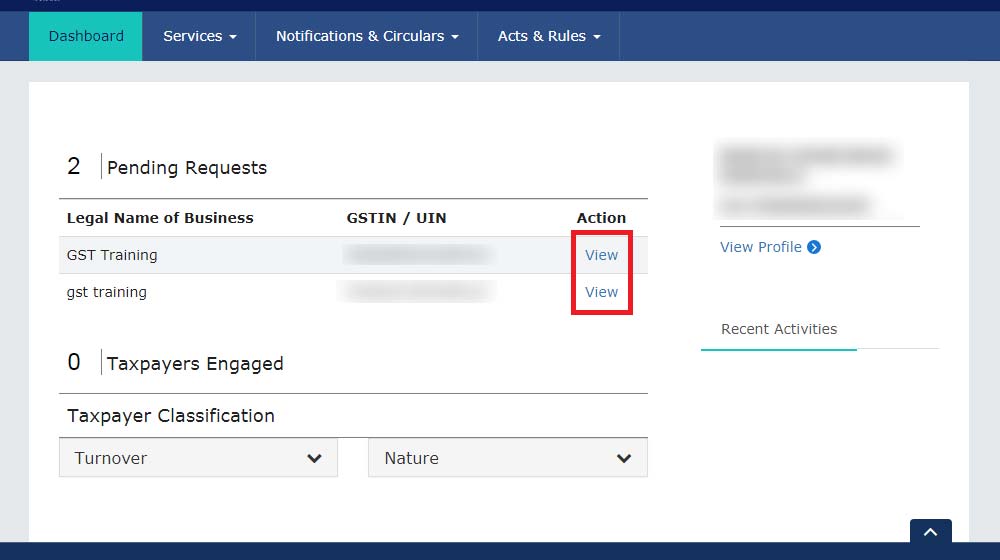

Step 3: Please click on the ‘View link’ against the employment request you would like to approve or reject

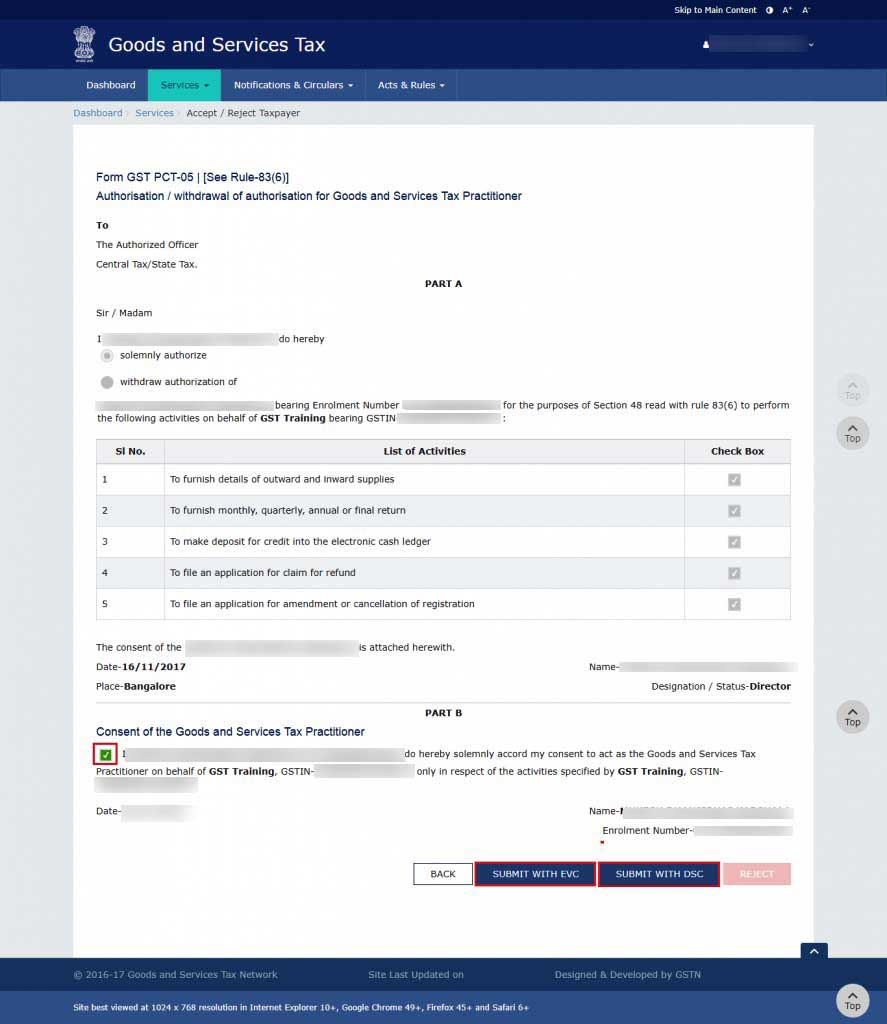

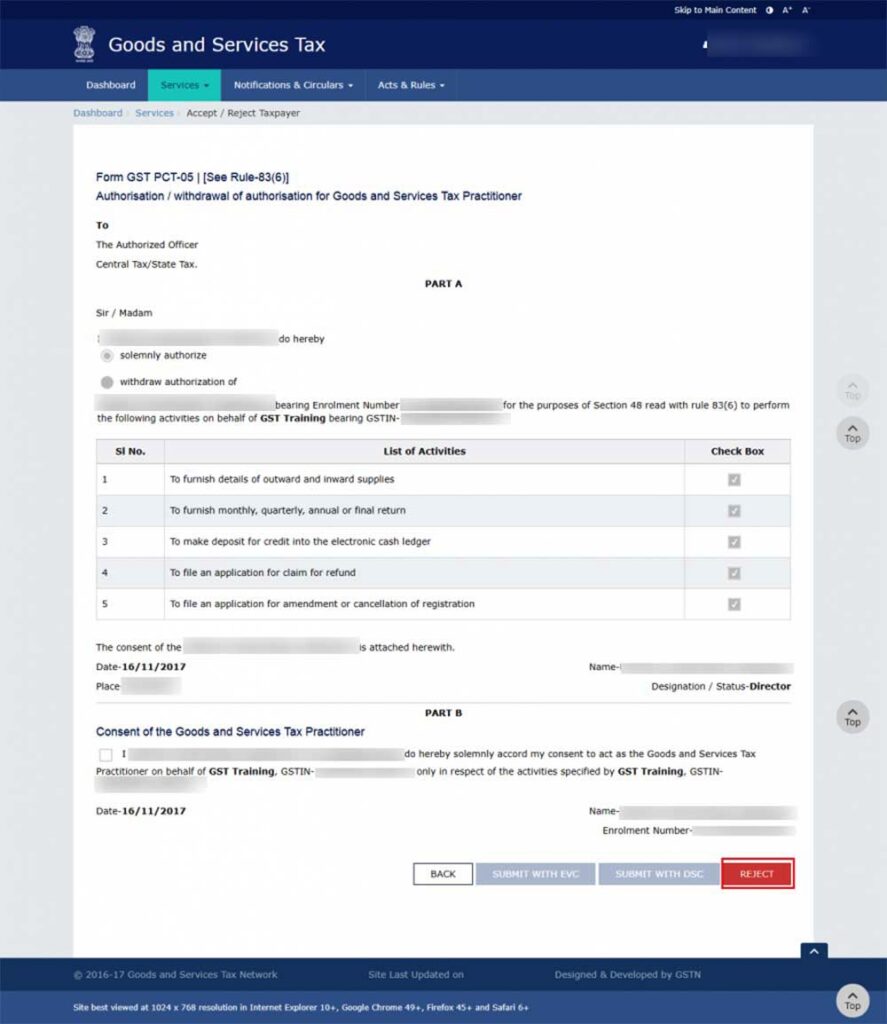

Step 4: The engagement request can either be accepted or rejected as follows:

- Select the consent box for acceptance and click the ‘Submit with DSC or EVC’ button.

- To reject: Click on the ‘Reject’ button without checking the consent box

i am trying for new registration, but it shows an error PAN or Legal name does not match, but i submitted my available records. Can you help to complete the registration.

I am a Bachelor in Arts Can I become gst practitioner.

Hello sir

I am graduate from commerce field. Presently working in MNC company as an accounts manager with handling all accounting transactions upto finalisation of accounts. can i Register under GST -Practitioner Professional.

Yes

Yes, definitely you can register for being GST practitioner

I am an M.SC graduate, Shall I register for GST practitioner? pls, tell.

yes

Then eligibility is in commerce for above, pls clarify

Yes

Sir…

I submitted GST Registration…. what is the next step…

Next step – You should wait for the reply received from the GST portal site

Sir, I am a contractor in Military Engineering Services and also a law graduate. Can I register for GST practitioner

Yes

Can an MBA Fin graduate take this course (GST Practioner), how does he earn from it?

Yes why not