Under the GST regime, registration is the foremost and the essential step for existing taxpayers as without registration, they would not get GSTIN number, which is a basic identity number of a taxpayer. Filling the correct details in the registration form is necessary but what if somebody entered the wrong details or missed out some important fields?

To ease the hurdles, Rule 12 and Form GST REG 14 provide a way to correct the information without visiting any government office or centre. An applicant can correct some information and change the particulars without approval from any authority and some fields require approval but editing can be done online in both cases.

The amendments for GST registration are categorised into three, which describe the level of approval and time period to amend the fields. While applying for an amendment in particular fields of a registration form, it is mandatory to mention the “Reasons” for the amendment in GST registration process.

Three Types Of Amendments That Can Be Done:

Change In Core Field: The changes in the Core field includes the legal name of the business, the address of the principal place of business, and any additional place of business. It takes 15 days to get approval from a proper office to amend the Core Fields.

Change In Non-core Field: There are some fields that don’t require any approval from a proper office and amendments in Non-core fields can be easily done online. All the fields except those which are covered under core fields come under a Non-core field.

Change In Email Or Mobile Number: The change in email or mobile number requires a verification by OTP(One-Time Password) after online verification on the common GST portal.

Recommended: All Latest Updates on 32nd GST Council Meeting

Try Free Demo for GST Registration Software

Eligible Applicant To Change The Registration Details:

The taxpayers under the following categories can amend the registration details:

- Normal taxpayers and new applicants

- Changes in TDS/TCS registration for the person having a UIN card and belongs to UN Bodies, Embassies & other notified

- person

- Non-resident foreign taxpayer

- GST practitioner

- Online application and retrieval service provider

The Fields Which Cannot Be Changed:

- Any amendment to the details of the PAN card cannot be done as the GST registration is wholly based on the PAN number

- Change in the constitution of the business cannot be done as it requires a change in the PAN number in the first place

- Modification in place of business from one state to another state cannot be possible as GST registration is state-specific

Apart from this, the primary authorised signatory can also be changed with the condition to add a new primary signatory. If the condition is not fulfilled, then changes in the primary signatory are not possible.

Timeline For Amendment in GST Registration Process

In case of any requirement for any modification in the GST registration, a taxpayer needs to submit the application with the required documents for amendments on the GST portal within 15 days. After the GST REG 14 amendment form approval, the changes will be corrected in form GST REG 06.

The application for amendments of registration can be saved for 15 days. However, if an applicant fails to submit the application for any reason, the application for amendments will be removed automatically.

How To Do Changes In Core Fields?

To change the details of the core fields in a registration form, you need to follow below-mentioned step by step procedure:

- Step 1: Go to the GST home page by clicking www.gst.gov.in

- Step 2: Log in with the provided credentials to the GST portal

- Step 3: Click on the ‘Services’ tab from the main menu, hover the mouse on the ‘Registration’ tab under ‘Services’

- Step 4: Click on ‘Amendment Of Registration Core Fields’ to open the link

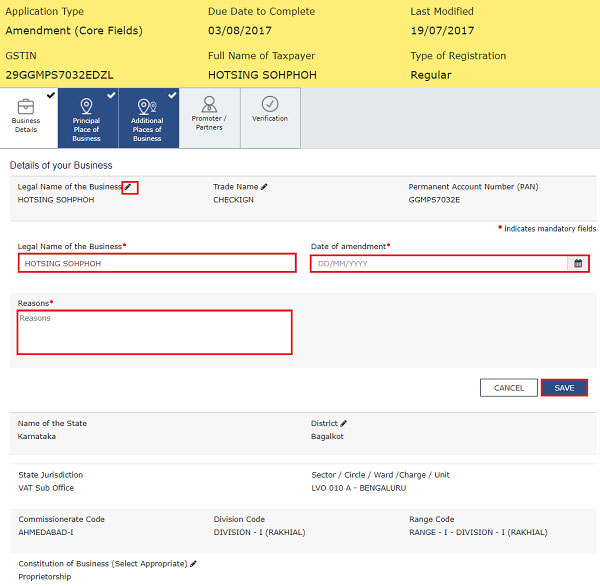

Business Details Tab

Step 5: The “Business Details’ tab appears as a default. Select the field which you want to edit by clicking the Edit icon

- Edit the particular detail you wish to edit

- Select the ‘Date Of Amendment’ by clicking on the calendar icon

- Provide the reason for the amendment in GST registration process online under “Reasons” tab

- Click the ‘Save’ button given at the bottom of the page

- After verifying all the “Business details”, press the “Continue” button at the bottom of the page

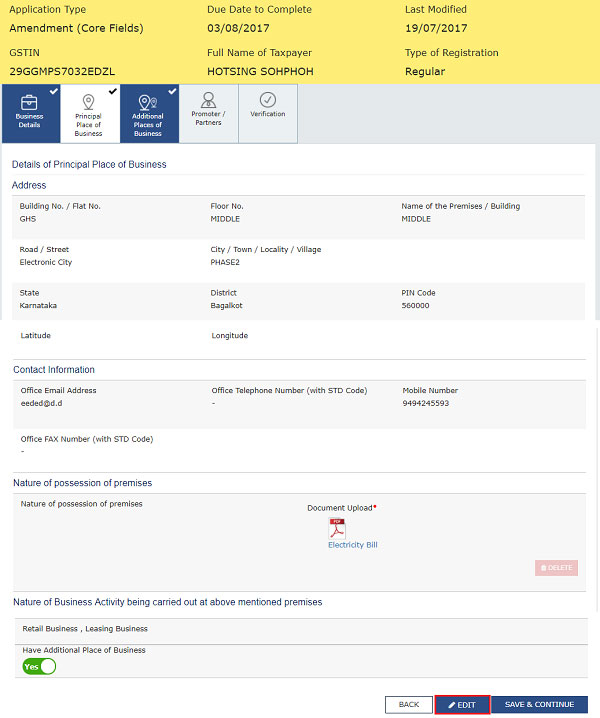

Principal Place of Business Tab

Step 6: Click on “Principal Place of business” provided in the main menu, after that select the “EDIT” button provided at the bottom of the page, if there is need to edit something

- Edit the required details and then follow the same procedure of entering “Reasons”, and “Date Of Amendment”

- Click on “Save” button at the bottom of the page.

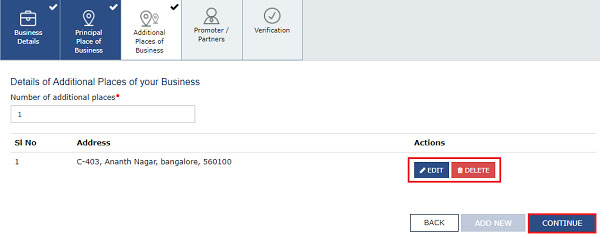

Additional Places of Business Tab

Step 7: Click on the “Additional Places of Business” Tab provided in the main menu, after that enter the details about “Number of additional places”, this field requires filling by values

- Click on the “Add New” button

- Edit the desired details in the relevant field

- After that, follow the same “Reasons” field and “Date Of Amendment”

- Click on the “Save & Continue” and “Save” button at the bottom of the page.

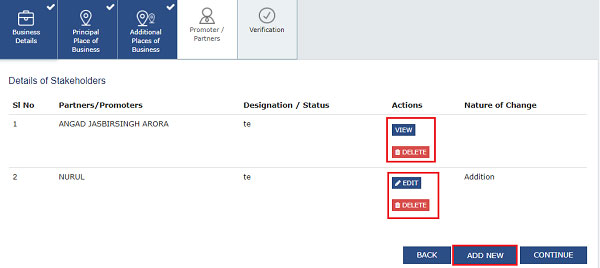

Note: To VIEW, DELETE, and EDIT promoter or partner details, click on the respective button

Promoter / Partners tab

Step 8: Select the “Promoter / Partners” tab, provided in the main menu

- Click on the “ADD NEW” button to add promoter/partners’ details

- Enter the details and upload the relevant documents as an identity proof

- After that, follow the same “Reasons” field and “Date of Amendment”

- Click on the “Save” & “Continue” button at the bottom of the page.

Verification Tab

Step 9: Select the “Verification” tab and click on the Verification checkbox

- In the “Name of Authorised Signatory” field, choose the authorized signatory by the drop-down list

- Enter the name of the place in the “Place” field

- After successfully amending the field under “Amendment Of Registration Core Fields”, digitally sign the form by using Digital Signature Certificate (DSC)/ E-Signature or EVC.

After successful completion of the amendment in the GST registration process online, the acknowledgement message will be sent automatically to registered Email and mobile no. in the next 15 minutes. Again, the message of application approval or rejection by a tax authority will be sent by SMS and email to the registered email ID and mobile number.

How To Do Changes In Non-Core Fields?

To change the details of the core fields for a registration form, you need to follow below-mentioned step by step procedure:

- Go to the GST home page by clicking www.gst.gov.in

- Login with the provided credentials to the GST portal

- Click on the ‘Services’ tab from the main menu, hover the mouse on ‘Registration’ tab under services

- Click on ‘Amendment Of Registration Non-Core Fields’ to open the link

- The Non-Core fields are shown in editable format, edit the details in the respective fields and tabs

- Select the “Verification” checkbox under the “Verification” tab

- In the “Name of Authorised Signatory” field, choose the authorised signatory by the drop-down list

- Enter the name of the place in the “Place” field

- After successfully amending the field under “Amendment Of Registration Core Fields”, digitally sign the form by using Digital Signature Certificate (DSC)/ E-Signature or EVC.

After successful completion of the amendment in the GST registration process, the acknowledgement message will be sent automatically to the registered Email and mobile no. in the next 15 minutes. The modification done in the Non-core fields doesn’t require any approval by the Tax Official.

can we change type of registration from input service distributor to regular tax payer

Hi Sir,

When i am trying to change the designation of the proprietor in non-core amendment field and it is not allowing me to amend because the field is locked can’t be change by mistakenly i putted proprietor as professional how can i change ?

I filed amendment reg additional partner included in firm. after validation my application the following error mentioned as already added partner d.o.b was mismatch. How can i edit the date of birth of the remaining two partner in core field

I change my pan card name Sandeep soni to Sandeep Kumar soni and same I updating in gst certificate but it’s showing error.

Name does not match with promotor.

Kindly help now what I do

How shall I upload my documents from gallary?

Hi sir

i have changed my name in PAN for aadhaar link from Natarajan Ganesh to Ganesh Natarajan. Now i want to change the GST firm address. its not allowing . its showing validation error. kind suggest

“Please raise complaint ticket on GST portal”

My mobile no is dead and allotted to someone else. Now OTP is going that mobile no which is not using by me. How to change mobile no in GSTN portal without OTP.

You need to do changes in Amendment Of Registration Non-Core Fields, for more details kindly contact GST practitioner

Hello I have nade some edits in the core fields on 18th Dec 2023 and today is 1st Jan 2024 still the status shows pending what to do?

Please raise complaint ticket on the GST portal site