Upon the system, the government is implementing to give the report to GST officers upon real-time grounds towards those vehicles who are running excluding the e-way bills to assist intercept stuck trucks at toll plazas and determine the GST theft.

The assessee will also give analysis reports upon determining the e-way bill despite there being no transportation of goods as this will assist the council in determining the cases of circular trading. It will also give the reports on recycling of e-way bills for the tax theft of vulnerable commodities to assist the officers in determining the tax evaders.

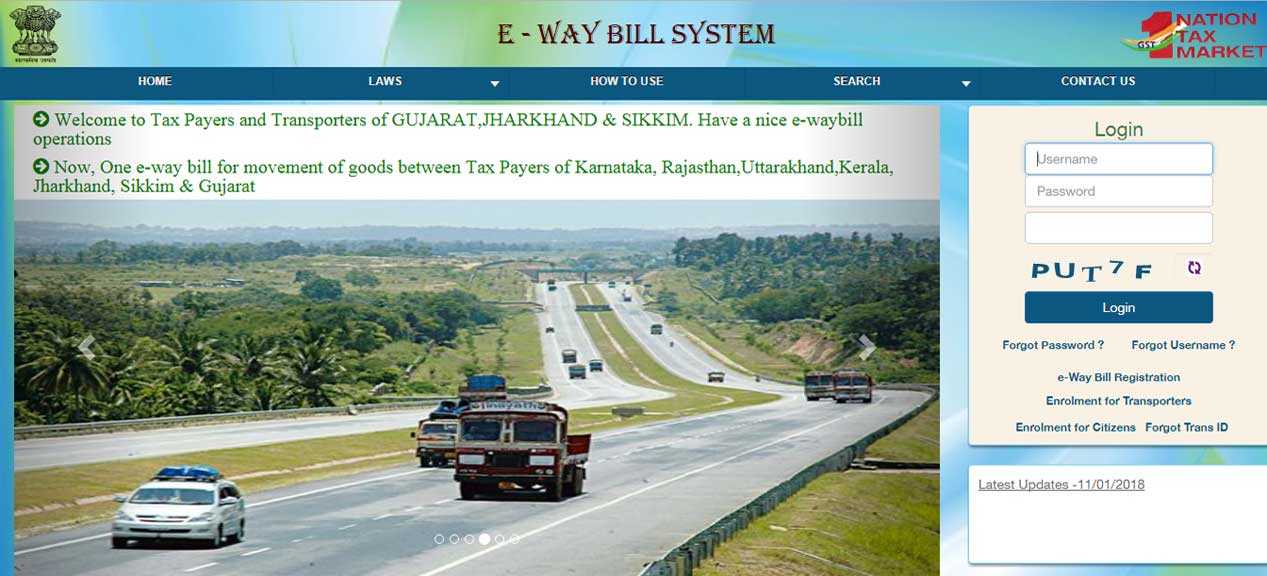

Beneath the Goods and Services Tax (GST) regime, e-way bills are made compulsory for the inter-state transportation of goods whose value is Rs 50k since April 2018 but the gold is privileged. The businesses and the transporters need to produce the electronic e-way bills prior to the GST inspector asking for the e-way bill.

Upon the ‘Real-time and Analysis Reports on RFID,’ the government is working for the GST officers to assist them to nab tax evaders who are not using the e-way bill platform.

Upon the e-way bill journey of 3 years, the government comments that 180 cr e-way bills are created out of which 2.27 cr was picked for the verification. In the 2019-20 FY, last March 2020, 62.88 crore e-way bills

The top 5 states who have created the maximum e-way bills for the state movement goods were created are Gujarat, Maharashtra, Haryana, Tamil Nadu, and Karnataka.

The top 5 sectors whose maximum e-way bills were created in the previous 3 years are textiles, electrical machinery, machinery and mechanical appliances, iron and steel, and automobiles.

From 1st Jan 2021 government implemented RFID/FasTag through the e-way bills and the transporter is needed to have the RFID tag in vehicles along with the information of the e-way bills created for the goods carried through the vehicle is uploaded to the RFID.

The information fed into the device is uploaded on the government portal when the vehicle goes through the RFID tag reader on the highway. The details will be recalled to the council to verify the supplies furnished through the GST enrolled individual.

To rectify the tax compliance the government has also started blocking the EWB bill generation when the person does not pose out with the GST registration

Upon the grounds of PIN codes, the e-way bill’s system has assisted to do the auto calculation of the distance. The system will auto calculate the distance between the source and the destination upon the grounds of the PIN codes.

In the upcoming period, the government indeed gives the real-time report upon the grounds on the vehicle movement for the opted e-way bills to assist the officer in determining the trail of the movement through the vehicle.

Towards the officers, the real-time report on vehicles moving without the e-way bills for the chosen toll plaza will be open to the officers to assist them to intercept only those vehicles who are not posing with the e-way bills.

“With enhancements in GSTN & NIC systems, the efficacy of point-to-point tracking is getting water-tight. At this pace, taxpayers will soon witness real-time monitoring of goods. Transportation sector may have real-time tracking technologies in place in the next 3- 5 years, whereby tax leakage will practically become impossible.”