It was cited by the Punjab and Haryana High Court that the plea could not be dismissed as not maintainable for not filing the requisite fee.

The Division Bench comprising Justices Sanjeev Prakash Sharma and Sanjay Vashisth was acknowledging the matter in which the Appellate Authority dismissed the plea as not maintainable on the basis that the taxpayer had unable to file Rs 10,000 as a fee for hearing the plea and the taxpayer was needed to deposit a total sum of Rs 20,000 as a fee.

The authority claimed that the plea was not complete for the deposition of the requisite fee as obligated under GST law.

Appellate Authority passed an order before the Punjab and Haryana High Court challenged by the taxpayer.

As per the taxpayer, as the plea may be not complete and incompetent for the deposition of fee it can not be held to be not maintainable.

As per the department, it was carried that if the taxpayer has deposited the remaining amount then the plea must be heard based on the merits and shall not be carried.

As per the bench “on account of the non-payment of the requisite fee, an appeal cannot be dismissed as not maintainable, and in fact, before the Appellate Authority takes up an appeal, the appellant should be informed of any deficiency and be given a chance to deposit and remove the deficiency, if any.”

As per the bench the appellate authority to hear the plea on merits and asked the taxpayer to deposit the remaining amount.

The bench in the view described above has permitted the plea.

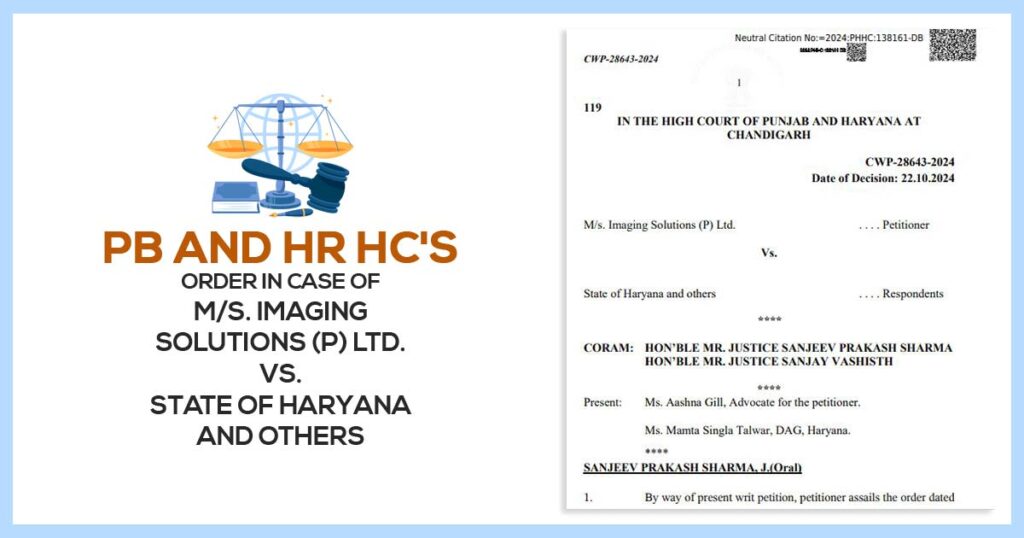

| Case Title | M/s. Imaging Solutions (P) Ltd. vs. State of Haryana and Others |

| Citation | CWP-28643-2024 |

| Date | 22.10.2024 |

| Advocate for the Petitioner | Aashna Gill |

| Advocate for the Respondent | Mamta Singla Talwar |

| Punjab and Haryana High Court | Read Order |