The Hon’ble Madras High Court in the matter of Tvl. Senthil Hardwares vs. State Tax Officer, Pattukottai, the order where a GST SCN was furnished before the taxpayer vide FORM DRC-01 and reply furnished via the Assessee was accepted by the Department, but a specific part of demand was confirmed vide the Order concerning defect, which was not part of the notice.

Case Facts:

A notice was furnished by M/s Tvl. Senthil Hardwares (“the Petitioner”) in FORM DRC 01 on the GST Portal dated April 19, 2022, followed via a reminder for a personal hearing on February 13, 2024 and that the personal hearing was carried dated April 27, 2024.

The applicant on the said date, furnished a detailed reply, which has also been accepted by the State Tax Officer (“the Respondent”). But, the Order on April 27, 2024 (“the Impugned Order”) served by the Respondent asked for Rs 16,36,068.

Read Also: How to Effortlessly Check Validity of GST SCN & Orders

The amount under a defect wasn’t the portion of the impugned notice furnished before the applicant on April 27, 2024, and therefore the applicant wasn’t part of the response on April 27, 2024.

The applicant dissatisfied with the situation has furnished the present writ petition.

Main Issue:

Whether a GST order be passed apart from the cited defects in the SCN?

Held-

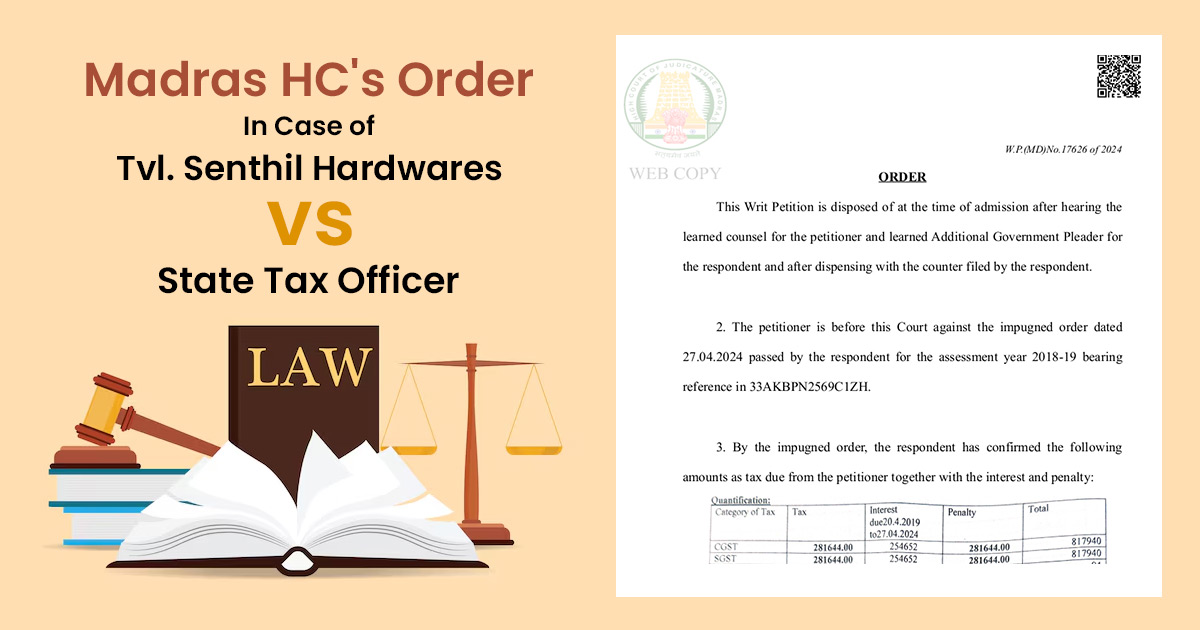

The Hon’ble Madras High Court in W.P. (MD) NO. 17626/2024 held as under

- It was marked that the impugned order impacted from a gross breach of the norms of natural justice since the applicant was not placed to notice of defects. Hence the cause that arose in the closure of the impugned order is not sustainable.

- It was carried that the impugned order which stands quashed, will be considered as corrigendum to the impugned notice. The respondent was asked to provide the fresh addendum to the impugned within 45 days. The applicant after that has furnished a response to it within 30 days. Consequently, the respondent passed a new order on merits and as per that with statutory as expeditiously as feasible ideally in 2 months.

Our View:

- In the matter of pari materia, the Hon’ble Supreme Court in the case of Commissioner of Customs, Mumbai v. Toyo Engineering India Ltd. ((2006) 7 SCC 592) carried that the Department cannot proceed beyond the show-cause notice.

- It was cited by the principles of natural justice that the party which is penalized should be heard and furnished a time to show his defence which is encapsulated in the legal maxim “ Audi Aultem Partem”, the ruling carried the principles of natural justice and protected the taxpayer from arbitrary use of power.

| Case Title | Tvl. Senthil Hardwares vs. State Tax Officer |

| Citation | W.P.(MD) No.17626 of 2024 and W.M.P.(MD)Nos.15134 & 15136 of 2024 |

| Date | 30.07.2024 |

| For petitioner | Mr.A.Chandra Sekaran |

| For respondent | Mr.R.Suresh Kumar Additional Government Pleader |

| Madras High Court | Read Order |