It was cited by Patna High court that the Appellate authority has a obligation to analyse the grounds that the taxpayer has raised in the memorandum of plea and wished to issue on merits if the plea is filed ex parte.

The Bench including Chief Justice K. Vinod Chandran and Justice Partha Sarthy, cited that “the Appellate Authority even while considering the appeal ex parte will have to consider the grounds raised in the memorandum of appeal, deciding the appeal on merits.”

Read Also: Patna HC: Appellate Authority Must Justify Dismissal of Appeal Under Bihar GST Act 2017

It was contested by the taxpayer/applicant that the order passed via the Appellate authority dismissed the plea based on the reason that the taxpayer is unable to produce any related documents even after having an opportunity.

The bench marked that “the Appellate Authority even while considering the appeal ex parte will have to consider the grounds raised in the memorandum of appeal, deciding the appeal on merits, failing which it would be abdicating its powers especially looking at the provisions where the Appellate Authority has been empowered to conduct such further enquiry as found necessary to decide the appeal, which decision also shall be on the points raised.”

Recommended: Patna High Court Rules That GST Pre-Deposit Can Be Paid from the ECL for Appeals

The bench in the aforesaid view has quashed the order and asked to restore the plea of the taxpayer to the appellate authority.

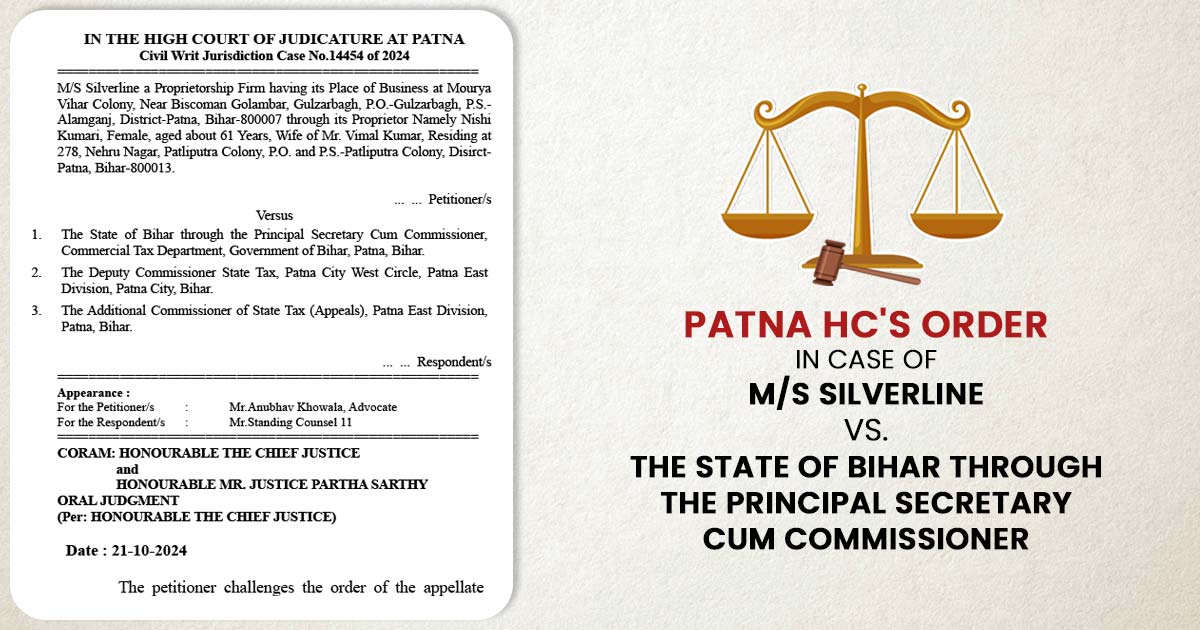

| Case Title | M/S Silverline vs. The State of Bihar through the Principal Secretary Cum Commissioner |

| Citation | Case No.14454 of 2024 |

| Date | 21.10.2024 |

| For the Petitioner | Mr.Anubhav Khowala |

| For the Respondent | Mr.Standing Counsel 11 |

| Patna High Court | Read Order |