The High Court of Punjab & Haryana in a case has set aside the income tax notice issued and proceedings initiated without performing the faceless assessment under section 144B of the Income Tax Act, 1961.

The petitioner Shikhar Gadh cited that the problem is pertinent to the existing petition stands examined and concluded by the court titled Jasjit Singh vs. Union of India and others and by the Coordinate Bench in Jatinder Singh Bhangu vs. Union of India and others, decided on 19.07.2024.

The court in the matter carried that these circulars or guidelines by the board can not have been furnished to override the legal provisions or to make them otiose or obsolete. It is crucial for Legislative enactments having financial implications to be followed strictly and mandatorily.

Read Also: What is Faceless Income Tax Assessment & How it Works for Taxpayers?

The authorities through practising the powers had in sections 119 and 120 of the Act, 1961 as well as Section 144B (7 & 8), are not permitted to seize the statutory provisions to their own delight which causes hurdles to the taxpayers. Confusion arises from this among taxpayers.

Learning that the law specified under the coordinate bench the division bench of Justice Sanjeev Prakash Sharma and Justice Sanjay Vashisth marked that the notice issued via the JAO under section 148 of the Act, 1961 and the proceedings initiated after that without performing the faceless assessment as predicts u/s 144B of the Act, 1961, have been discovered to be opposite to the provisions of the Act 1961.

The notices are been set aside by the court. It was viewed by the court that the norms and circulars could be issued merely to supplement the legal provisions and for their execution.

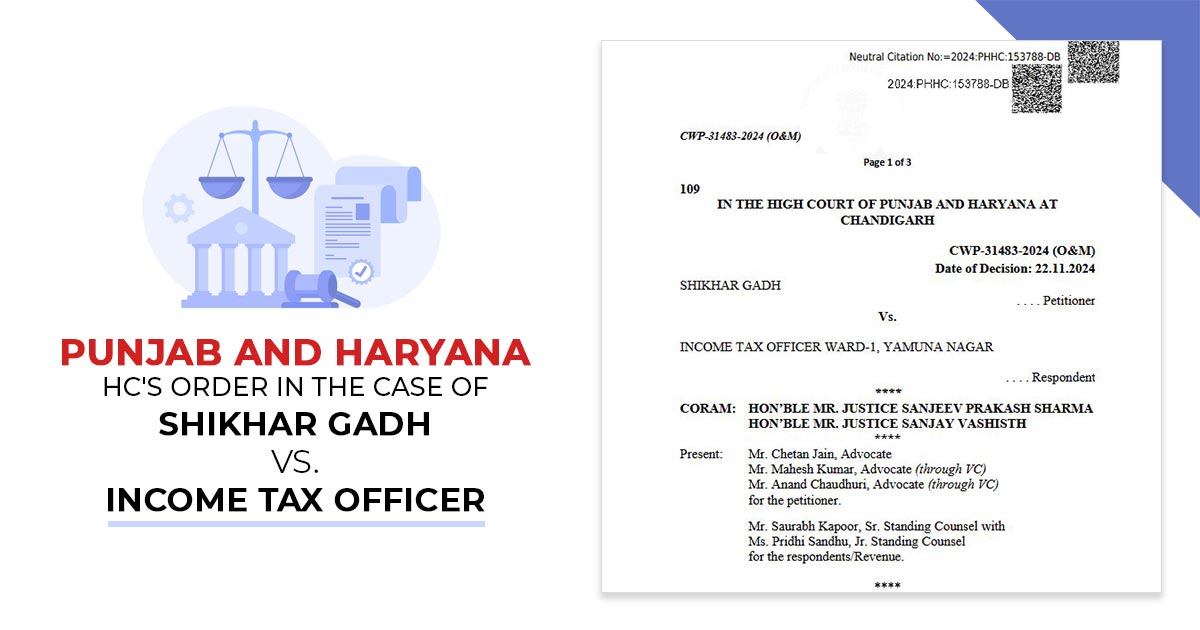

| Case Title | Shikhar Gadh vs. Income Tax Officer |

| Citation | CWP-31483-2024 (O&M) |

| Date | 22.11.2024 |

| Petitioner by | Mr Chetan Jain, Mr Mahesh Kumar, Mr Anand Chaudhuri |

| Respondents by | Mr Saurabh Kapoor, Ms Pridhi Sandhu |

| Punjab and Haryana High Court | Read Order |