The time extension notification on 24.04.2023 extending the time duration to pass the order u/s 73(9) and 73(10) of the Uttar Pradesh Goods and Service Tax Act, 2017 will apply solely from 31.03.2023 and not before that, the Allahabad High Court carried.

Section 73 provides the authority to the proper officer to pass the order levying the penalty as well as interest in which any tax does not get paid or short paid or incorrectly refunded or where the GST Input Tax Credit (ITC) has been claimed incorrectly or used for any cause apart from the reason of fraud or any wilful misstatement or suppression of facts to evade tax, post following the due process specified in section.

Section 73(9) furnishes for issuance of order. Section 73(10) stipulates a 3-year limitation period for issuing such an order from the date on which the annual return was provided by the taxpayer.

The applicant has approached the HC asking to quash orders via which the applicant’s bank accounts were frozen. It was furnished via the applicant that the impugned orders were breached of sub-section 10, Section 73 of the U.P.G.S.T. Act, 2017 as they had been passed post the allowed time duration.

By placing reliance on notification dated 24.04.2023 respondents justified the passing of orders under Section 73(9) and (10) of the Act. They asserted that the aforementioned notification extended the time limit stated in sub-Section 10 of Section 73 for the year 2017-18 up to 31.12.2023 making the orders passed valid.

It was carried by the court that the respondents placed reliance on the notification on 24.04.2023, they do not regard that the notification has merely been provided retrospective effect from 31.03.2023.

It was carried out by the court that beneath normal situations, 31.12.2018 is the due date to file the annual return for the year 2017-18. Though the Central Board of Direct Taxes and Customs notifications on 03.02.2018, which was adopted through the state of UP, these dates were extended to date 05.02.2020. It was carried out by the court that the three-year duration to pass an order u/s 73 (10) of the Act would end by 05.02.2023.

“… the notification dated 24.04.2023 would be applicable retrospectively but only from 31.03.2023 meaning thereby, if the time limit of three years prescribed in sub Section 10 of Section 73 read with sub Section 1 of Section 44 expired prior to 31.03.2023 then the notification dated 24.04.2023 extending the time limit for passing of an order under sub Section 9 of Section 73 would not be applicable, apparently so,” the Division Bench Justice Rajan Roy and Justice Manish Kumar held.

The impugned order was carried to be without jurisdiction and as per that the writ petition was permitted.

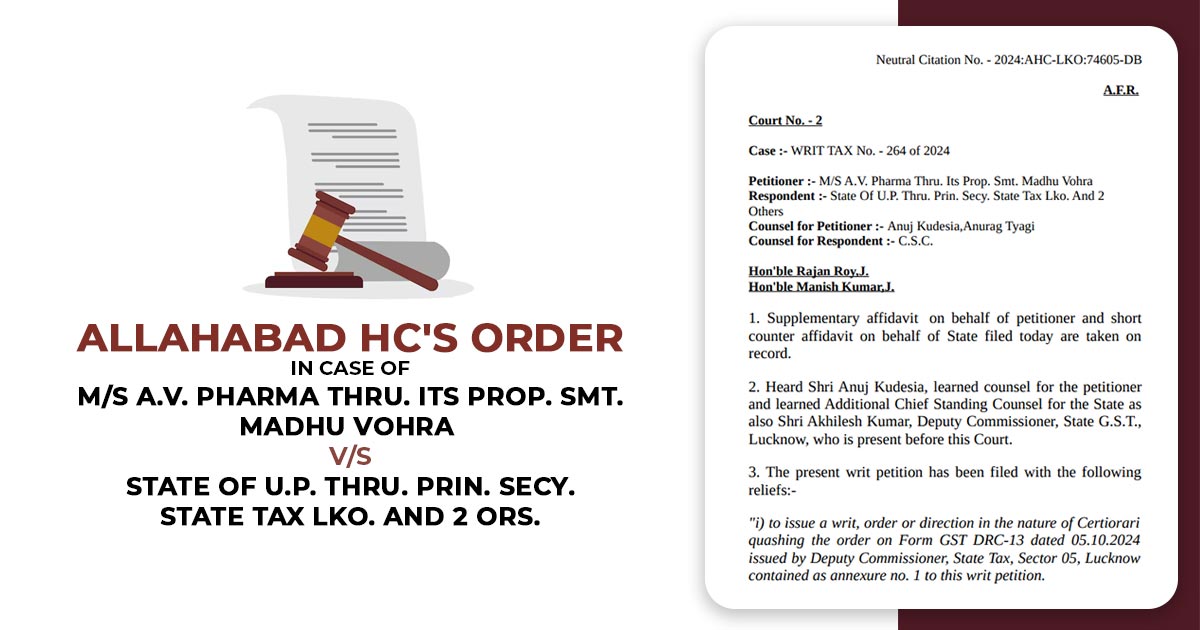

| Case Title | M/s A.V. Pharma Thru. Its Prop. Smt. Madhu Vohra vs. State of U.P. Thru. Prin. Secy. State Tax Lko. and 2 Ors. |

| Citation | WRIT TAX No. – 264 of 2024 |

| Date | 12.11.2024 |

| Petitioner by | Anuj Kudesia, Anurag Tyagi |

| Respondent by | C.S.C. |

| Allahabad High Court | Read Order |