The demand and penalty order passed u/s 129 of the Central Goods and Services Tax Act 2017 against a trader whose GST registration came to be suspended after it found that the goods in transit were accompanied by proper tax invoice and the e-way bill had been set aside by the Allahabad High Court.

A division bench of Chief Justice Arun Bhansali and Justice Vikas Budhwar laid on M/s Sahil Traders v. State of U.P. and another, 2023 wherein a coordinate bench had ruled that once the goods were discovered with a proper tax invoice and E-way bill, the consignee will be considered owner and goods will need to be discharged as per Section 129(1)(a) of the CGST Act.

Section 129 is for the detention and seizure of goods and conveyances and their release on the payment of requisite tax and penalty in the matters where these goods are transported in breach of the provisions of the CGST act or rules.

The goods of the applicant were being transported from Patna to Gurugram. It was aggrieved from the demand for the penalty in Form GST MOV-09. No discrepancy was found upon physical verification of the goods it asserted however it was detained by specifying the movement of the goods without proper documents.

The tax invoice and the e-way bill carrying the goods were on 01.10.2024 whereas the suspension of the registration of the applicant by the jurisdictional authority was dated 03.10.2024. On 04.10.2024 the vehicle came to be intercepted and demand was raised against the Petitioner dated 16.10.2024.

The applicant’s counsel furnished that it is not a matter of the respondent that the vehicle was not accompanied by the requisite documents. The same SCN (Show Cause Notice) that the registration of the applicant was suspended based on which the demand was raised which is not justified.

The department’s standing counsel asserted that the registration was received from the applicant based on the fake documents and hence as the documents that were carrying the goods in question were received on the grounds of the bogus registration, the order of passing was justified.

Initially, the High Court directed to Halder Enterprises v. State of U.P. and others (2023) wherein the goods were intercepted dated 03.10.2023 and the suspension took place with effect from 18.09.2023.

It was carried that once the goods were discovered with the proper tax invoice along with the e-way bill then the circular on 31.12.2018 issued via the Central Board of Indirect Taxes and Customs, GST Policy Wing would apply.

As per the circular if the invoice or any other mentioned document accompanies the consignment of goods then either the consignor or the consignee must be considered to be the owner.

In this context, the High Court marked that

“This is not the case of the respondents that the goods were not accompanied with proper tax invoice and E-way bill and only on account of the fact that the registration was suspended on 03.10.2024 that the action has been initiated and the order impugned has been passed as such the issue stands covered. Consequently, the writ petition is allowed.”

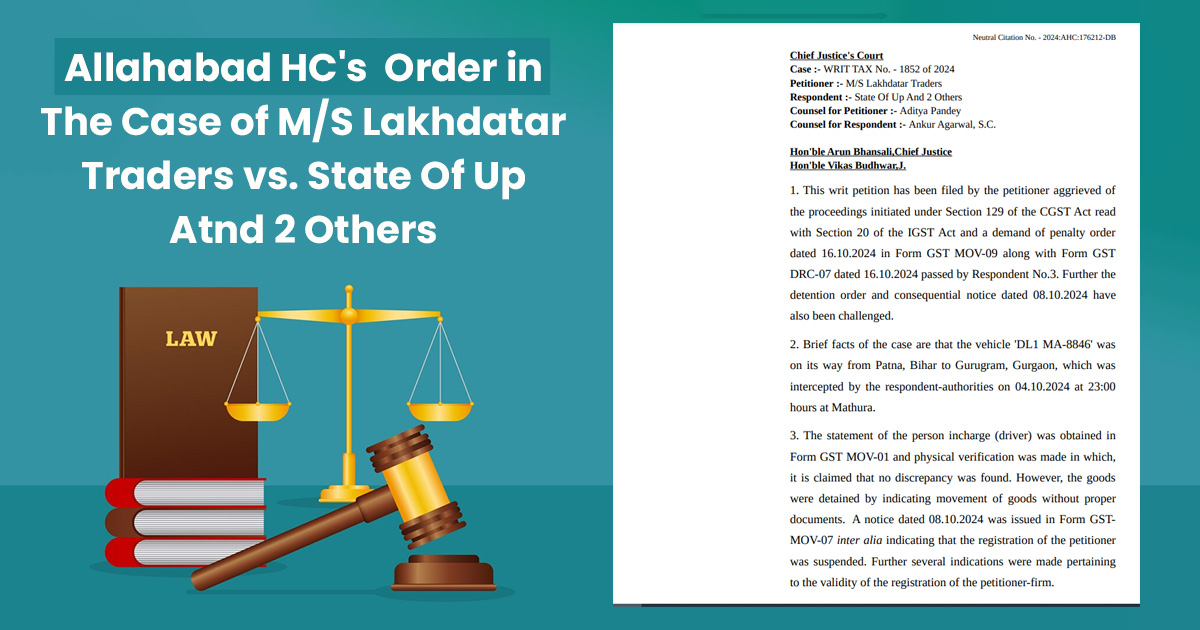

| Case Title | M/S Lakhdatar Traders vs. State Of Up And 2 Others |

| Citation | WRIT TAX No. – 1852 of 2024 |

| Date | 11.11.2024 |

| Counsel for Petitioner | Aditya Pandey |

| Counsel for Respondent | Ankur Agarwal, S.C. |

| Allahabad High Court | Read Order |