The Income Tax Appellate Tribunal ( ITAT ), Hyderabad quashes an Order of the Commissioner of Income Taxes (Appeals) – National Faceless Assessment Centre ( CIT (A) ), Delhi mentioning the absence of proof warranting the assessees to pay advance tax under the provisions of Section 209 of the Income Tax Act, 1961.

Ramadevi Nelaturi Cuddapah initiated the income tax appeal, for a person who does not file her income tax return (ITR) for the Assessment Year ( A.Y. ) 2019-20. The Jurisdictional Assessing Officer (AO) came to know that the appellant has submitted a cash deposit of Rs 16,50,000 with the District Cooperative Central Bank Ltd, Kadapa, based on which Notices u/s 148 and 142(1) of the Income Tax Act, 1961 were issued.

The AO, not having received a reply from the Appellant-assessee, completed the “Best Judgment Assessment” and brought Rs 16,50,000 to tax as the ‘Unexplained Expenditure’ under section 69C of the Income Tax Act, 1961. As per Section 249(4) of the Income Tax Act, 1961, the Assessment was appealed and dismissed in limine by the CIT(A).

The Income Tax Appellate Tribunal, Hyderabad, in the plea merely presided over by Inturi Rama Rao, Accountant Member, post pursuing the material on record and the order of the commissioner of Income taxes (appeals)- National Faceless assessment centre noted that none of the material available on the record recommends that the taxpayer has left to file an advance tax under Section 209 of the Income Tax Act, 1961.

The ITAT Bench under this observation carried that the CIT(A) had made a mistake in invoking the provisions of Section 249(4) of the Income Tax Act, 1961 while dismissing the matter of the Appellant in limine. Therefore the ITAT set aside the impugned order of the CIT(A) asking the NFAC to dispose of the appeal on merits following the law.

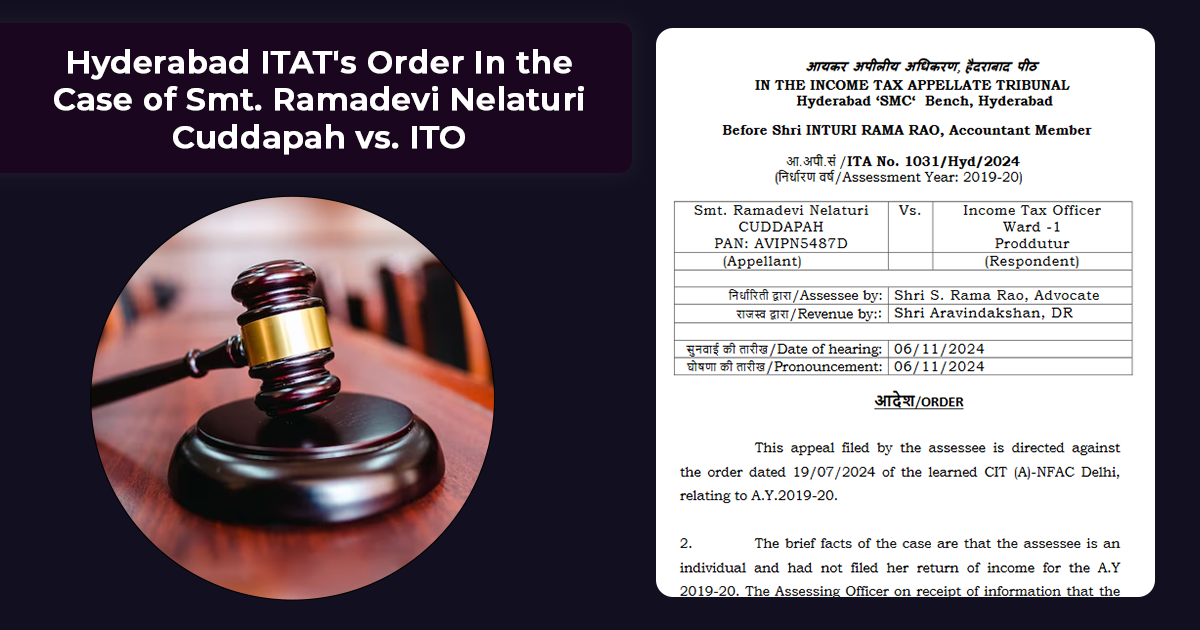

| Case Title | Smt. Ramadevi Nelaturi Cuddapah vs. ITO |

| Citation | ITA No. 1031/Hyd/2024 |

| Date | 06.11.2024 |

| Appellant by | Shri S. Rama Rao |

| Respondent by | Shri Aravindakshan |

| ITAT Hyderabad | Read Order |