The provisional attachment u/s 83 of the CGST Act ceases post 1 year and could not be attached again without providing a fresh reason, the Rajasthan High Court mentioned.

The Division Bench, including Chief Justice Manindra Mohan Shrivastava and Justice Ashutosh Kumar, was dealing with a matter in which the taxpayer contested the attachment of the department of their bank account because, as per Section 83(2) of the CGST Act, the provisional attachment of a bank account gets discontinued after 1 year.

On 26.06.2023, the impugned order was issued however the department has not released the taxpayer’s bank account till now.

It was furnished by the taxpayer that even though the highest duration of attachment furnished u/s 83 of the Central Goods and Services Tax Act, 2017 was finished, the attachment order that was issued dated 26.06.2023, the taxpayer has not been allowed to use its bank account by the bank.

It was furnished by the department that the statutory position is clear that the highest duration of attachment shall be 1 year as given u/s 83 of the Act of 2017. Automatically the same attachment will be ended via the operation of law and no order is needed to be passed.

The bench asked the Punjab National Bank to permit the taxpayer to function its bank account till the attachment of the account concerns certain proceedings other than the one about which the attachment order was passed before dated 26.06.2023.

The bench in the above-said view permitted the petition.

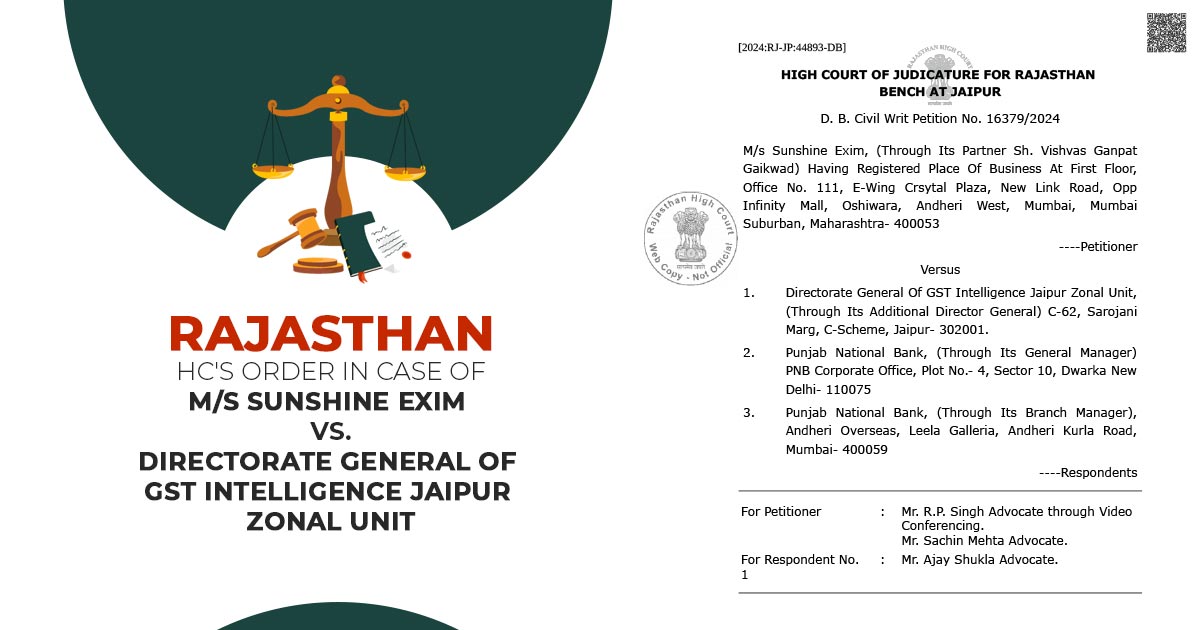

| Case Title | M/s Sunshine Exim vs. Directorate General Of GST Intelligence Jaipur Zonal Unit |

| Citation | D. B. Civil Writ Petition No. 16379/2024 |

| Date | 24.10.2024 |

| For Petitioner | Mr. R.P. Singh, Mr. Sachin Mehta |

| Respondent by | Mr. Ajay Shukla |

| Rajasthan High Court | Read Order |