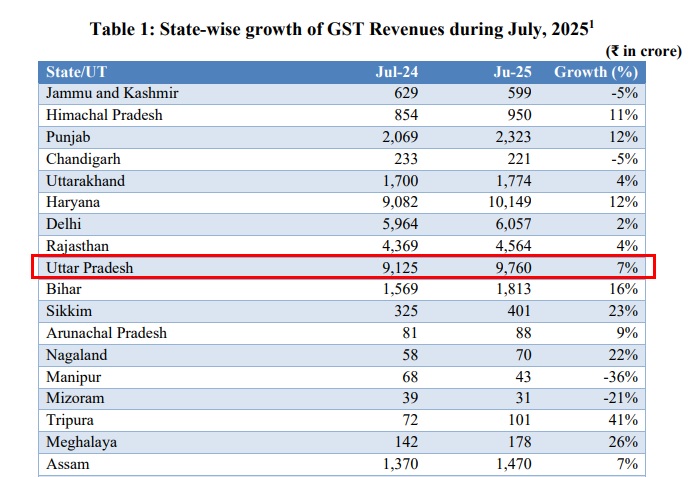

The GST collection in Uttar Pradesh, following a slowdown in performance, has finally signalled recovery in July, attaining ₹9,760 crore, a 7% increase over the same month in the previous fiscal year (2023), as per the latest data released by the Goods and Services Tax Network (GSTN).

It is the first time in the existing fiscal year that UP has registered a positive year-on-year growth in GST revenue. In June, there is a 4% reduction in the GST growth, which has raised concerns in the government. A statewide campaign has been launched by the state tax department to determine the causes that are to be recognised.

Though the cumulative GST growth of the state for the financial year so far (April–July) remains negative, it shows the challenges that the government could face in the forthcoming months. There is a -2% growth from April to July in cumulative pre-settlement and post-settlement GST in UP.

“UP, one of the country’s top five GST contributors, had been witnessing either flat or negative growth in monthly GST collections during the first quarter. The July rebound has offered some respite, but may not be enough to compensate for the lag in previous months, especially June,” a tax department official cited.

According to data released by the Goods and Services Tax Network (GSTN) on July 1, the national GST collections for July reached an impressive ₹1.96 lakh crore, reflecting a year-on-year growth of 7.5%. In terms of absolute figures, Maharashtra topped the list with collections amounting to ₹30,590 crore, followed by Karnataka, Tamil Nadu, and Uttar Pradesh.

Notably, Uttar Pradesh’s growth in July aligns with the national average and is nearly comparable to that of the leading contributors, Maharashtra and Karnataka.

In comparison to the significant growth experienced by states such as Madhya Pradesh, which saw an increase of 18%, and Bihar, with a 16% growth rate, Uttar Pradesh’s growth rate of 7% is relatively modest.

Another official cited that, “The July figure is encouraging, but we can’t celebrate just yet. This needs to become a trend.” The July revenue is the tax paid in June. “We can expect the GST collection to grow in the festive months of October and November,” he added.