The Pune ITAT held that levying late fees under Section 234E for TDS returns processed before June 1, 2015, was unjustified, noting that the revision to Section 200A was yet to take effect.

The taxpayer, Shrikrishna Laxminarayan Thakur, furnished the TDS returns for diverse quarters across Assessment Years 2013-14, 2014-15, 2015-16, and 2016-17. All these returns were filed late and processed u/s 200A by the Central Processing Cell (CPC) processed them, levying late fees under section 234E for the delay.

Before CPC taxpayer furnished rectification applications to eliminate the fees, which were rejected. The taxpayer, dissatisfied with the order, submitted a plea to the Commissioner of Income Tax (Appeals) [CIT(A)]. The appeal was dismissed by the CIT(A) and upheld the order of CPC.

The taxpayer submitted a plea to the ITAT when dissatisfied with the CIT(A) order. The taxpayer’s counsel, charging late fees u/s 234E for returns processed before June 1, 2015, was not valid.

The counsel said that the provision in section 200A was revised w.e.f that date. The revenue counsel kept the orders of the lower authorities. For late filings, fees were levied, counsel said.

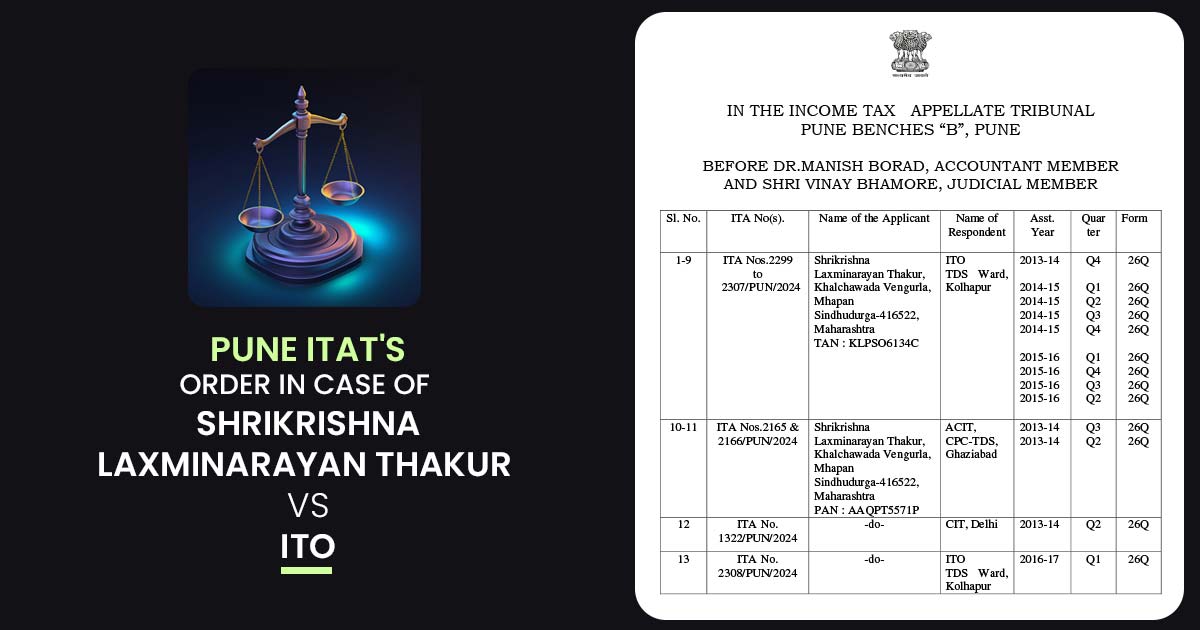

The two-member bench, including Dr. Manish Borad (Accountant Member) and Vinay Bhamore (Judicial Member), cited that before judicial pronouncements, the issue of late fees under Section 234E was well-settled.

The tribunal mentioned that the revision to section 200A introduced through the Finance Act 2015 provides administration to authorities to impose fees u/s 234E, though it could be imposed merely from June 1, 2015.

In decisions such as the Kerala High Court’s rulings in Olari Little Flower Kuries Pvt. Ltd. vs. Union of India and Jiji Varghese vs. ITO(TDS), the tribunal relied on which confirmed that no fees can be charged for periods before June 1, 2015.

It was discovered by the tribunal that 8 appeals of the taxpayer related to Assessment Years 2013-14 and 2014-15, with returns processed before June 1, 2015, were covered by these precedents. The tribunal, while permitting the taxpayers’ grounds, cancelled the imposition of late fees for these appeals.

The remaining 5 appeals pertained to the Assessment Years 2015-16 and 2016-17, with returns processed after June 1, 2015. The tribunal kept the applicability of the fees under Section 234E.

Also Read: Kerala HC: Order Not Liable to Pay Late Fee U/S 234E for Filing Delayed TDS Returns

It directed the revenue authorities to recalculate the fees, taking into account only the delay from June 1, 2015, until the date of return processing. The tribunal determined that the amendment to Section 200A was applicable prospectively. Consequently, the taxpayer’s appeals were partly authorised.

| Case Title | Shrikrishna Laxminarayan Thakur vs. ITO |

| Case No. | ITA Nos.2299 |

| For The Petitioner | Smt. Deepa Khare |

| For The Respondents | Shri Arvind Desai |

| ITAT Pune | Read Order |