The Income Tax Department has launched its new E-filing portal on June 7th, 2021. Consequently, these days, it is creating an awareness and learning campaign on how to proceed for registration and re-registration of Digital Signature Certificate (DSC) on the new Income Tax e-filing portal.

Latest Update

- The taxpayers now download the Digital Signature Certificate (DSC) Management utility at the official portal. Download Now

- The CBDT department has published the issues and solutions of the Digital Signature Certificate (DSC). Read PDF

- The Income tax department has published guidance related to facing an issue in DSC. Read PDF View more

Download Income Tax Software

What Exactly is DSC & Who Can Create it?

- As per Section 140 of the IT Act 1961, the person responsible for signing the I-T return could be

- Managing Director or

- any other Director (in case the MD is unavailable) in case of a Company;

- Any authorized person possessing a legal power of attorney in case of the presence of a Non-resident Company;

- Managing Partner of a Firm or any other Partner (in the specific case of Managing Partner being unavailable);

- Chief Executive Officer/ Principal Officer or Competent person in case of other entities such as Body of Individuals, Association of Persons,, Artificial Juridical person, Trust, Local Authority and so on

- Karta in case of a HUF;

- Self in case of an Individual or;

- Any authorized person possessing legal power of attorney in case the individual is not capable of signing the I-T Return or is outside India.

Any person who is willing to sign the Income Tax Return ‘digitally’ has to complete the registration process for the DSC on the e-filing website (www.incometax.gov.in ) before signing. Further, It is important to mention that any person can change or update his DSC registration any number of times.

Essentials Required in DSC Registration?

- To register the Digital Signature Certificate, the taxpayer must have

- the Registered user of the Electronic–Filing portal having a valid user ID and password;

- Downloaded and installed the emsigner utility;

- The USB token that is procured from a Certifying Authority Provider should be plugged into the computer;

- DSC USB token should be a Class 2 or Class 3 Certificate;

- DSC to be registered should be active and not expired; and

- DSC should not be revoked.

Steps to Download Emsigner Utility

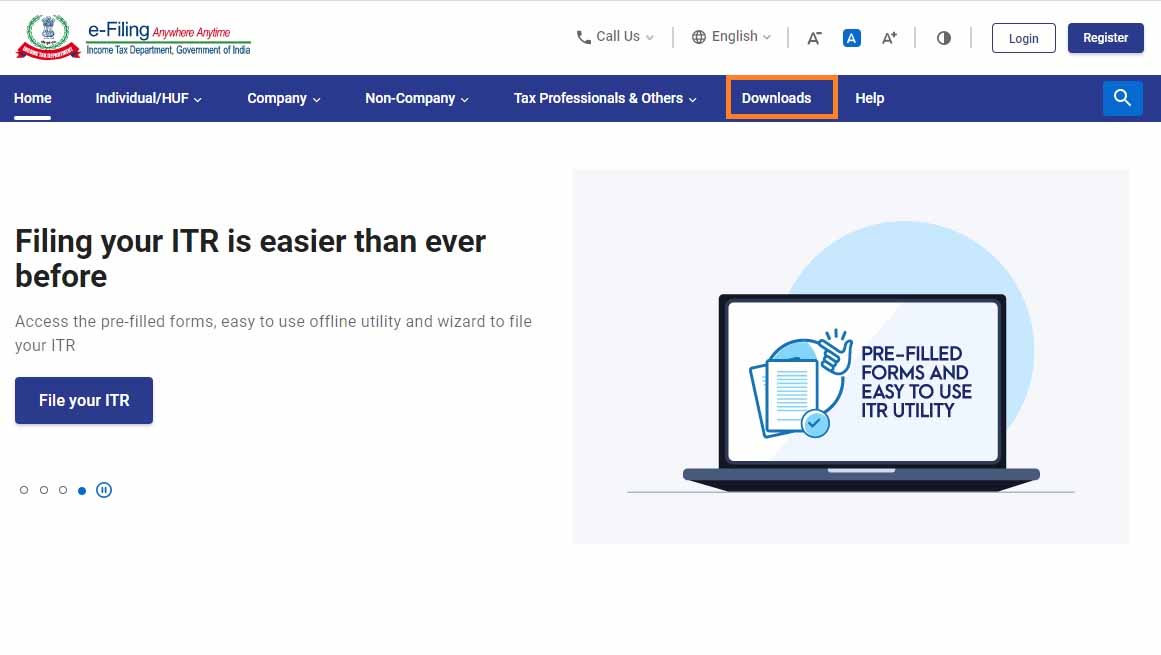

Step 1: Open the Income Tax e-filing portal

Step 2: Select the ‘Downloads’ tab from the header menu.

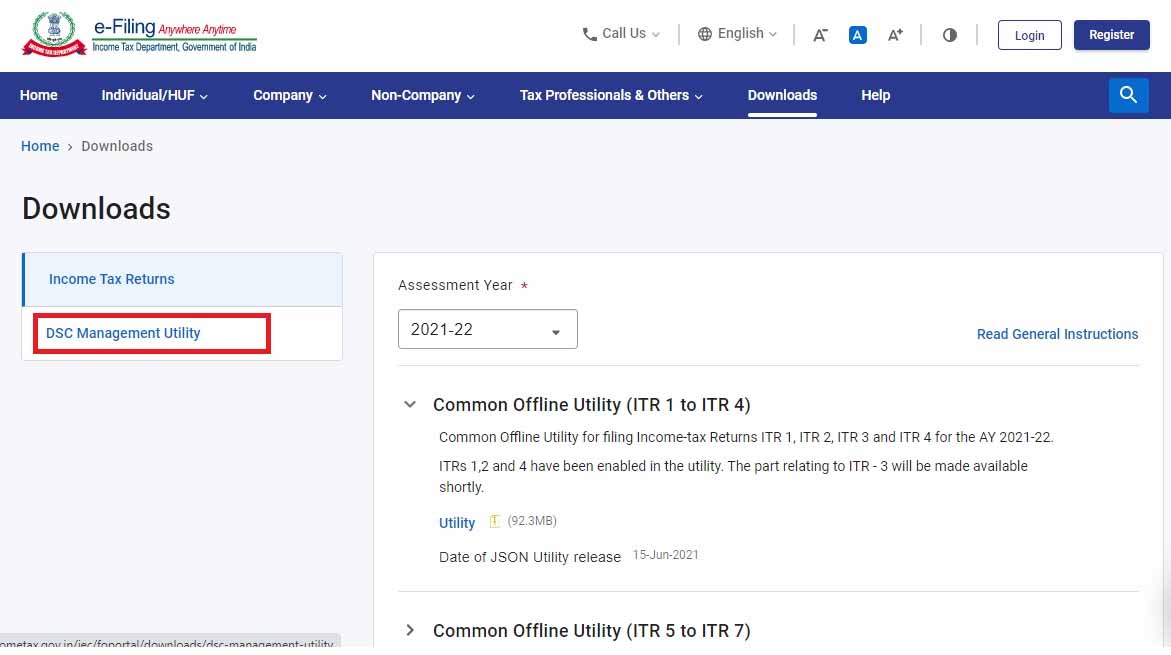

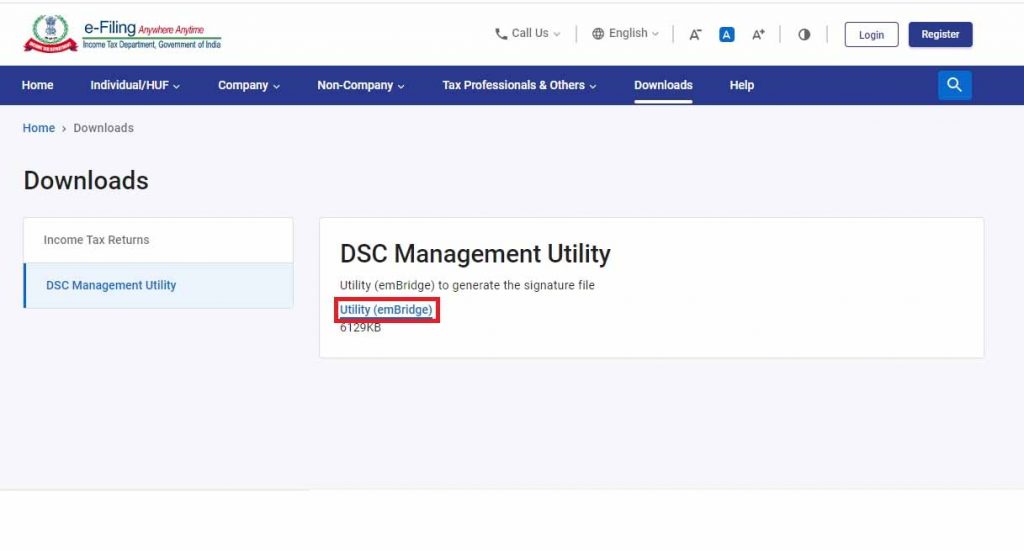

Step 3: Now Click on DSC Management Utility.

Step 4: Download the Utility (emBridge) to generate the signature.

Complete the Process of DSC Registration on the New Tax Portal

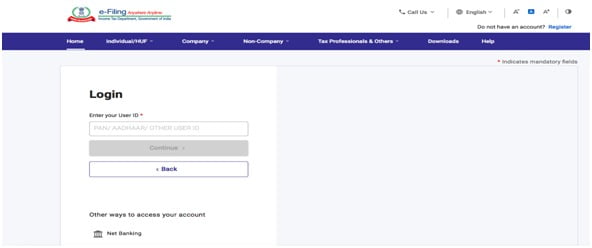

Step 1: The authorized signatory or Individual shall have to log into the E-filing website(www.incometax.gov.in ) using the Login particulars such as the user which may be your PAN, Aadhar Number, or any other ID and password of the company/firm / HUF / Individual and so on.

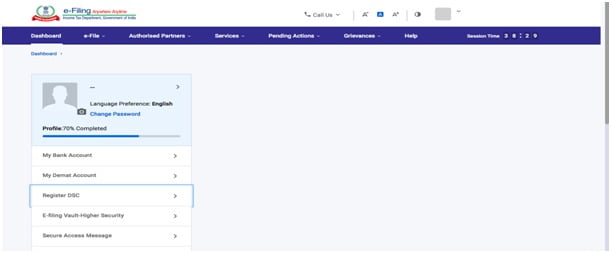

Step 2: He has to click on ‘My Profile’ from the Dashboard.

Step 3: Then, at the left side of the screen, he has to click the option ‘Register DSC’.

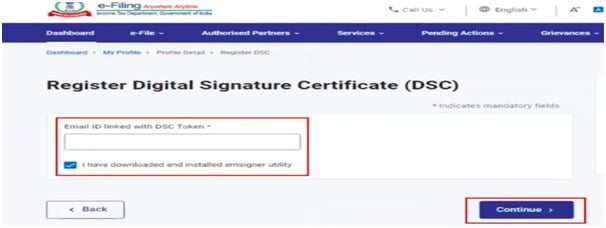

Step 4: Thereafter, Enter the linked mail ID and then select

“I have downloaded and installed emsigner utility” and click on ‘Continue’.

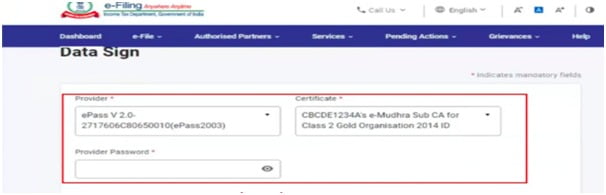

Step 5: In the last step, select the provider and certificate. Now Enter the provider password. Click on sign

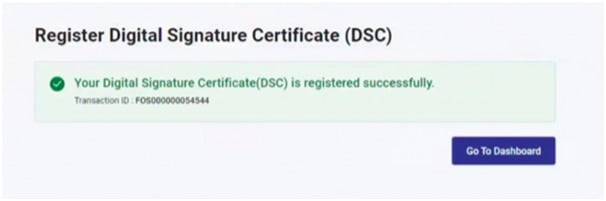

If the attempt for DSC is successful then a message will be displayed with the choice to go to the Dashboard.