According to the recent survey done by a private firm on Tuesday, it is disclosed that the history of nine years India’s factory production level fallen in July 2017, due to the implementation of Goods and Services Tax (GST).

Powerd By SAG INFOTECH

Notifications can be turned of anytime from browser settings

According to the recent survey done by a private firm on Tuesday, it is disclosed that the history of nine years India’s factory production level fallen in July 2017, due to the implementation of Goods and Services Tax (GST).

The new GST tax regime has also not exempted the individuals, software professionals and the freelancers, who dealt in exporting services and softwares. Under GST law, every individual involved in supplying any goods and service outside the country, is mandate to register self for GSTIN.

The GST Council may reduce tax rates on job work to those who are making fabric to the garment and put it under 5 percent slab rate structure in the GST framework. The meeting will be conducted tomorrow and may be the industry have to register online for goods worth above Rs 50,000 before getting transported.

It is a difficult time for numerous sectors across the nation as the GST is trying to cover up all those into strict compliance. With this into effect, the bicycle industry is also under the problems of tax rates and input tax credit all at once.

The finance minister took a turn in his statement and stated that in the future course of time, the GST rates may be rationalized. The most comprehensive tax regime may see a difference after some time with the scope of rationalization of slab rates 12 and 18 percent into one.

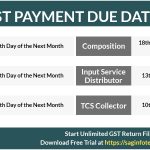

Goods and Service Tax is an ambitious tax regime applicable from 1st of July 2017 made a number of indirect taxes subsumed into it. The government has now revealed the due dates for the payment of GST.

Nitin Gadkari, Road Minister has written a letter to Union Finance Minister Arun Jaitley to review the higher taxation rates on alternative fuels such as biodiesel and ethanol, in the light of new regime.

India’s biggest tax regime i.e. Goods and Services Tax (GST) has been implemented in the country from the 1st July 2017. But, with the roll out of this taxation regime, there is also an immediate medium is required to counter the problems faced by the taxpayers and to resolve the discrepancies found, on a regular basis through Audit.

The Central Board of Excise and Customs (CBEC) has clarified the confusion on tax rates of Sarees. The statement stated that whether designer sarees or embroidered, will impose a five percent tax rates under the new Goods and Services Tax (GST).