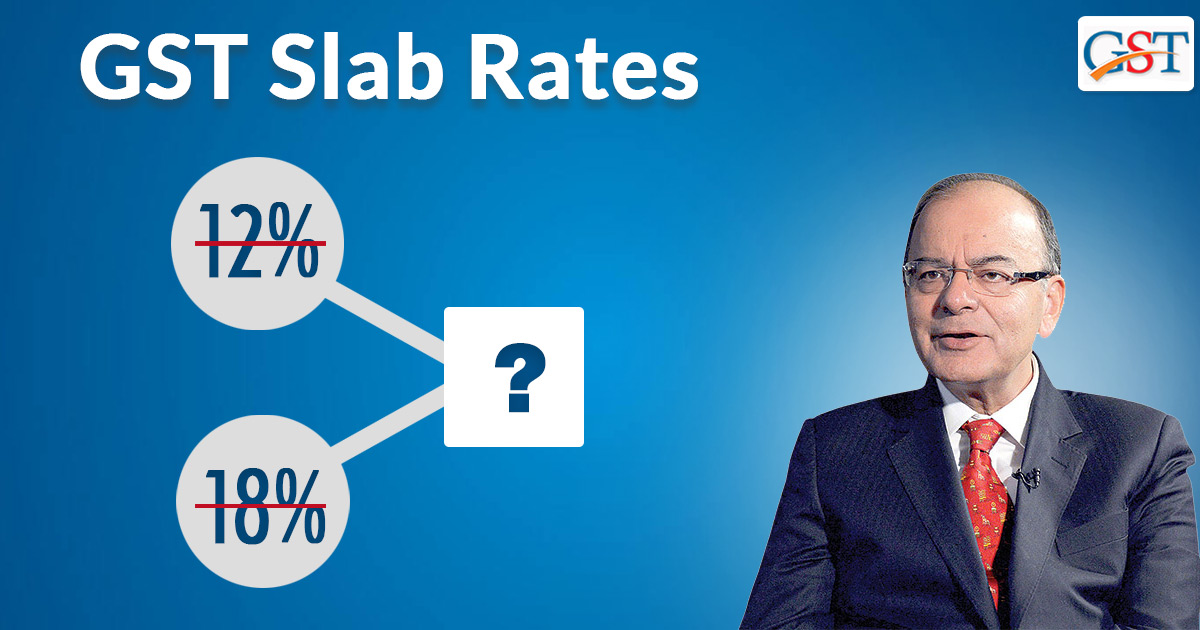

The finance minister took a turn in his statement and stated that in the future course of time, the GST rates may be rationalized. The most comprehensive tax regime may see a difference after some time with the scope of rationalization of slab rates 12 and 18 percent into one.

Arun Jaitley was present at the meeting while discussing two bills related to J&K and here mention that “I do concede that as it (GST) moves forward, there will be scope for rationalising the rates. There, probably, will be a scope that the two standard rates of 12% and 18 per cent, after some time, could be clubbed into one. That is a fair possibility and a suggestion.”

The two bills discussed were Central Goods and Services Tax (Extension to Jammu and Kashmir) Bill, 2017 and the Integrated Goods and Services Tax (Extension to Jammu and Kashmir) Bill, 2017 and were passed by voice note. Currently, GST has 5, 12, 18, 28 percent slab rate with luxury and sin good cess. While some of the items are exempted and nil rated.

Read Also: Meaning of SGST, IGST, CGST Along with Input Tax Credit Adjustment

The finance minister cleared out that merging two slab rates into one can cause inflation much more impactful while considering the criticism of multiple slab rates introduced under GST. He just stated that a single slab rate cannot be considered for the whole country with such a large population coming below the poverty line.

While discussing further on the bill of J&K, he mentioned that “If they (J&K) didn’t integrate, the traders would not have got input credit and the tax on final products would have been higher… That would have made products costlier and consumers would have to pay more, J&K is a consumer state and GST being a destination based tax, revenues of the state would increase.”