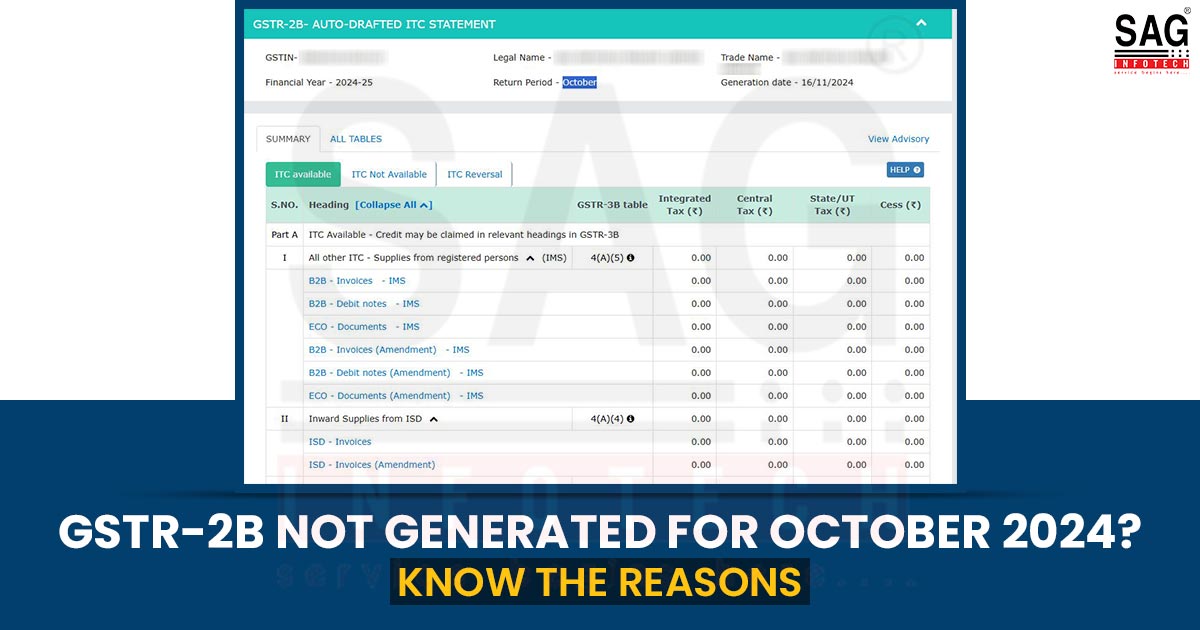

An advisory on getting late GST registration reported by some taxpayers even after successful Aadhar Authentication as per Rules 8 and 9 of the CGST, Rules, 2017, has been issued by the Goods and Service Tax Network (GSTN). Taxpayers complained that even after successful Aadhar Authentication their GST Number is not furnished to them. Now […]