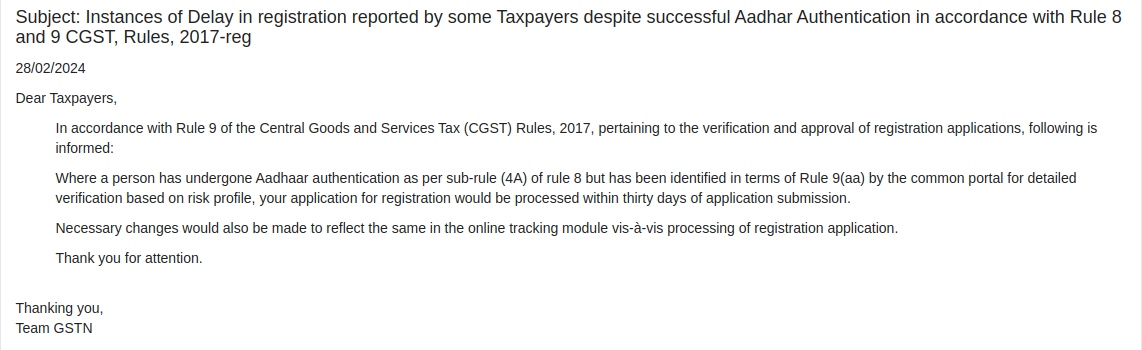

An advisory on getting late GST registration reported by some taxpayers even after successful Aadhar Authentication as per Rules 8 and 9 of the CGST, Rules, 2017, has been issued by the Goods and Service Tax Network (GSTN).

Taxpayers complained that even after successful Aadhar Authentication their GST Number is not furnished to them. Now the portal states that if post Aadhaar authentication, the person is recognized in terms of Rule 9(aa) by the common portal for detailed verification established on the risk profile, the application for registration shall be processed within 30 days of application submission.

Verification of the application and approval under Rule 9

Under Rule 9(aa) where a person, who has experienced authentication of an Aadhaar number as stipulated in sub-rule (4A) of rule 8, is recognized on the common portal, established on data analysis and risk parameters, for carrying physical verification of places of business the notice in FORM GST REG-03 might be issued not later than 30 days from the submission date of the application.

CBIC New Advisory for Taxpayers