The GST Department has introduced numerous types of GST returns and GST registration forms. In order to clear any kind of misconception or confusion regarding the GST return and registration form. We have enlisted in various procedures to get the required forms applicable to individual dealers.

We have provided a small flow chart depicting the methods and directions to be used for the fulfilment of the GST compliances:

- Regular Dealer

- Composition Dealer

- Tax Deductor

- Input Service Distributor

- UN Bodies / Embassies

- Non-Resident Assessee

- Temporary Registration

- E-Commerce Dealer

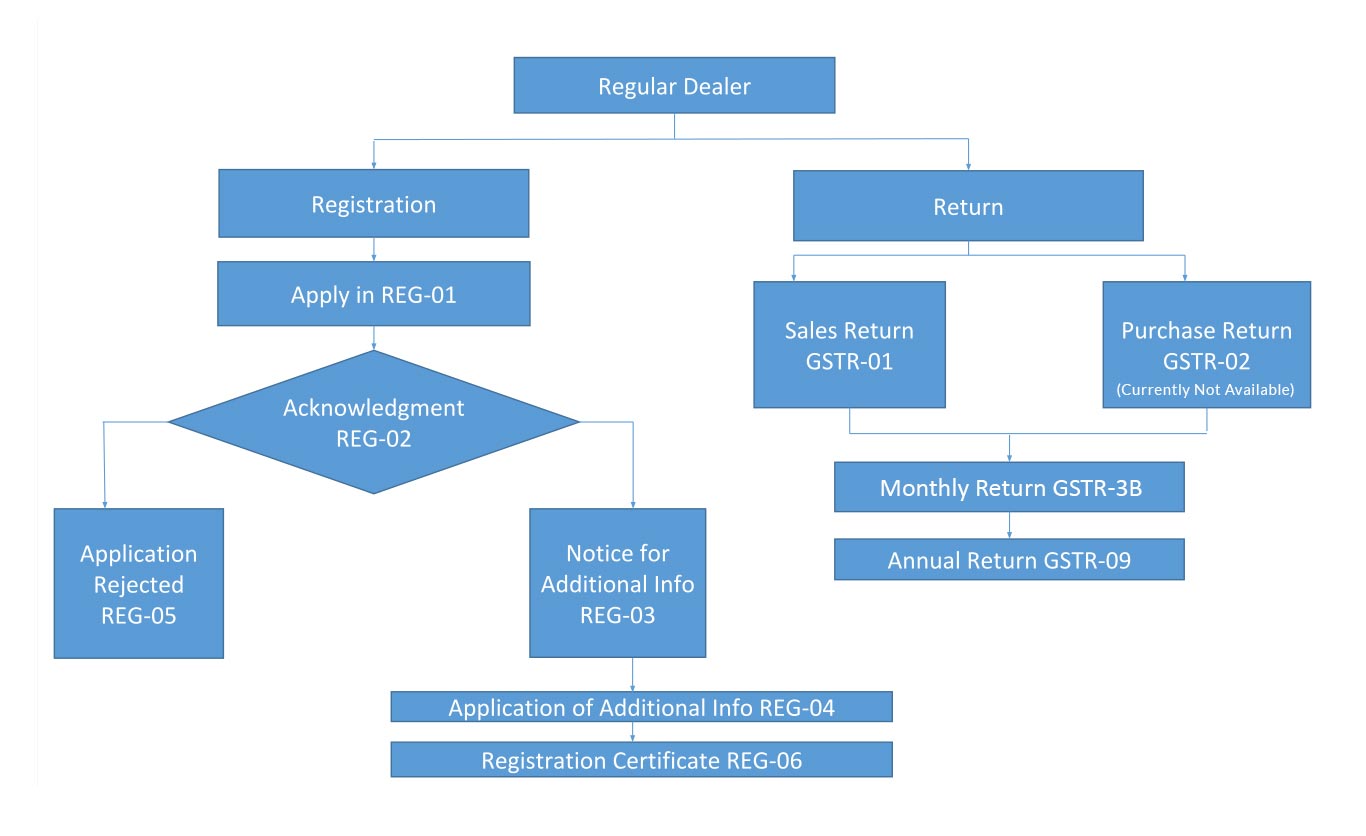

GST Registration & Return Process for Regular Dealers

Assessees who do not fall under any specific category like composition scheme or foreign taxpayer etc. will be liable to fall under the following procedure.

The Registration Process

- Apply form is REG-01: Fill all the dealers and attach the required documents

- After Uploading the same an acknowledgement will be generated in REG—02 Form

- Authority either rejected the application in REG-05 after being given the opportunity of being heard or gave notice in REG-03 for additional information for additional information.

- The Assessee can fill in the additional information in REG-04 at the proper time which is mentioned in the notice

- If the authority is satisfied then he can give the registration certificate in form REG-06

The Return Process

- The taxpayer must file the GSTR-01 form in case of outward taxable supplies on or before the 11th day of next month for monthly return filers & on or before the 13th day of next month for Quarterly return filers.

- The taxpayer must file the GSTR-3B form in case of outward taxable supplies on or before the 20th day of next month for monthly return filers & on or before the 22 & 24th day of next month for Quarterly return filers for State A & State B respectively.

- While the GSTR-09 for an annual return which will be filed on or before 31st December at the end of the F.Y.

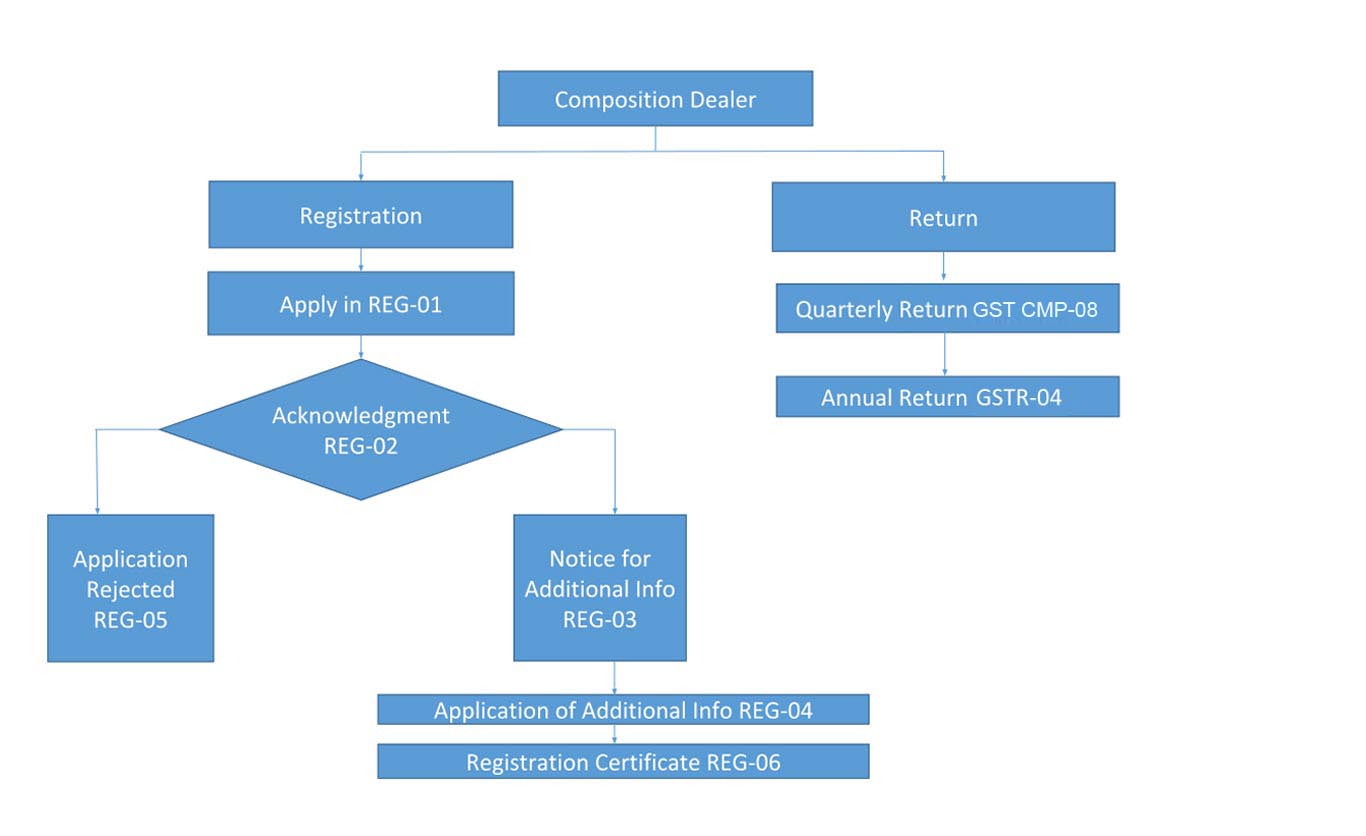

GST Registration & Return Process for Composition Dealers

Assessees who fall under the category of composition/compounding dealers won’t have to maintain invoices do not need to deal with interstate transactions and will have to follow the below procedure.

The Registration Process

- For the registration, he will have to apply in REG-01, and after the acknowledgement as REG-02, there might be two cases.

- If the application is rejected, the form will be REG-05 and if accepted, the notice of additional information will be demanded in REG-03.

- Then the application for additional info will be demanded in REG-04, after which a registration certificate will be available in filling REG-06.

The Return Process

- Then there will be two forms, for quarterly returns, there is CMP-08 and for annual returns, there is GSTR-4

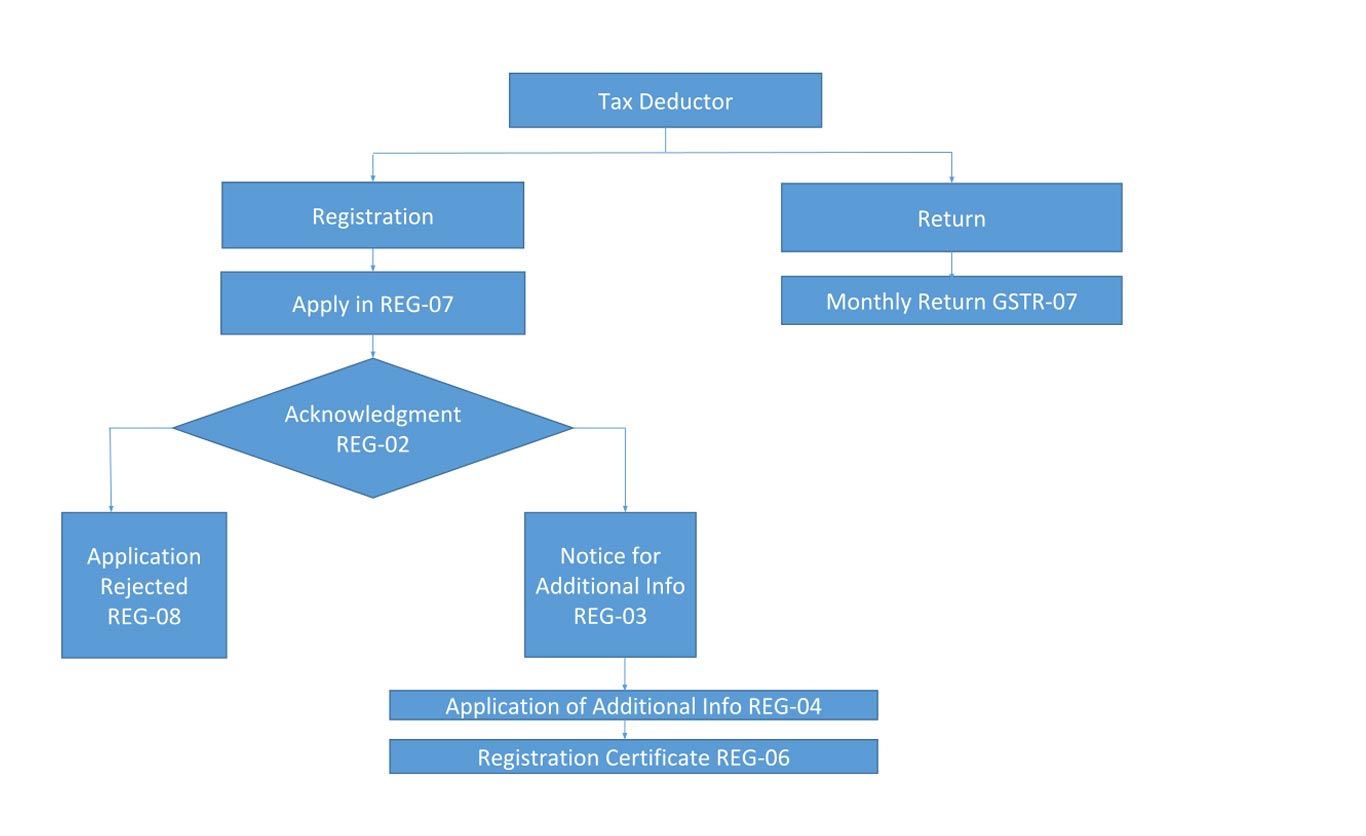

GST Registration & Return Process for Tax Deductors

An Assessee who will register himself as a Tax Deductor will be liable to follow these compliances.

The Registration Process

- For the registration, he will have to apply in REG-07, and after the acknowledgement as REG-02, there might be two cases.

- If the application is rejected, the form will be REG-08 and if accepted, the notice of additional information will be demanded in REG-03.

- Then the application for additional info will be demanded in REG-04, after which a registration certificate will be available in filling REG-06.

The Return Process

- The tax deductor will have to file the GSTR 7 form

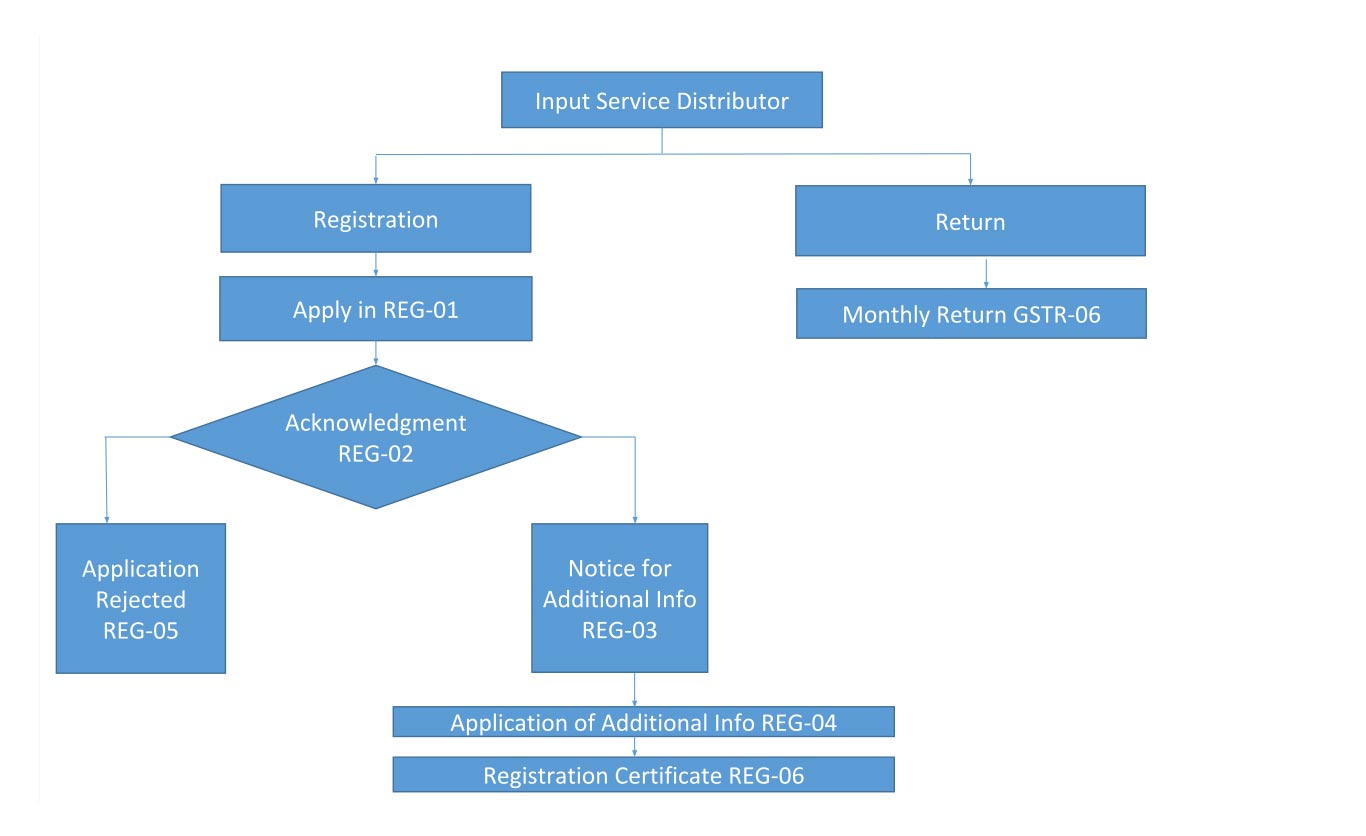

GST Registration & Return Process for Input Service Distributor

An assessee who is an input service distributor and distributes input tax credits to his branches will be covered under this category.

The Registration Process

- For the registration, he will have to apply in REG-01, and after the acknowledgement as REG-02, there might be two cases.

- If the application is rejected, the form will be REG-05 and if accepted, the notice of additional information will be demanded in REG-03.

- Then the application for additional info will be demanded in REG-04, after which a registration certificate will be available in filling REG-06.

The Return Process

- The input service distributor will have to file GSTR 6 on or before the 13th of next month

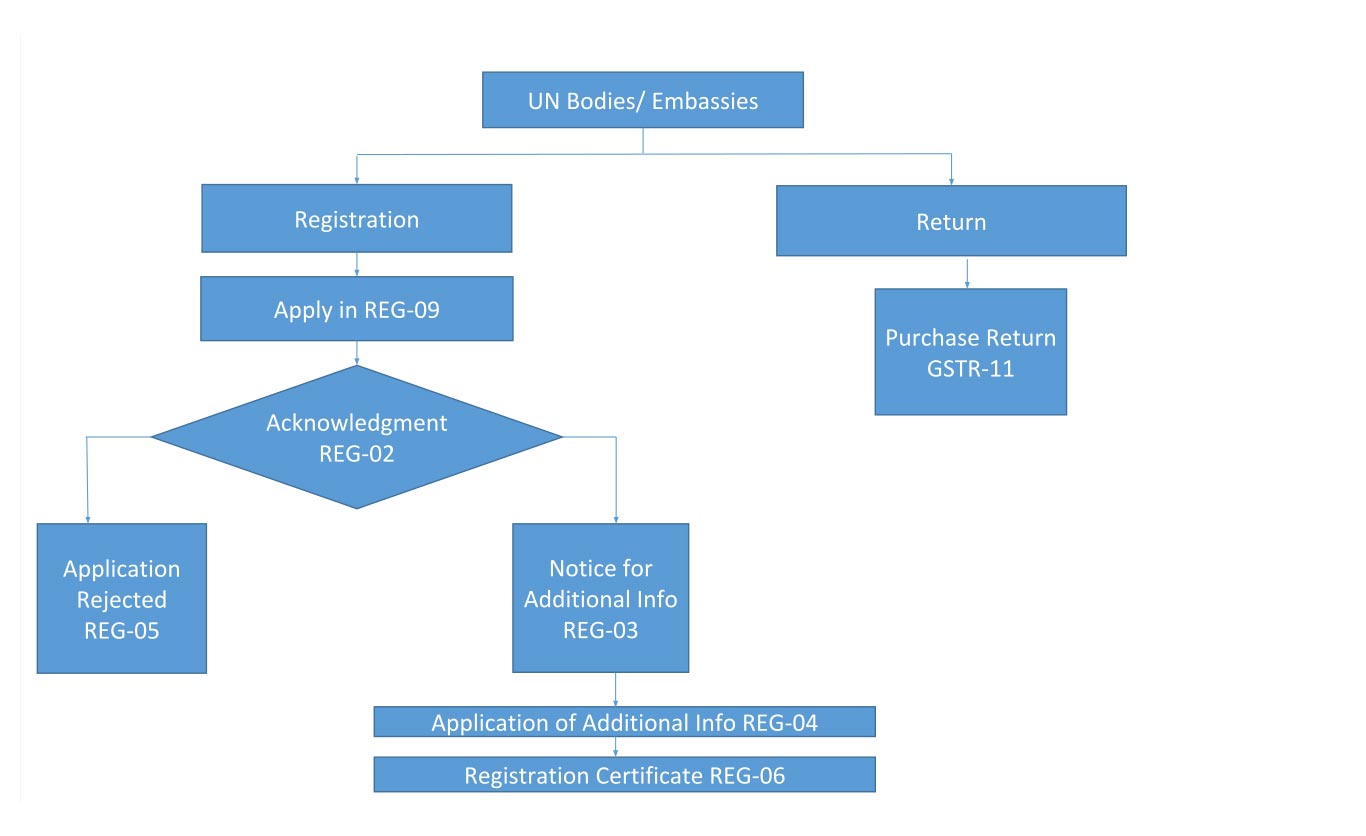

GST Registration & Return Process for UN Bodies / Embassies

The UN Bodies or Embassies who want to register themselves for GST should follow the following steps to be part of GST without affecting administration.

The Registration Process

- For the registration, he will have to apply in REG-09, and after the acknowledgement as REG-02, there might be two cases.

- If the application is rejected, the form will be REG-05 and if accepted, the notice of additional information will be demanded in REG-03.

- Then the application for additional info will be demanded in REG-04, after which a registration certificate will be available in filling REG-06.

The Return Process

- The UN bodies/ Embassies will have to file GSTR 11

- There is no due date for filing of form GSTR-11, UIN holder can file any time after the end of the relevant Quarter

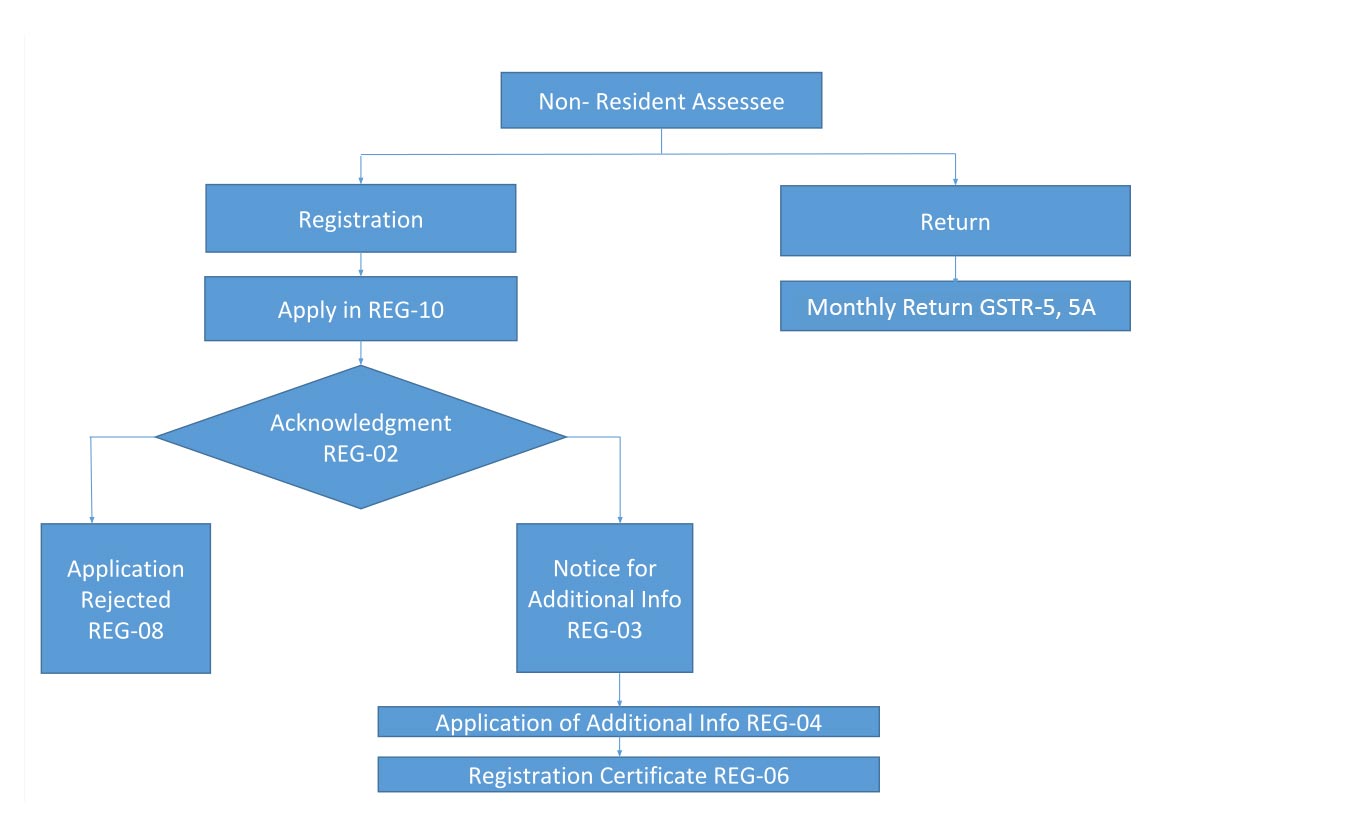

GST Registration & Return Process for Non-Resident Assessee

Other than UN bodies and Embassies, if a non-resident assessee either company or individual is liable to register themselves in the GST System too. After registration, they are liable to fill out the following forms.

The Registration Process

- For the registration, he will have to apply in REG-10, and after the acknowledgement as REG-02, there might be two cases.

- If the application is rejected, the form will be REG-08 and if accepted, the notice of additional information will be demanded in REG-03.

- Then the application for additional info will be demanded in REG-04, after which a registration certificate will be available in filling REG-06.

The Return Process

- The Non-resident assessee will have to file the GSTR 5 return form on or before the 13th of the next month

- GSTR 5A for Online Information and Database Access or Retrieval (OIDAR) Service Providers and the due date is the same as GSTR 5

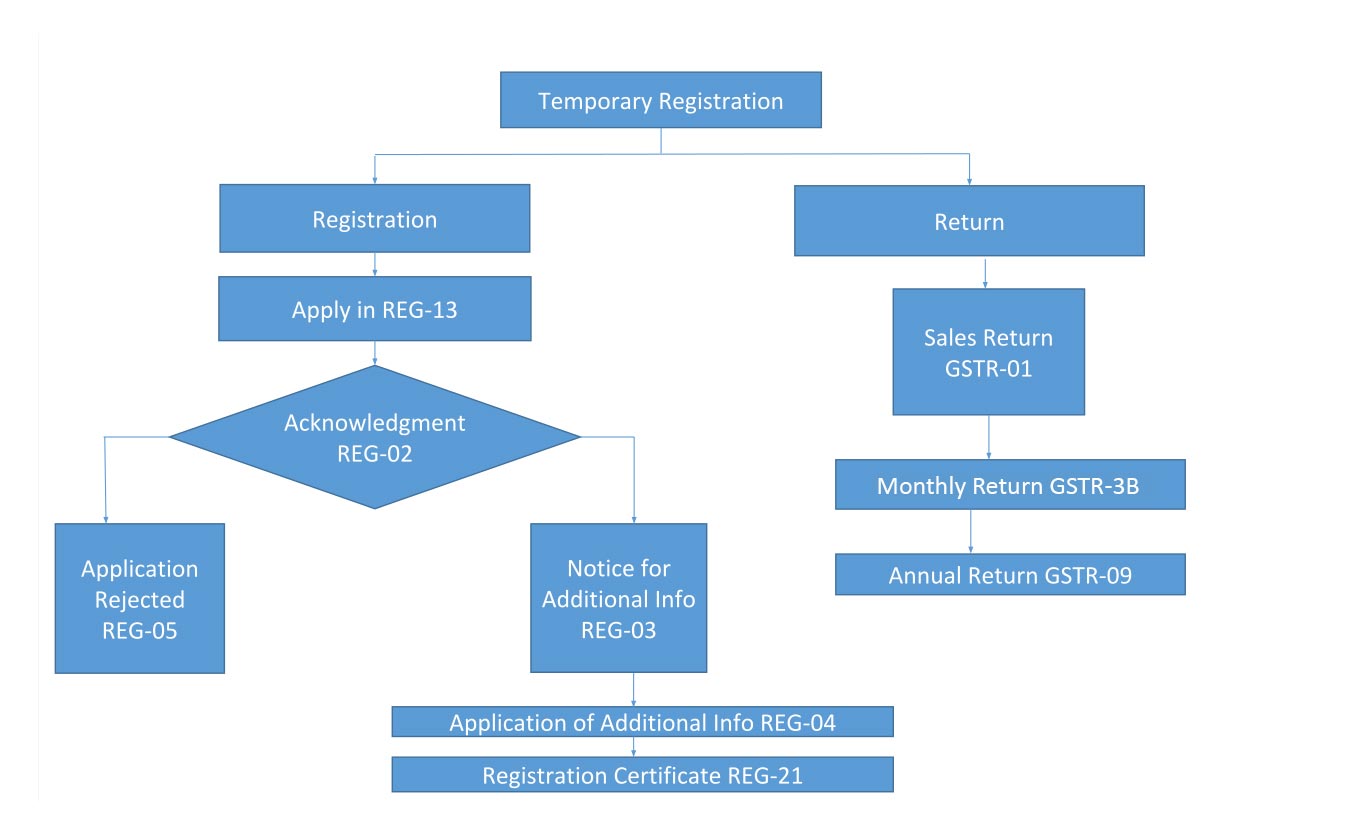

GST Registration & Return Process for Temporary Taxpayers

If any assessee wants to register themselves in GST on a temporary basis then, they must follow the steps mentioned below.

The Registration Process

- For the registration, he will have to apply in REG-13, and after the acknowledgement as REG-02, there might be two cases.

- If the application is rejected, the form will be REG-05 and if accepted, the notice of additional information will be demanded in REG-03.

- Then the application for additional info will be demanded in REG-04, after which a registration certificate will be available in filling REG-21.

The Return Process

- The temporary taxpayers have to file sales return form GSTR-01 and summary return GSTR 3B

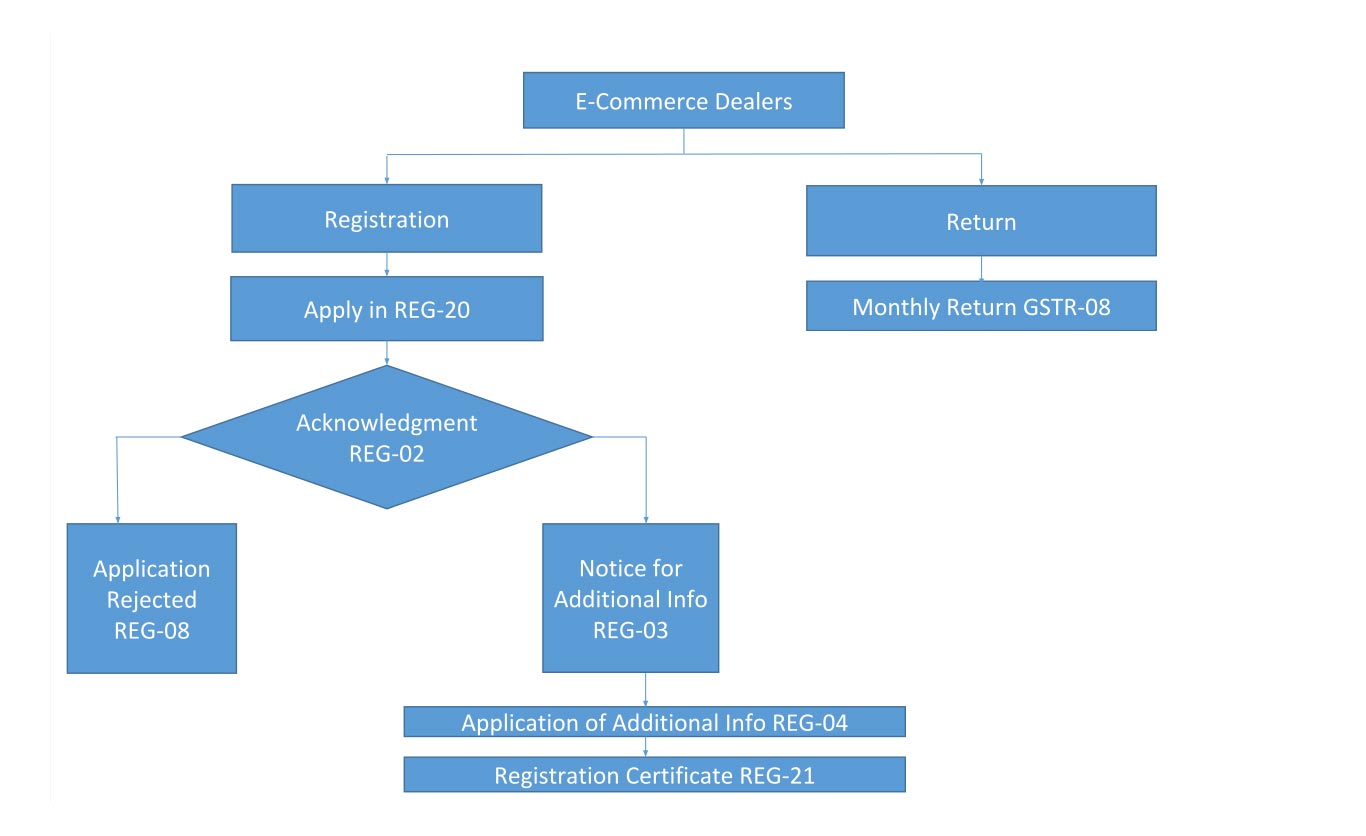

GST Registration & Return Process for E-Commerce

Today is the world of e-commerce trading. So here in GST, there is a facility given by the department that the assessee can register himself as an e-commerce assessee. An assessee who registers themselves as an e-commerce entity will be following these simple steps.

The Registration Process

- For the registration, he will have to apply in REG-20, and after the acknowledgement as REG-02, there might be two cases.

- If the application is rejected, the form will be REG-08 and if accepted, the notice of additional information will be demanded in REG-03.

- Then the application for additional info will be demanded in REG-04, after which a registration certificate will be available in filling REG-21.

The Return Process

- The E-commerce organization will have to file GSTR 8 on or before the 10th of next month

- For an annual return, there is GSTR – 09B

Read Also: Free Download GST Software for Return E-Filing, E Way Bill & Billing

I m vinay from Goa I need to start cement dealership business

When should I pay payment

What is time for my return

Just clear me

Sir, please the type of registration you want to take under GST

I have maintain a hard ware like Cement, iron and plumbing material shop. My annual turnover upto 1.5 to 2 Crores. What type of returns I maintain in GST? please tell me term and conditions and returns details.

Dear Mam,

I am Accounts Manager at Private limited company and i want to start a new Business where GST will be Applicable, So kindly let me know the provision of GST for enrollment as a new Dealer.

Currently for new dealer, there are no provisions for registration. New dealers can register themselves only after the implementation of GST on and after 1st July 2017.

MAM, MY FARM IS IN AP, I AM PURCHASING GOODS FROM HP, TURNOVER IS LESS THAN 20 LAKS. HOW MANY AND WHAT TYPE OF RETURNS I HAVE TO SUBMIT TO DEPT? PL. LET ME KNOW….

You are liable to file GSTR-1/2/3 quarterly.

Thanks for the detail information Shikha.

Can I have a PDF of the article on Dealerwise registration forms & How to file online GST return

It will be also good if u give some slideshow or ppt for online return filing process, as and when it is notified

Download GSTHelpline mobile app for PDF presentation.

Hi

Madam

What about the contractor whether they have to register under GST?

Sir, I have reg. service tax payer.I provide 10 employees to an MNC co. They (MNC) will pay me the salaries of all personnel employed by me. I become a contractor for manpower supply only for which some % is paid monthly. I migrated to GST and obtained the no:

Now do i need to pay GST for the salaries paid to the employees monthly.Please reply and help

The payment from MNC is ” salries to employees + my admin charges” The unit is in EPIP zone.

The firm is proprietary only

K.rangaswamy

Hi Shikha

i have few questions on GST. please proivde your mail id. nimishakavi_vr@yahoo.com

gst@sagipl.com

When will the tax is paid when a lump um amount is paid and supply is taken against such deposit.

How the ITC will be allowed to delete.

If you are cover under lump sum dealer than you cant take ITC benefits

Normal Dealer have to issue Tax Invoice & Composition Dealer have to Issue Bill but when normal dealer supply non – taxable / exempted goods or service than he have to issue Tax Invoice or Bill (Issuing Bill is compulsory or he may issued Tax Invoice in this case)

please advice