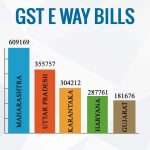

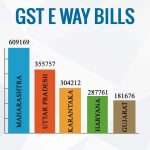

In a report and a tweet from the GSTN account had clearly stated that the Maharashtra tops in generating e way bills for the transportation of goods through motorized vehicles of value more than 50,000.

Powerd By SAG INFOTECH

Notifications can be turned of anytime from browser settings

In a report and a tweet from the GSTN account had clearly stated that the Maharashtra tops in generating e way bills for the transportation of goods through motorized vehicles of value more than 50,000.

Goods and services tax is a major tax structure implemented through India with a scope of tighter compliances and revenues for the government. In the wake of this fact, many of the GST officials are trying hard to account for every taxable transaction.

The current sorry state of the once flourishing Surat’s Textile Industry can be attributed to the policies of the State Government.

After more than one month of GST E Way Bill implementation, now the GST council and central government have mandated the rollout of the intrastate E Way Bill in the states of Maharashtra, Manipur and Union territories (without legislature).

Recently the central government and GST council have implemented intrastate GST e-way bill in the state of Odisha starting from 23rd May 2018. The state is now responsive towards the GST e-way bill for the movement of goods interstate.

GST Intrastate eway bill is compulsory from 3rd June 2018 across India as according to the decision taken by the central government in a bid to roll out the much awaited eway bill provision as soon as possible.

Recently as notified by the CBIC, the E Way Bill for intrastate movement of goods is going to be launched on 20th May 2018 for Rajasthan state. This step will further advance the e-way bill system in the nation. GST e-way bill notification for the Rajasthan state has been scheduled and was informed by the […]

With the GST implementation in July 2017, it was predicted that the manufacturing states might face the revenue loss but producer states such as Uttar Pradesh and Bihar would generate a hike in revenue collection.

The group of ministers under the Bihar deputy chief minister Sushil Kumar Modi led ministerial panel will be looking into incentivising the digital payments under goods and services tax on May 11.