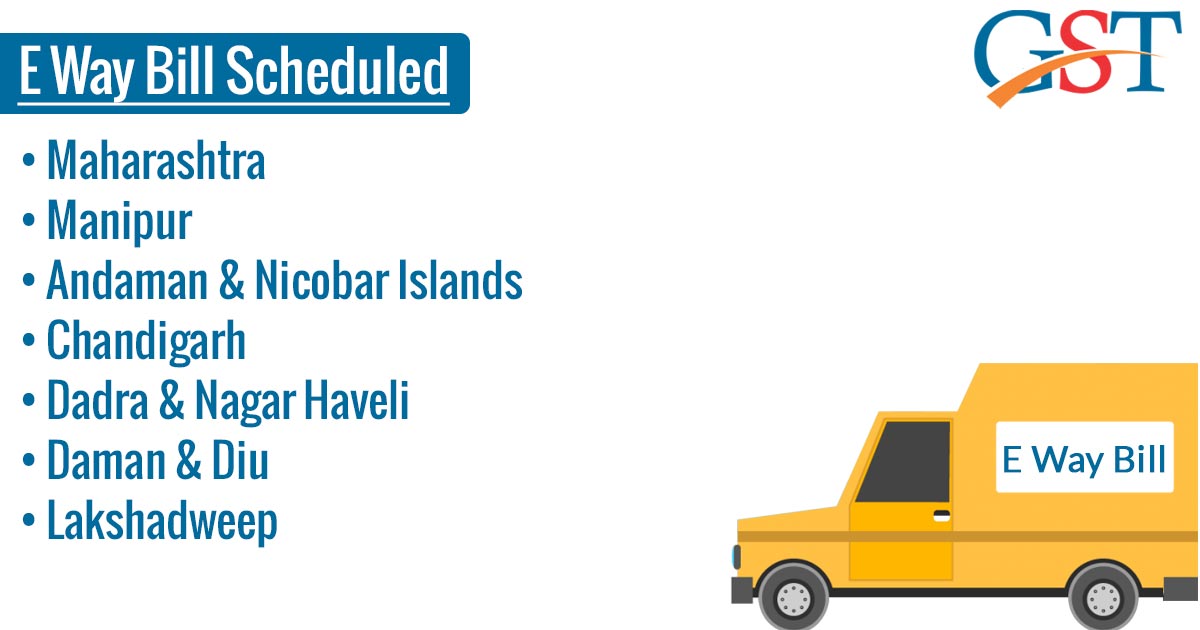

After more than one month of GST E Way Bill implementation, now the GST council and central government have mandated the rollout of the intrastate E Way Bill on 25th May 2018 in the states of Maharashtra, Manipur and Union territories (without legislature).

Starting from 23rd May 2018, the intrastate GST E Way Bill is compulsory for the states including Andhra Pradesh, Arunachal Pradesh Assam, Bihar, Gujarat, Haryana, Himachal Pradesh, Jharkhand, Karnataka, Kerala, Madhya Pradesh, Meghalaya, Nagaland, Rajasthan, Sikkim, Telangana, Tripura, Uttarakhand, UP and union territories of Puducherry.

The GST e-way bill is already getting much hype and till now there are more than 5 crores 30 lakh E Way Bills generated including one crore sixty lakh bills for intrastate movement of goods.

Earlier there are 27 states and union territories who have implemented the e-way bill for the intrastate movement of goods while remaining states are soon to roll out the e-way bill in their respective region. In case if there is any doubt or query regarding the applicability, the taxpayer or transporter can reach out to their respective tax department.

Recommended: Advanced Features of Gen GST E Way Bill Software