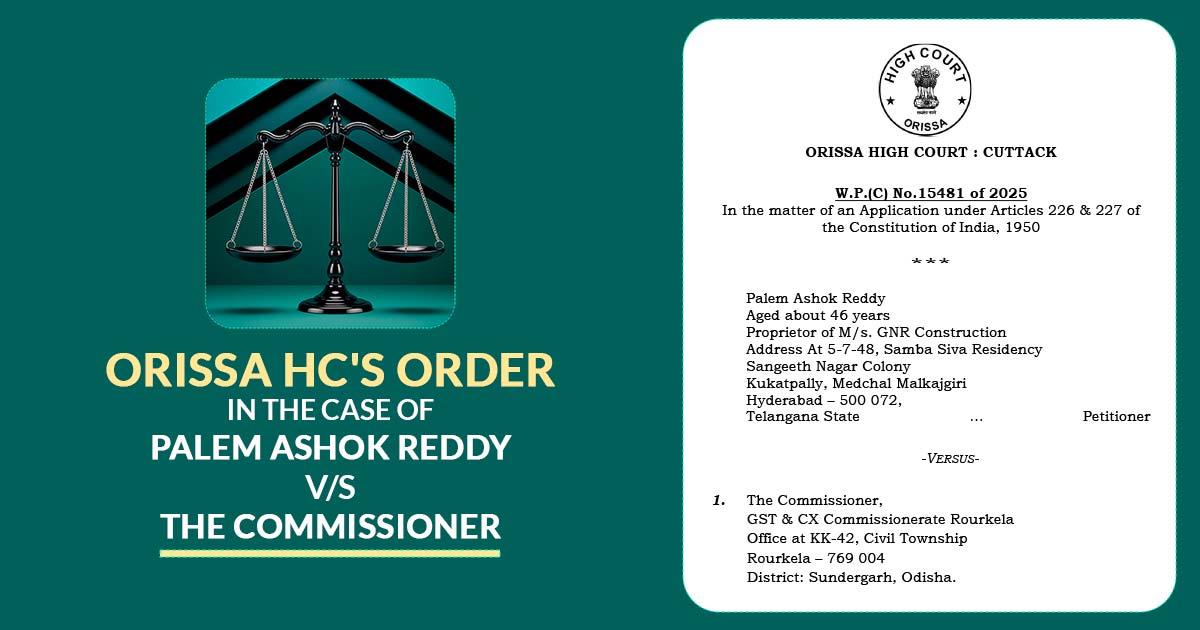

An issue was addressed under the Orissa High Court for the validity of multiple assessment orders for the identical financial period in the case of Palem Ashok Reddy vs. Commissioner, GST & CX Commissionerate, Rourkela.

An ex parte assessment order on July 2, 2024, issued by the Rourkela Commissionerate, demanding service tax of over Rs. 5.76 crore for the financial years 2015-16 and 2016-17 has been contested by the applicant Palem Ashok Reddy.

Read Also: Section 12A Exemption Can’t Be Denied Solely for Delay in Submitting Audit Report

As the Nashik Commissionerate previously passed another assessment order for the same duration on 12th July 2024 after the petitioner participated in the assessment proceedings, the challenge has emerged.

The applicant claimed that the ex parte order from Rourkela was not valid because of non-service of notice, a fact confirmed via the postal department’s consideration showing that the addressee cannot be located.

Read Also: Summary of GST Assessments with Types and Process

Opposite to that, the Nashik order was a consequence of a complete assessment in which the applicant appeared and showed their case. Post analysing the facts and hearing both parties, the HC determined that merely one operative assessment order could statutorily exist for a provided tax period.

The court outlined that an order grounded on the merits of the case, where the taxpayer has the chance to show their claims and proofs, must take precedence over an ex parte order, particularly when the latter was passed without proper notice.

The principles of natural justice support the same ruling, ensuring that the taxpayers have a proper chance to defend themselves in the assessment proceedings. The court ruled that the ex parte order from Rourkela was “wholly without jurisdiction and a nullity” because of the absence of proper notice.

Ex parte assessment order dated July 2, 2024, has therefore been quashed by the Orissa High Court and confirmed that the assessment order on July 12, 2024, passed by the Nashik Commissionerate, which considered the submissions of the applicant, is legally binding and operative.

The same decision specifies that when multiple assessment orders are there for the identical period and subject cases, then the one arrived at via the due process and on merits shall endure.

| Case Title | Palem Ashok Reddy vs. The Commissioner |

| Case No. | W.P.(C) No.15481 of 2025 |

| For The Appellant by | Mr. Bijay Panda |

| For the Opposite Parties | Mr. Sujan Kumar Roy Choudhury |

| Orissa High Court | Read Order |