If Assessee has uploaded TDS return but there occur some mistakes while furnishing the TDS statement PAN is wrongly mentioned, short deduction of TDS amount, excess utilization of any challan etc. In that case, the assessee has to do online corrections in the TDS statement on “TRACES” (TDS Reconciliation Analysis and Correction Enabling System).

Steps for Online Corrections in TDS/TCS Statement

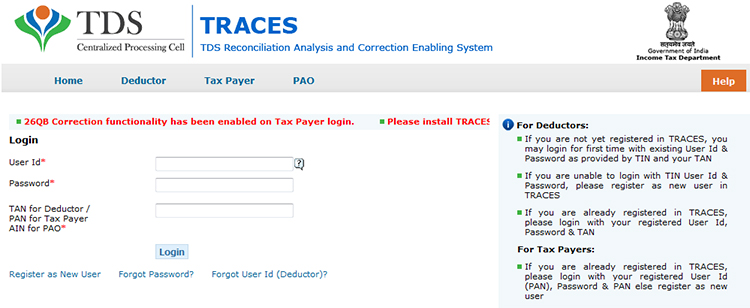

Step 1: Log in to TRACES website

Step 2: Go to “Request for correction” under “Defaults” by entering the relevant Quarter, Financial Year, Form Type, and Latest Accepted Token number. The correction category should be “Online”, and the request number will be generated

Step 3: The request will be available under “Track Correction Request” when the request status becomes “Available” Click on Available / In progress status to proceed with the correction and provide information of valid KYC

Step 4: Select the type of correction category from the drop-down as “Challan Correction”

Step 5: Make the required corrections in the selected file

Step 6: Click on “Submit for Processing” to submit your correction (Only available to admin user), and the request can be submitted via Digital signature of an Authorised person.

Step 7: A 15-digit token number will be generated and mailed to the registered e-mail ID

Online Corrections’ List of TDS/TCS

All types of corrections, like “Personal information, Deductee details and Challan correction” can be made using online correction functionality available from FY 2007-08 onwards, depending upon the type of correction.

| Type of Error or Defaults | Correction Type | Available from FY | DSC Required |

|---|---|---|---|

| If the challan is unmatched | Challan correction | FY 2007-08 Onwards | No |

| Add a new challan | Add a challan to the statement | FY 2007-08 Onwards | No |

| To clear the interest and late fee demand payment | Pay 220, interest, levy, late filing | FY 2007-08 Onwards | No |

| To move the deductee row | Request for overbooked challan (move the deductee row from the challan) | FY 2007-08 Onwards | No |

| To update PAN | PAN correction | FY 2007-08 Onwards | Yes |

| To add/modify the deductee row | Add/Modify deductee details | FY 2013-14 Onwards | Yes |

| To update personal details | Personal information | FY 2007-08 Onwards | Yes |

| To modify salary details | Add or delete salary details | FY 2013-14 Onwards | Yes |

Note: For the paper return, online correction cannot be done

Status of Online Correction Requests

- Requested: When the user submits a request for correction.

- Initiated: The request is being processed by TDS CPC

- Available: Request for correction is accepted, and the statement is made available for correction. The user can start correcting the statement. Clicking on the hyperlink will take the user to the validation screen. Once the user clicks on the request with ‘Available’ status, the status of the request/statement will change to ‘In Progress

- Failed: Request cannot be made available due to a technical error. The user can resubmit the request for the same details

- In Progress: The user is working on a statement. Clicking on the hyperlink will take the user to the validation screen

- Submitted to Admin User: Sub-user / Admin User has submitted a correction statement to Admin User

- Submitted to ITD: Admin User has submitted a correction statement to ITD for processing

- Processed: Statement has been processed by TDS CPC (either for Form 26AS or for defaults)

- Rejected: Statement has been rejected by TDS CPC after processing. Rejection reasons will be displayed in the ‘Remarks’ column.

20-21 TDS PAN NUMBER IS WRONG CAN WE CORRECT IT ANY PENALTY IS THERE

No, No Penalty will be imposed by the department.

unable to file 4th Qtr 24Q for FY 2020-21. kindly help

I am filing the TDS online correction statement of the District Malaria Office (DMO) for Q1 FY 13-14. I have made all challan corrections and saved and the return is also reflected in “Corrections Ready for Submission”. However when clicked on ‘Submit For Processing”, no further window or message or DSC window is showing.

What to do?

Hi Peter,

I am facing the same problem. Can you please tell me how did you resolve this problem?

I too facing the same issue. Does any one got the solution for this?

I am facing the same problem. Can you please tell me how did you resolve this problem?

ANYONE RESPOND PLEASE

Hi Peter,

I am also facing the same problem, when i am trying to click on submission for process the page is not responded.

What’s the error i.e. T-FV-4339 No value to be provided under this field

during e-TCS return and how to correct it by me

Please provide help

Thanks & Regards

T-FV-4339 No value to be provided under this field

Sir, We have paid the contract amount to individuals who liable to get TDS @ 1%. and the deducted & paid also. Because of the wrong section quoting in TDS Return we got TDS Demand @ 10% (net 9% demand is payable). Please tell me how to correct this error.

Utilized Q1 challan to Q3 TDS Payable But, now received demand on interest on late payment for the same. kindly help me out with how to rectify this issue by correcting.

There is 3 correction request raised in TRACES in the month of August 2019. And as requested the copy of the required documents has been submitted on time. In that, two correction requests got approved. Only one got rejected saying ‘details not submitted’. Is there an option to resend this correction request online ? or what is another possible way to get it approved? or Incometax/traces helpdesk team can do anything on this?

Please contact to TRACES

Sir i have filed 26Q for Q2, but after filing its showing Short deduction amount in traces Rs. 19, 905/-, but i have checked my whole return there is no mistakes in amount filed and deducted sections are also correct. How can i know the reasong for showing the amount as short deduction , Pls help..

Apply for request the justification report. In that report you can find the reason of showing as short deduction.

T-FV-1038 Consolidated File is not valid. HOW TO RESOLVE THIS ERROR IN RPU UTILITY

Please contact to Traces Portal

Hi

I am trying to revise the TDS return for Q3 for Fy 19-20 which is paid wrongly. Want to make it as NIL. Successfully done for 2quarters but 3Q is showing:’Challan details in correction do not match for some of the non-updatable matched challan columns’. what does it mean any idea? All challans are correct only doing by downloading the latest conso file only

Please contact to Traces Department.

Hi

How did you Solve the error.

Challan details in correction do not match for some of the non updatable matched challan columns?

Hi… Any resolution found for this error?

Hi Rohit,

Were you able to solve this query. If yes pls let me also know how did you resolve this. I’m facing similar error and couldn’t resolve this till now.

DID YOU GOT SOLUTION TO THIS ERROR

Challan details in correction do not match for some of the non updatable matched challan columns

Hi..

Any resolution for this??

Correction statement rejected for form 24Q and reason showing “Validate for the total amount of tax deposited”, but there is no change in tax deducted and deposit amount. The only amount paid is changed.

Please contact to portal

Correction statement rejected for form 24Q and reason showing “Validate for the total amount of tax deposited”, but there is no change in tax deducted and deposit amount. The only amount paid is changed.

Please Contact to Traces

Correction statement rejected for form 24Q and reason showing “Validate for the total amount of tax deposited”,

what is the reason & what to check, Please help

We are facing an error while adding challan since we filed q3 with authorized signatory which is not the profile of TDS – different authorized signatory. Please tell us how to do the correction.

Go to traces site-Login-profile- Update profile(KYC)

While trying to submit an online correction statement on tdscpc.gov.in, I am getting a message flashed in front of me – You cannot submit the statement. What may be the reason? This is the case of an individual taxpayer, who is also registered as an admin user on the tdscpc.gov.in and KYC is complete with his DSC registered on the site.

Please contact to department.

I have mistakenly applied for correction request while checking the previous one…after saw the mistake I canceled it but it is still visible. Does it will affect in any way please help.

No, it will not affect as you have mistakenly applied for a correction request but not made any corrections.

I have TDS overbooked the amount Rs. 8000. And two unclaimed challans 6500 and 1500. When I try to move deductee there is an error stating there are no challans with balance 8000 or more. How to resolve?

Please contact to Traces Portal regarding this issue.

Hii Sir, we had paid TDS for the month of May 20 in 8th Jun, i.e, 1-day delay and accordingly paid Interest on TDS for 1 month as per rule but while checking interest calculation report in genius software, it doesn’t show interest for the month of may but only showing interest paid of apr-20 months in may-20 which was also paid late. Now, it shows Excess Interest paid. How to deal with it?

Pls help

7th June is Sunday ie Public Holiday so interest will be calculated from 8th June

Hi,

Initially, we have missed out one employee details to update in the 24Q 4th quarter. After quaterly filing, we have made Deductees Added to Salary Statement in online traces for TDS 24Q 4th Quarter. Now it is showing submit to Admin User. But we have online one login ID and we don’t have sub user. what is the solution for this. can you help me. please.

Please contact to TRACES.

I have added my levy payment challan on trances. How many days it will take for rectification? or incase rejected where we can see the status

Please contact to TRACES

I HAVE DEPOSITED THE DEMAND FOR INTEREST ON LATE PAYMENT. BUT STILL, IT SHOW PAYABLE ON PORTAL. WHAT TO DO

Please contact to TRACES

How to request a Justification report with only one PAN-AMOUNT details. I have also tried with same PAN and zero amount as there are only one taxable person and total of 2 persons on the payroll

enter the first person pan and tax paid amount

enter the second person pan number with zero tax amount

i.e enter both pan numbers

Hi,

While filing Q4 etds return in FUV I have entered the wrong challan deposited date for e.g. date should be 06.02.2020 & I have added 06.02.2019. I Have raised challan correction request but I was unable to edit the Tax deposited date, So I clicked on add challan & added the correct challans with proper date. And moved the deductees to the particular challans, Token number was also generated yesterday. And today the statement status is ” Processes with defaults” But I Am unable to download the Conso file as an error is “Unmatched challans for Q4” I am also unable to connect the traces helpline number. Can anyone help me out with this problem????

Hi,

I made TDS payment through 26QB for a property purchase. I made the payment for Rs. 58,696 which is 1% of the full value in May 2020. I had made the booking for the property in Feb 2020, 3 months prior to the payment date. The challan and payment amount reflect the correct amount Rs. 58,696(0 interest, 0 penalty). However, the Form 16B downloaded from Traces has only Rs. 44,022 as the amount remitted. Please help me understand why there is a mismatch. How can I fix this?

Hello,

In for 24Q under annexure II (salary details), deduction shown earlier can be modified in correction statement..?

Yes, you can modify the deductions

I already submitted the 24Q 4th quarter 2019-2020 but there is some correction in the annexure II data 80C and 80d which deductible amount is not shown in the statement But I can get the online correction is it possible to correct the data and submit

Yes, you can do the online correction.

I have filed the original TDS Return 26Q for Qtr 2 on 19-10-19. However, later on, I have added 2 challans of 24Q online by mistake and downloaded Conso file for revising return so that I can delete both the challan.

I have filed the TDS Return 6-7 times but they rejected with reasons “Total Amount of Tax Deposited validation failed (Sum of Tax + Interest + Surcharge + Others + Fee should be equal to Total Challan Amount”

I have checked every time and the challan matches with the deductee TDS amount. Also, the Justification report could not be downloaded stating no error is there.

Now, please guide me on how to rectify it.

Please contact to department

I’ve filled up Form 26QB but before payment of TDS, a mistake in the form was seen. Instead of going for the correction I generated new Form 26QB and paid the TDS amount. Now, do you need to do something above the first 26QB for which I did not pay tax?

No, you don’t need to do anything for the first 26QB for which you have not paid tax.

No, you don’t need to do anything for the first 26QB for which you have not paid tax.

I wanted to file a correction statement relating to the short deduction of the TDS amount. I have paid the sum on line. I clicked on Request for correction button under Defaults drop-down button, Selected relevant F.Y., Quarter, Form Type & On-line correction category & clicked on submitting Request button. But when I clicked on Track Request Button under Defaults drop-down, nothing is showing. Please assist. Thank you

Please contact to TRACES Portal

Hii,

Can sombodty tell me that i want to change pan no. online on traces but pan correction option not showing….. what shall i do for this

There is no option of changing the PAN No.

You might have not registered your DSC in Traces. Register your DSC and then try.

I have filed 3rd qtr TDS returns other than salary, there is a challan paid separately two late int on one of the deductees, please guide how this can be shown in TDS returns

You have to add the challan in 26Q.

Hi,

I want to change the date of payment and date of deduction in 24Q, The same I had done thrice but every time its got rejected with error rejection as ” Validate for the total amount of tax deposited”. please advise what to do to clear this error.

Please request Justification report and check error in that report.

There was a mistake in the date of deduction while filing the return. Now the return has been processed with defaults and I have downloaded the justification report and it is saying I have to pay interest of Rs.XX/-. I requested correction but there is no option to change the date of deduction. Can you help me, please?

Please contact to TRACES

We do correction FY 2014-15, through TRACES. When trying to submit through DSC it showing “PAN of Authorized / Responsible Person as per Personal Information of the correction and as per TRACES Profile should be same. Please update the PAN of the Authorized / Responsible Person in the correction file.” Could you please help us in this regards.

Please contact to Traces regarding this error.

I have filed a correction return on 11.11.2019 and it has got processed in traces as processed with defaults. In IT site TDS acknowledgement number the amount has given correctly as claimed as per the return. But when I download CONSO file after 15 days it is still no updated. Can anyone help me with this?

Contact department for assistant

Online correction TDS CPC given an error – Inconsistent statement filed. Deposit date of NIL Challan to be in the same qtr of the statement

pls, help us on how to solve the error.

Please check the details of challan provided in the TDS statement and whether it is valid for the particular return quarter.

I am trying to submit a correction statement after making necessary changes in deducted details of Q1 2018-19. it is submitted to admin user but white submitting for processing no message or error is being displayed. It seems like submit for processing button is not working or not getting processed. Please help

Hi, I also face the same issue, please specify how did you have solved this issue,

Hi, I also face the same issue of how you resolve it.

That might be a browser issue or website issue, so in that case, you need to ask TDS CPC helpdesk.

Try the process with alternate browser or contact traces for further assistance.

I am trying to submit a correction statement after making necessary changes in deducted details it is submitted to admin user but white submitting for processing no message or error is being displayed. It seems like submit for processing button is not working or not getting processed. facing same issues if know pls help me

Please specify the details.

Hi, Are you getting any resolution for this issue?

I Want to Add/Delete the salary detail in Annexure -II of 24Q of 4th QTR 2018-19 on the procedure of Online correction at Traces Site, But this type of message coming again and again.

“Add/Delete Salary Details-Annexure II will be available subsequently.”

Please Help me in this regard

MAM, I HAVE SAME PROBLEM, PLEASE HELP ME.

You can make revisions/corrections after downloading conso file request.

How to correct the financial year of TDS challan?

In case of physical challan, you may contact your concerned bank branch for rectification of challan. In case of challan paid through online mode, you need to contact your concerned assessing officer for rectification.

Hi,

Kindly help me in adding challans for a short deduction demand in traces. I paid short deduction amount alone in one challan 281 and another challan 281 for the interest amount. I just added these challans to that quarter statement without doing any modification and the statement got “processed with defaults”.

What is the mistake I am doing? kindly help me, please. step by step instruction would be great-full if anyone replies. thanks

Just adding challans to the statement is correct if there is a demand for only interest and late fee. However for short deduction of TDS you need to request conso file, import it into the department’s utility/ TDS software and do the changes in deductee records and then file a correction statement.

Hi,

There is a TDS short deduction for the FY 2018-2019 Q2 and got a notice for the same. Paid the Short deduction by challan 281 and when filing time the interest amount also was there which was paid subsequently in another challan 281. When I do the add challans in traces the traces process it with defaults.

Don’t know where I am making the mistake. While adding the challans to the statement I just simply save the pop-up window and go for the correction. Is it the correct way or I need to change any values in the edit challan option while adding? guide me for the exact procedure step by step so that this won’t get processes with defaults. thanks

Hi, I filed a TDS correction statement online, but it has been submitted to Admin user and I don’t have Admin user Login details. Any suggestions/ Solutions how I can solve this.

Submitted to admit user means you have done the corrections and have submitted it once. Now you need to go to ‘Action summary’ and click on “submit for processing” for final submission.

Hi sir,

I am Suri, After I filed TDS correction Return in traces, it rejected with reason “Total amount of Tax deposited validation failed (Sum of Tax + Interest + Surcharge + Others + Fee Should be equal to total Challan Amount)

Please give me a solution for correction filing

Dear all,

I HAVE FILED THE Q3 RETURN BUT TWO VENDORS ARE SHOT DEDUCTION PAYMENT DONE. I PAID THE ANOTHER CHALLAN WITH INTEREST, PLEASE TELL ME THE PROCESS OF HOW TO CORRECTION IN ONLINE WITH NEW CHALLAN

Firstly you have to add challan to your statement via online correction. Once the challan is added, request conso file, import it into the fvu and do the necessary corrections. You have to divide the amount paid/credited of deductees in proportion to TDS deducted in different challans & show it accordingly.

Hi,

I received Demand Payment against my Form 26QB submission for TDS on the sale of the property. I paid the demand via new challan. How do I add it to Form 26QB? Do I need to File Correction? I tried but do not see any option to add challan?

Thanks

Nitin

A separate challan is given for demand payment in case of TDS on sale of the property. You will have to pay the amount via that challan only by filling the particulars of notice, demand raised etc. No need to add it to Form 26Q. Traces will automatically remove the demand with challan paid.

Validation Error. Total Taxable Amt in challan should be=sum of pay amt of the attached deductee rows

Validation Error. Tax Deducted in challan should be=sum of Tax Deducted in attached deductee row