If Assessee has uploaded TDS return but there occur some mistakes while furnishing the TDS statement PAN is wrongly mentioned, short deduction of TDS amount, excess utilization of any challan etc. In that case, the assessee has to do online corrections in the TDS statement on “TRACES” (TDS Reconciliation Analysis and Correction Enabling System).

Steps for Online Corrections in TDS/TCS Statement

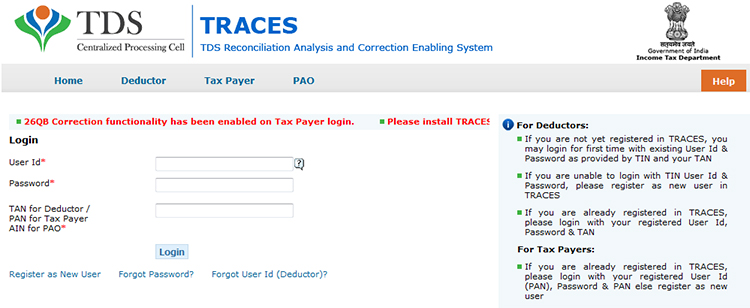

Step 1: Log in to TRACES website

Step 2: Go to “Request for correction” under “Defaults” by entering the relevant Quarter, Financial Year, Form Type, and Latest Accepted Token number. The correction category should be “Online”, and the request number will be generated

Step 3: The request will be available under “Track Correction Request” when the request status becomes “Available” Click on Available / In progress status to proceed with the correction and provide information of valid KYC

Step 4: Select the type of correction category from the drop-down as “Challan Correction”

Step 5: Make the required corrections in the selected file

Step 6: Click on “Submit for Processing” to submit your correction (Only available to admin user), and the request can be submitted via Digital signature of an Authorised person.

Step 7: A 15-digit token number will be generated and mailed to the registered e-mail ID

Online Corrections’ List of TDS/TCS

All types of corrections, like “Personal information, Deductee details and Challan correction” can be made using online correction functionality available from FY 2007-08 onwards, depending upon the type of correction.

| Type of Error or Defaults | Correction Type | Available from FY | DSC Required |

|---|---|---|---|

| If the challan is unmatched | Challan correction | FY 2007-08 Onwards | No |

| Add a new challan | Add a challan to the statement | FY 2007-08 Onwards | No |

| To clear the interest and late fee demand payment | Pay 220, interest, levy, late filing | FY 2007-08 Onwards | No |

| To move the deductee row | Request for overbooked challan (move the deductee row from the challan) | FY 2007-08 Onwards | No |

| To update PAN | PAN correction | FY 2007-08 Onwards | Yes |

| To add/modify the deductee row | Add/Modify deductee details | FY 2013-14 Onwards | Yes |

| To update personal details | Personal information | FY 2007-08 Onwards | Yes |

| To modify salary details | Add or delete salary details | FY 2013-14 Onwards | Yes |

Note: For the paper return, online correction cannot be done

Status of Online Correction Requests

- Requested: When the user submits a request for correction.

- Initiated: The request is being processed by TDS CPC

- Available: Request for correction is accepted, and the statement is made available for correction. The user can start correcting the statement. Clicking on the hyperlink will take the user to the validation screen. Once the user clicks on the request with ‘Available’ status, the status of the request/statement will change to ‘In Progress

- Failed: Request cannot be made available due to a technical error. The user can resubmit the request for the same details

- In Progress: The user is working on a statement. Clicking on the hyperlink will take the user to the validation screen

- Submitted to Admin User: Sub-user / Admin User has submitted a correction statement to Admin User

- Submitted to ITD: Admin User has submitted a correction statement to ITD for processing

- Processed: Statement has been processed by TDS CPC (either for Form 26AS or for defaults)

- Rejected: Statement has been rejected by TDS CPC after processing. Rejection reasons will be displayed in the ‘Remarks’ column.

FY 16-17-Q4 -UNDER THE NIL CHALLAN 4 DEDUCTEES 15G/H FILED. THEN IN AUDIT ONE, ANOTHER CHALLAN FILED.

QUESTION IS-IN NIL CHALLANS DEDUCTEES CREDIT AMOUNT REQUIRED 0. ALSO, CORRECTION AND FILED BUT RETURN REJECTEDREASON IS-Date of Deposit doesn’t lie in the same quarter for Unmatched Challan

PLZ SOLVE

You cannot show NIL challans in the TDS statement. Statement gets rejected if NIL challans are shown. The deductee entries of 15G/H are shown in the matched challans only.

I have placed a request for correction. The status is being shown as “Initiated” since a week. Please help with the resolution process.

Please contact GSTN helpdesk to resolve the issue

Hi Sir,

The status is being shown as “Initiated” since a week. how long it will be shown as same, bcz I am also faceing the same problem

Sir

I have filed a correction statement online but it is getting rejected again and again. The following error is showing “Validation Error. Tax Deducted in challan should be=sum of Tax Deducted in attached deductee row’ Please Suggest how can I correct this?

Please check whether the”Total Tax deposited” shown in deductee rows is in fraction or whether the challan is overbooked.

Please resolve the validation error as TDS deducted and deposited in challan should be equal to deductee row. Correct the challan amount.

2014-15 Q4 26Q return processed with demand. Form 16A cannot download due to challan mismatch. for challan correction traces requires the token number, challan details and PAN and amount, all given correctly, but traces says its wrong. Challans are book adjustments but challans given in statement not marked “yes”. how to solve this issue

Please elaborate your query.

online only PAN change

We have uploaded the FVU file online. But it got rejected. And the rejection reason is “Challan details in correction do not match for some non-updatable matched challan columns”

This issue occurs when the deductor makes changes in any of the existing matched fields of booked challan. Deductor needs to file a correction statement without making any changes in any field of BOOKED Challan except “”Interest, Others & Section Code””.

While uploading submits for processing not clicked properly but edits correction and back button worked properly. I checked with Chrome, Mozilla and IE 11 same problem continuing.

We are unable to understand your query, please elaborate.

I have filled late TDS return for Q4 for 17-18 with late payment interest of Rs.20450.after return filed we got intimation for demand for late filing fees. As per calculation, late payment interest is Rs.16356 and the late filing fee is Rs.13600. At the time of filing, we paid Rs.20450 hence after deduction of Rs.16356 balance amount I adjusted with late filing fee i.e Rs.4094 and balance amount paid Rs.9506. Still, we got intimation for the demand of Rs.4094.I don’t understand why this showing demand.

Download Justification report and check the workings

PAN of Authorised / Responsible Person as per Personal Information of the correction and as per TRACES Profile should be same. Please update the PAN of Authorised / Responsible Person in the correction file

The above error occurs only in F.Y 2012-13 and F.Y 2013-14, all other years correction was done without any other error.

The pan number in personal information and traces profile is same, the error occur continuously, please help me

This issue occurs only when the PAN, name etc mentioned in personal verification (in TDS return) and the particulars mentioned in traces website profile (Authorized person) is different. Contact department for assistance if both are same and still the issue persists.

Hi,

After preparing the necessary corrections, while submitting the statement for processing, an error appears as “Unable to submit the correction statement”.

Tried in Google Chrome, Mozilla Firefox and IE.

This error starting from this month previous month I have filed many returns online with DSC

Please, Help me on this matter…

CHECK YOUR PRN AND DATE OF FILING OF ORIGINAL RETURN. IF PROBLEM PERSISTS THEN CONTACT DEPARTMENT FOR ASSISTANCE.

WHAT HAS PRN AND ORIGINAL RETURN DATE GOT TO DO WITH ONLINE CORRECTION AT TRACES? IF THESE ARE WRONG THEN VALIDATION WILL FAIL BUT NOT GO TO CORRECTION READY FOR SUBMISSION STATE AND THEN FAIL WITH MESSAGE “UNABLE TO SUBMIT CORRECTION STATEMENT” AS IS HAPPENING NOW.

These are validations of dept., these details are required for KYC before filing correction.

You have any solution for this problem….Please share

Hi,

I contacted TDS CPC, there is some technical error in website. executive suggested me to only Add Challan online without DSC & do other changes offline through NSDL for corrections.

TRACES WEBSITE HAS GONE MAD.

THERE ARE SO MANY DIFFERENT TYPES OF ERRORS AND PROBLEMS THAT IT HAS BECOME IMPOSSIBLE TO WORK ON TRACES LEADING TO DELAYS AND WASTED TIME.

THE WEBSITE IS BADLY MAINTAINED. THE GOVERNMENT SHOULD LOOK INTO IT.

Same Problem Boss

Traces department said 2 months not working

same thing with me…any solution ???

HELLO,

After preparing the necessary corrections, while submitting the statement for processing, an error appears as “Unable to submit the correction statement”.

Tried in both chrome and IE.

Please, someone, provide the solution to this.

Hello,

After preparing the necessary corrections, while submitting the statement for processing, an error appears as “Unable to submit the correction statement”. Tried in both chrome and IE.

Please, someone, provide the solution to this.

Please check whether the PRN and date of filing of original return are correct. also, check whether the original return has been processed or not. if the problem persists then contact the department for assistance.

Mam, While submitting the request for Form16A a message display as “This statement has challan(s) with zero deductee rows. Please select the checkbox for no deductee rows”.

What does it mean? I never get this message any time before. Please clarify.

Means there are no valid deductee rows against the selected challan.

24Q TDS rectification for the year 2017-18 status shows accepted for a long time around 10 days it is unable to process. Please guide me what to do?

Contact department’s helpdesk.

NAMASTHE.

On August 3rd, 2018 we filed revised TDS returns for Q1, Q2 AND Q3 through TIN centre for the FY 2011-12. In Traces website the status is still showing as “Pending for processing”

Contact department’s helpdesk.

Same is the case with us… Offline corrections are taking lot of time

Contact department for assistance.

I am facing same problem

In online TDS return correction, “Modify/ Add deductee details” not appear in the drop box. what to do.

You can file such type of correction through RPU by importing conso file.

Hi

can I submit correction statement of the same quarter which is ‘pending for processing’ since last 15 days, because I know wrong entries in the previously filled statement?

No, once this correction is processed, then only you can file next correction return.

I AM UNABLE TO DO ONLINE PAN CORRECTION WITH THE HELP OF DSC. It is NOT SHOWING PAN CORRECTION OPTION HENCE DSC ALSO REGISTERED AT TRACES SITE.

Contact department’s helpdesk for assistance.

Hi, we have filed TDS details for the fourth quarter. But later we had to correct an assessee detail as it was wrongly entered and filed it on 05/7/2018. Now when we try to download the corrected form 16A from TRACES with the Token number of the corrected statement of TDS, it is showing the error ‘Token number is not valid for the regular statement’. Kindly help. From where can I download the corrected form 16A. WHich token number should be given. When I give the token number of the first return it is showing ‘wrong details entered’. When I give the token number of the corrected return it is saying ‘Token number is not valid for the regular statement’. Kindly help

Hi,

I need a help to solve the problem in TRACES. I have to correct a PAN in online for which I have DSC. While using DSC the screen says – As you are proceeding in Digital Signature By-Pass Mode you are permissible to apply for Challan Correction, Interest payment and Add Challan to statement. So I am unable to correct the invalid PAN. What is this mode how to overcome it and how to rectify the PAN? Kindly advice me. thank you in advance.

Regards,

You can also make correction through KYC mode on traces website.

I have filed correction returns for FY 2017-18 Q1 & Q3 to correct the PAN of a deductee. Subsequently received demand default notice towards interest on late payment. The TDS was paid well before the due date. My question is whether interest is also applicable in respect of correction in PAN?

No, interest is charged only on late payment of TDS or late fee. No interest is charged on PAN correction.

We had been deposited TCS in the wrong PAN in the month of NOv.17, Can this be rectified now?

You need to file correction statement of Form 27EQ for the respective quarter.

We have made TDS payment to a wrong vendor (e.g ALPHA Pvt. Ltd with PAN no. AAAA…) in Q2 of F. Y 2017-18. How can we update the correct vendor( e.g BETA Pvt. Ltd with PAN no. BBBB…) ?

I HAVE PAID 16480.00 THROUGH BIN. I HAVE CLAIMED RS. 8240.00 IN TDS RETURN. NOW I AM NOT ABLE TO EDIT CHALLAN AND CONSUME REMAINING RS. 8240.00 IN STATEMENT. HOW TO CORRECT BIN DETAILS. I AM EVEN NOT ABLE TO EDIT CHALLAN.

No need to edit the challan. You just need to enter remaining deductee details for the relevant challan amounting to Rs. 8240/-.

PAN of Authorised / Responsible Person as per Personal Information of the correction and as per TRACES Profile should be same. Please update the PAN of Authorised / Responsible Person in the correction file.

This message is shown while submitting for processing of the return.

please help me how we can change the authorized person name in correction file.

You have to check whether deductor’s pan no is as same as updated at traces website.

PAN of Authorised / Responsible Person as per Personal Information of the correction and as per TRACES Profile should be same. Please update the PAN of Authorised / Responsible Person in the correction file.

This message is shown while submitting for processing of the return. please help me how we can change the authorized person name in correction file.

You have to check whether deductor’s pan no is as same as updated at traces website.

PAN of Authorised / Responsible Person as per Personal Information of the correction and as per TRACES Profile should be same. Please update the PAN of Authorised / Responsible Person in the correction file.

This message is shown while submitting for processing of the return.

please help me how we can change the authorized person name in correction file.

Prepared correction statement correcting employee’s salary and payment details for 24Q after online adding challan for short deduction. FVU is generated but 24CQ Electronic statement warning reports error “Date of Tax deducted does not pertain to the quarter for which the TDS/TCS statement is prepared (Error code T-FV-4300)”.

Factually, statement belongs to Q4,2016-17, but since the short deduction is paid now, we want to show current date of deduction. Will these returns be approved by traces or we will have to show the date of deduction as 31/03/2016.

Thanks

Parmes.

Date of deduction can be entered as the current date. You can file your return ignoring the warning message.

I have filed 24Q for quarter 4 TDS Statement It was rejected by the TRACES. first I tried for online correction as I had to enter 80 C and Chapter IV deduction details for one employee. I deleted Employee Salary details and tried to add salary, deduction, Taxable Income details for the same employee TRACES was not accepting Addition of employee details even though there was the deduction of TDS during the year in previous quarters and previous quarters return were accepted by the TRACES. I then filed offline correction. and the same was rejected by the TRACES the rejection reason was “Deductee Details not unique for the addition of new deductee”

Kindly reply what could be the reason

Vibhash Shah

You need to modify the salary details and enter 80C deductions. If you are filing it through any software, it will automatically delete the previous entry and add the new one.

Dear SAG INFOTECH,

When I filed my TDS correction statement(24Q) for Q3 (FY 2017-18), it was rejected and the rejection reason is “The previous correction not found”. How to rectify this issue? Kindly help

Santhakumar

You have to import the latest conso file and thereafter make the required changes and submit it for processing.

Dear sir/madam,

We have filed our first TDS return 26Q for Quarter 4 of FY 17-18 on June 4,2018.

Since we filed the TDS return belatedly by 4 days, an intimation u/s 200A/206CB was sent to us. As per the said demand notice, an amount of Rs.1210/- is required to be paid by us.

In the demand notice, we are required to pay the said default amount by logging on to our account on tdscpc.in.

Since it is our first TDS return, we are required to register on the TRACES website in order to pay the said amount.

When we try to register on the TRACES website, we are getting redirected to the income tax e-filing website.

We are not able to REGISTER AND CREATE A TRACES account to download the justification report.

Kindly provide guidance on how to resolve the above problem as we are required to pay the interest and late fee.

Sir,

what are the steps for registering the DIGITAL SIGNATURE TOKEN(USB TYPE) in traces

Refer the link. https://contents.tdscpc.gov.in/en/digital-signature-etutorial.html

Dear Sir,

I have filed TDS return for Q4 for Salaries, unfortunately, I have deducted fewer TDS after getting the notice to me I had paid balance TDS amount, later on during filing of correction statement after adding challans its asking salary for which it is deducted in Annexure-2 of salary details but it is already shown in filed return. if i give salary again it may lead to higher salary for Employee in his Form-26AS.

So how to rectify the problem ? whether to change salary in previous quarters by filing correction statement by add/remove salary options and later on shall I file the return for correction statement by adding challans and giving the balance salary which I have removed from previous quarters? or is there any alternative available for it to solve the problem

You can reduce the ‘payment/credit amount’ i.e. taxable amount from originally filed entries and show that amount in the new challan. Adjust your total ‘payment/credit amount’ in Q-4 in proportion to the total TDS you have deposited for the quarter.

Sir, We have Filed TDS return of Q2 of 2017-18, it has been processed without defaults but we have to change the Deductee details because TDS Deducted was wrongly mentioned for 4 employees.

when I tried to file Correction statements, it keeps showing the error” Challan details in correction do not match with some of the non updatable matched columns”

Kindly help to resolve the issue

Even we are getting the same error for updating the Amount paid/credited column.

Sir, I had filled TDS 24Q return through offline but mistakenly I enter a wrong date in the challan amount deposited date column. Are there any possibilities to change the correct challan date without a digital signature?

Yes, you can file offline correction for the same.

In the traces website, I add one challan after it showing “SUBMITTED TO ADMIN USER” and I click Submit for processing button is no response, can you please guide the process to solve it.

Try adding the challan from the alternate browser or contact traces helpline.

Hi

I have wrongly filed three rows of deductee detail in q2 of fy 2017 18 for 26 q. I need to delete those deductees from the statement. I use the rpu 2.2 provided by tin. Here it prompts that deletion is not allowed.

Please help me in this regard

The deletion of deductees is allowed in TDS correction return. Try filing correction directly from traces website.

Thanks for your reply.

I tried already through online corrections. But I couldn’t. Can you please guide me with precise menu/option in Traces or a link to the tutorial for the same.

Please any help

We already mention all points in this blog, please read thoroughly.

You Can Proceed by Nullification of the deductee rows which you have filed wrongly. Just Payment and TDs should be zero.

you cannot delete entries.

Yes, agreed

I have filed four quarters of 26Q Q1 returns F.Y 2017-18 Successfully. Now we identified that one Vendor PAN Number is wrongly mentioned in all the quarterly returns. Question: Is there any charges for Online PAN correction. (PAN Correction is more than 3 Digits).

Please suggest me, Is there any alternative?

HI

While doing Online correction (before FY 2011-12) on getting an error like these: TRACES is not enabled for the requested statement. Kindly file correction through NSDL and the subsequent correction can be filed on TRACES

Is there any alternative ???

No.

I AM UNABLE TO DOWNLOAD TBR AFTER CORRECTION IN TRACES, SO PLEASE HELP ME

Hi,

I have filed my revised return on 26-March-2018 and also completed the e-verification. The problem is that I generated two challans by mistake from tow different banks online and added only one challan details while submitting. How can I get the refund of the challan which is not added in the return? Is there any online process for that or I need to visit income tax office?

Thanks

I’ve filed for a 26qb correction. Now the correction status is showing as ‘In progress’. Do I need to do anything else? I’ve done e verification thru net banking. I’m not sure if it is successfully completed or not because I’ve not got such message. Please help

No, the further procedure is required on your part. In case of any discrepancy, contact department for assistance.

Subho,

First login to your bank, come to traces by clicking view 26 AS or Tax centre on the bank website and then resubmit the correction request by entering challan details. In progress, status means it is incomplete from your side.

Yes agreed