The Finance Act, 2025, has incorporated numerous amendments along with introductions. One such example is the introduction of the new tax regime. Though it seems chaotic, in essence, it is one of the revolutions in the area of tax. The Finance Minister has announced the new tax slab rates for the:

- Individuals

- Hindu Undivided Families

- Co-operative societies

Who Can Choose the New Income Tax Regime As Per Section 115BAC?

- With effect from financial year 2025-26, 115BAC is the default regime if HUF, as well as the individuals having business income and assessee willing to opt for the old tax regime, then Form 10-IEA has to be filed.

- All taxpayers are required to file Form 10-IEA, which is required to file the return within the ITR 3 or 4 pertaining to the business income that is opted under the new scheme.

- Note: Form 10 IEA is not required to be filed in the ITR 1 or 2, and if the option is mentioned in the ITR, they can select the latest tax scheme.

For the Finance Ministry, it was necessary to insert 2 new sections for the objective of bringing a new tax regime into execution. These 2 sections are as follows:

Section 115 BAC: This is a new tax rate for the income of

- Individuals

- Hindu Undivided Families

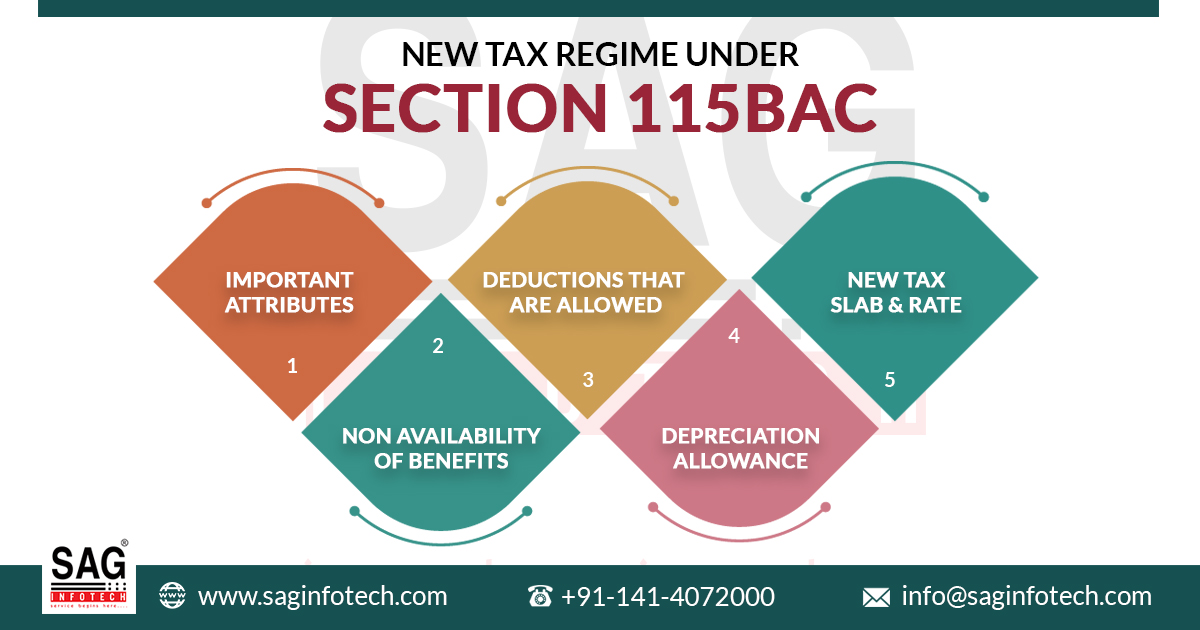

Important Attributes of the New Tax Regime Under Section 115BAC

- The aforesaid new tax regime is applicable from the Financial Year 2025-2026.

- The new income tax regime is the default; you may or may not opt for the old tax regime. In case of not opting for an old tax regime, the new (Default) tax regime shall be applicable.

- The rates of cess and surcharge in a new income tax regime are the very same as those prevalent in the existing/Old tax regime

- Even Senior Citizens and Senior Super Citizens can opt in for a new tax regime.

- In the new tax regimes, the rebate under section 87A is available to the resident individuals having a total income of equal to or less than Rs 12 lakhs per annum. But in the old tax regime rebate is available to the resident individuals having a total income equal to or less than 5.

New Tax Slab (Wef From FY 2025-26)

| Total Income | Rate of Tax |

|---|---|

| Up to Rs 4,00,000 | NIL |

| From Rs. 4,00,001 to Rs. 8,00,000 | 5% |

| From Rs. 8,00,001 to Rs. 12,00,000 | 10% |

| From Rs. 12,00,001 to Rs. 16,00,000 | 15% |

| From Rs. 16,00,001 to Rs. 20,00,000 | 20% |

| From Rs. 20,00,001 to Rs. 24,00,000 | 25% |

| Above Rs 24,00,000 | 30% |

Non-Availability of Benefits

However, if the taxpayer opts in for the new tax regime, then the following deductions and other benefits shall not be accessible to him:

- House Rent Allowance

- Leave Travel Allowance

- Children’s Education Allowance

- Deduction from the family pension scheme

- Other Special Allowances [Section10(14)]

- Interest on the housing loan of the vacant property or self-occupied property

- Deduction from Family Personal Income

- Chapter VI-A deductions

- Deduction or Exemption for any other allowance or other perquisite, and so on

Deductions That are Allowed

Though many deductions are not allowed under the new income tax regime; however, there are certain exceptions to it.

- Deduction under section 80 JJAA, i.e. additional i.e. additional employee cost is available

- Deduction under section 80CCD(2), i.e. employer’s contribution to pension account, is allowed

- Conveyance Allowance for the performance of the office duties is allowed.

- Daily allowance to employees is allowed

- Any allowance that is made for the cost of the Tour/Travel/Transfer

- Transport Allowance for Differently Abled Employees is allowed

Section 80LA

In case a person owns a unit in the International Financial Services Centre that is referred to in sub-section (1A) of section 80 LA, who has exercised the option, the conditions listed in section 115 BAC shall have to be modified to the extent that deduction as per section 115 BAC shall be available to the aforesaid unit.

Depreciation Allowance

In case of Depreciation allowance that is made with respect to a block of assets that has not been given full effects to before the assessment year that is going to begin from April 1, 2021, then the corresponding adjustment shall have to be made to a written down value of such block of assets as on April 1, 2020, in a prescribed manner; however, if the option of the new tax regime has been implemented for a previous year that is relevant to assessment year beginning from April1, 2021.

Frequency of choosing between the options of tax regimes

For Salaried Person

An Individual who has a salaried income but no business income has the option to make a choice between the old tax regime and the new tax regime every year

Business Income

However, the above-mentioned option that is available to salaried persons is not available to Individuals having business income. If the businessman has once opted for an old tax regime and subsequently selects the default new tax regime, then the old regime cannot be selected at life time.

Application for the withdrawal/exercise of the option

Individuals or Hindu Undivided Families have to file Form 10-IEA to opt in or take a step to opt out of the new tax regime.

Due Date of Filing Form 10IEA

- For Business Income before the due date of filing the Income Tax Return

- If the assessee does not have business income, then Form 10IEA is not applicable

Frequency of Filing the Form 10-IEA

- A person earning a Salary Income shall not be required to file the above-mentioned Form 10-IEA for every year during which he wants to select the new tax regime.

- A person earning business income has to file Form 10IEA only when a person opts for the old regime. If a person continues the new regime (default regime), then Form 10IEA is not required to be filed.

Non-filing of the Form 10-IEA

In case of non-filing of the Form 10-IEA by the aforesaid due date, then the taxpayers are deemed to be in the new regime (default regime). If taxpayers are willing to opt old regime, then Form 10-IEA needs to be filed.

Switching from the Previous Chosen Option

As per the circular issued by CBDT dated April 13, 2020, once the chosen tax regime has been communicated to the employer, thereafter, employees cannot change the tax regime during that financial year. Nevertheless, at the time of filing the Income Tax Return, an individual shall have an option to switch to another tax regime, irrespective of the fact of what has been communicated to the employer.

Contents of Form

- Name of the Individual/Hindu Undivided Family

- Confirmation regarding profit or gains from the business or profession

- Address

- Permanent Account Number

- Date of Birth/Date of Incorporation

- Confirmation

- Date of Birth/Incorporation

- Details of previous Form 10-IEA filed (in case applicable)

- Declaration