The Andhra Pradesh Authority for Advance Ruling (AAR) has held that maintenance charges for flow meters do not form a composite supply with the supply of recycled water and are hence subject to tax at 18%.

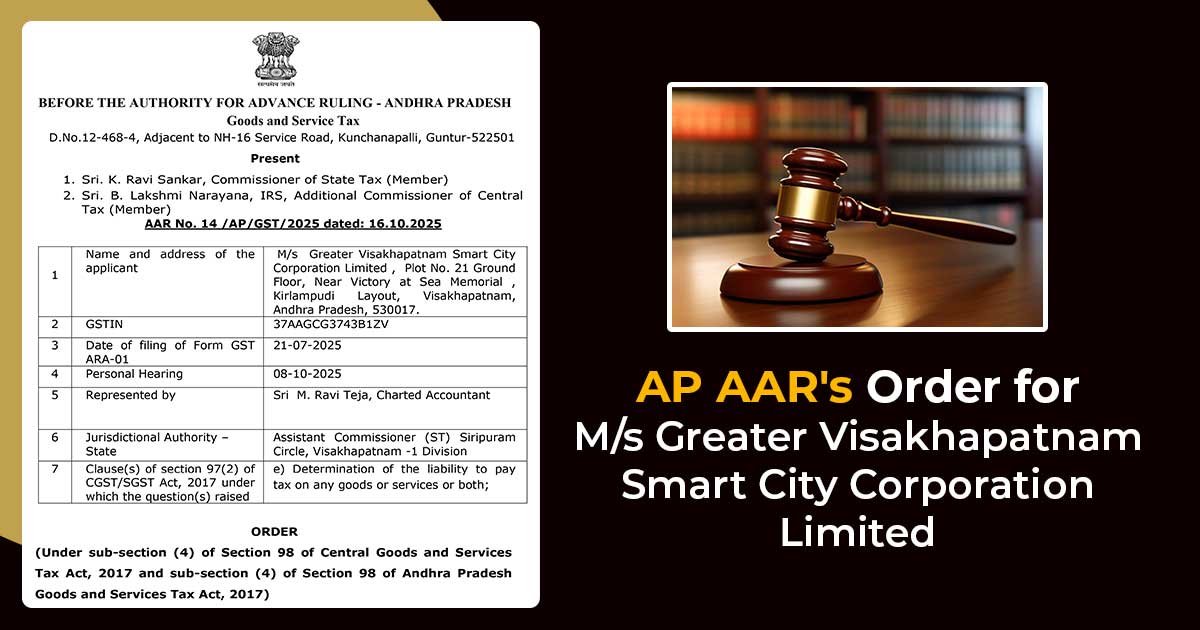

The petitioner, M/s Greater Visakhapatnam Smart City Corporation Limited (GVSCCL), has submitted an application for an Advance Ruling u/s 97 of the CGST Act, 2017. The applicant sought clarification on whether the maintenance charges for flow meters installed at the premises of Hindustan Petroleum Corporation Limited (HPCL) should be treated as a composite supply along with the supply of recycled water, which is nil-rated.

The applicant that supplies recycled water to HPCL under a tripartite agreement stated that the water supply is the principal supply, and that meter maintenance is an ancillary activity. They said that such services are naturally bundled and supplied in conjunction, and hence the maintenance charges must be obligated at the nil rate applicable to the principal supply.

The Authority, including Shri K. Ravi Sankar and Shri B. Lakshmi Narayana, examined the agreement and the definition of ‘composite supply’ u/s 2(30) of the CGST Act.

As per the authority, the tripartite agreement separates the consideration for the supply of recycled water from the maintenance charges, which are imposed at a rate of 0.75% of the monthly bill. It cited that the maintenance of flow meters is a special service that could be given via any third party and is not integral to the supply of water itself.

AAR stated that the cost of maintenance charges is separate and not naturally bundled with water supply; they do not fulfil the criteria of a composite supply. The supply of recycled water stayed a principal supply; however, the maintenance service is an independent, standalone supply.

Read Also: Easy to Know Mixed and Composite Supply Under GST

Subsequently, the AAR held that the maintenance flow meters are categorised under SAC 9987 and are accountable to GST at 18% (9% CGST + 9% SGST). The nil rate applied to the recycled water could not be extended to the maintenance charges.

| Case Title | M/s Greater Visakhapatnam Smart City Corporation Limited |

| Case No. | AAR No. 14 /AP/GST/2025 |

| GSTIN | 37AAGCG3743B1ZV |

| Represented by | Sri M. Ravi Teja |

| Andhra Pradesh High Court | Read Order |