The Finance Bill 2021, has inserted two sections in Income Tax Act 1961, one is Section 206AB and the second is Section 206 CCA.

The aforesaid section has provisions for the higher rate of TDS/TCS that is to be executed for the non-filers of the income tax return. Section 206AA and 206CC are already applicable in case of non-furnishing of Permanent Account Number for the purpose of imposing higher rates.

Latest Update

- The Union Budget 2023 amended the definition of a specified person. This amendment provides relief by excluding individuals who are not required to file income tax returns for the relevant assessment year and non-residents who lack a permanent establishment in India. The Central Government notifies these exclusions in the official Gazette.

| Provision of Old Section 206AA | Provision of Old Section 206CC |

|---|---|

| Tax is deducted: Impose rates specified in the relevant provisions of this Act. Impose the rate or rates in force. Impose the rate of 20% | In this case: Tax is collected Impose two times the rate specified in the relevant provision of this Act. Impose at the rate of 5% |

About New Section 206AB TDS Rate

It provides for the TDS rate to be applicable if the amount credited or paid to a specific person is higher than the below-mentioned rates.

- Two times the rate that is specified in the relevant provision of the Act

- Two times the rate or rates in force or

- At the rate of 5%

- If the tax is deducted under sections 192, 192A, 194 B, 194BB,194LBC or 194N, the provision mentioned in subsection (1) of section 206AB does not apply.

- A proposal of consequential amendment in section 194-IB is there to omit the section 206AB reference from sub-section (4) of the mentioned section.

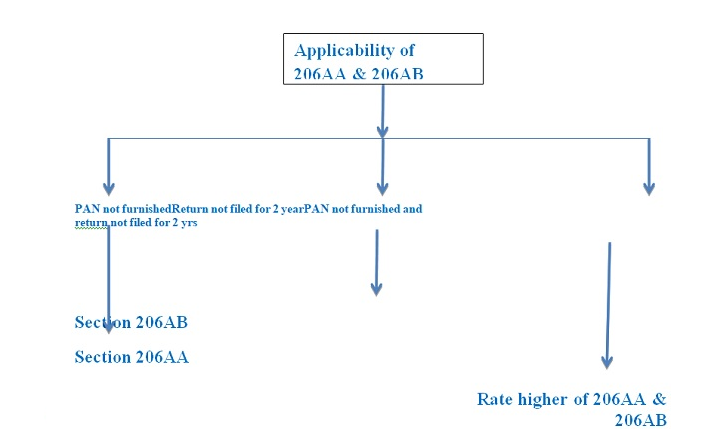

- As per sub-section 2 of 206AB, where both the sections 206AA and 206AB are applicable. In other words where

- The Specified person has not submitted a PAN

- And Not filed the Income Tax Return

Then the tax shall be deducted at a rate higher amongst both the sections respectively.

Specified Person

Specified Person means the person who satisfies the below-mentioned conditions:

- A person has not filed ITR Immediately before the previous year in which the tax is needed to be deducted, The deadline for filing the return of income under subsection (1) of section 139 has expired.

- The total Tax deducted at source (TDS) or tax collected at source, whatever the case may be is Rs. 50,000 or more in both the previous years.

- Nevertheless, the specified person shall not include

- A non-resident, who does not possess a Permanent Establishment (PED) in India.

About New Section 206CCA TCS Rate

Similarly, the government is considering adding 206CCA provides for levying the TCS rate.

- At twice the rate that is specified in the relevant provisions of the Act or

- At the rate of 5%

Adding further, the sub-sections (2) and (3) of section 206CCA are nearly similar to the provisions of sub-sections (2) and (3) of section 206 AB that have already been explained above.

Note: The amendments are in compliance from 1st April 2022.

Is Lower Tax Deduction (LTDC) applicable in section 206AB and 206CCA?

Not applicable and 206AB overrides all other provisions of the IT Act. 206AB apply even of if the assessee has lower (or) nil TDS certificate (or) assessee has filed a declaration us 197A for non-deduction of tax. However this provisions will be attracted only if the tax otherwise deductible under chapter XVII-B.