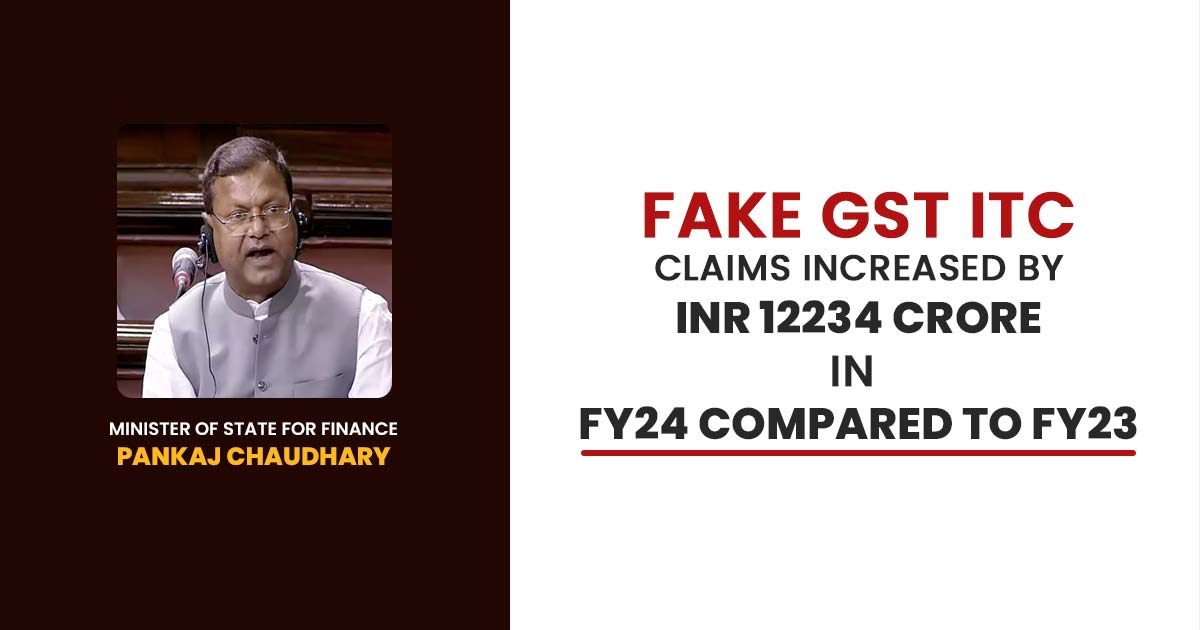

Parliament informed that central GST officers’ bogus ITC claims detection has surged to 51% to Rs 36,374 crore in 2023-24. The Minister of State for Finance Pankaj Chaudhary has shared the information about the bogus ITC cases booked by Central Tax formations during the 2022-23 and 2023-24 fiscals.

In 2022-23, the central officers have booked 9190 cases comprising the bogus GST Input Tax Credit (ITC) of Rs 36,374 crore. In the cases 182 people were arrested and voluntary deposits of Rs 3,413 crore were made.

Rs 24,140 crore bogus ITC were detected in 7,231 cases during 2022-23. 152 persons were arrested and Rs 2,484 crore taxes were deposited voluntarily.

5,966 are the number of cases that have been booked by central tax formation during 2021-22.

Chaudhary mentioned the hurdles in tracking the bogus ITC fraudsters pertinent to the masterminds who used to function in the bogus ITC generation via the control and management of a difficult web of entities made across jurisdictions.

Read Also: Input Tax Credit Guide Under GST: Calculation with Examples

Through the coordination with various stakeholders, these hurdles are being attained along with the statutory enforcement agencies.