The Ministry of Corporate Affairs will soon discontinue Version 2 (V2) of the portal. The Version 2.0 platform is used by LLPs and companies for statutory compliance filings, incorporation, and closure of companies.

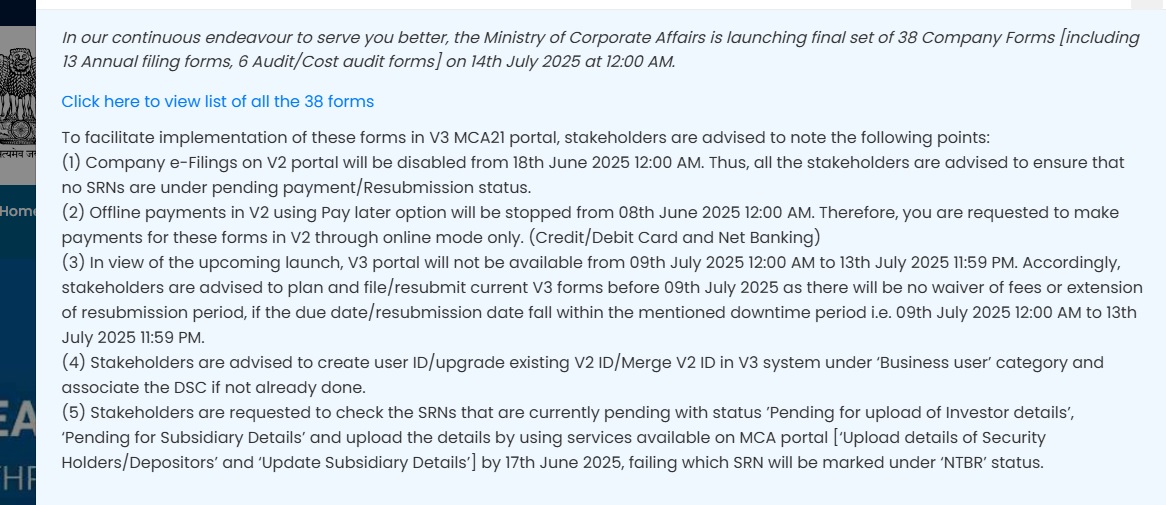

The MCA has reported that it is launching a final set of 38 forms, which includes 13 annual filing forms and 6 audit/cost audit forms, scheduled for release on July 14, 2025. The company filing process will be migrated from Version 2 (V2) to Version 3.0 (V3) of the MCA portal, rendering V2 obsolete with this launch.

The MCA has issued norms for stakeholders to ease the implementation of such forms in V3. To begin with, the ministry stated that company e-filings on V2 will be disabled starting June 18 this year. As per the notification, stakeholders must ensure that no Service Request Numbers (SRNs) are in pending payment or resubmission status.

As per the notification, stakeholders are requested to review the currently pending SRNs, particularly those related to investor and subsidiary information, and upload information services on the MCA portal.

From June 8, the V2 offline payments using the pay later option will be stopped. Thus, the Ministry has advised companies to e-file payments for such forms in V2 using the online mode only.

Concerning the forthcoming launch, the V3 will not be available from July 9 to 13. “Accordingly, stakeholders are advised to plan and file current V3 forms before July 9 as there will be no waiver of fees or extension of resubmission period,” the ministry stated.

The services of MCA21 have been gradually transforming via the ministry from older V2 to V3, which was started in FY22.

The new version 3 is superior to its predecessor, offering more features like e-Adjudication, Consultation, Scrutiny, and compliance management.

The aim of features like e-adjudication and e-consultation on V3 is to rectify the experiences of the stakeholders, easing the regulatory procedures and proceeding for a business-friendly environment.

Unlike V2, where the forms are required to be downloaded, filled, and then uploaded on the portal, V3 authorises the forms to be submitted directly online. From V2 to V3, the LLP-related solutions have been shifted previously.

To access V3 portal services, the Ministry has advised stakeholders to create a new user ID or upgrade their existing Version 2 ID, or merge their V2 ID into the V3 system under the ‘Business User’ category.

The MCA21 portal was launched in 2006 that has the motive to automate the processes of the regulatory requirements and compliances under the Companies Act, 2013, and the LLP Act 2008.