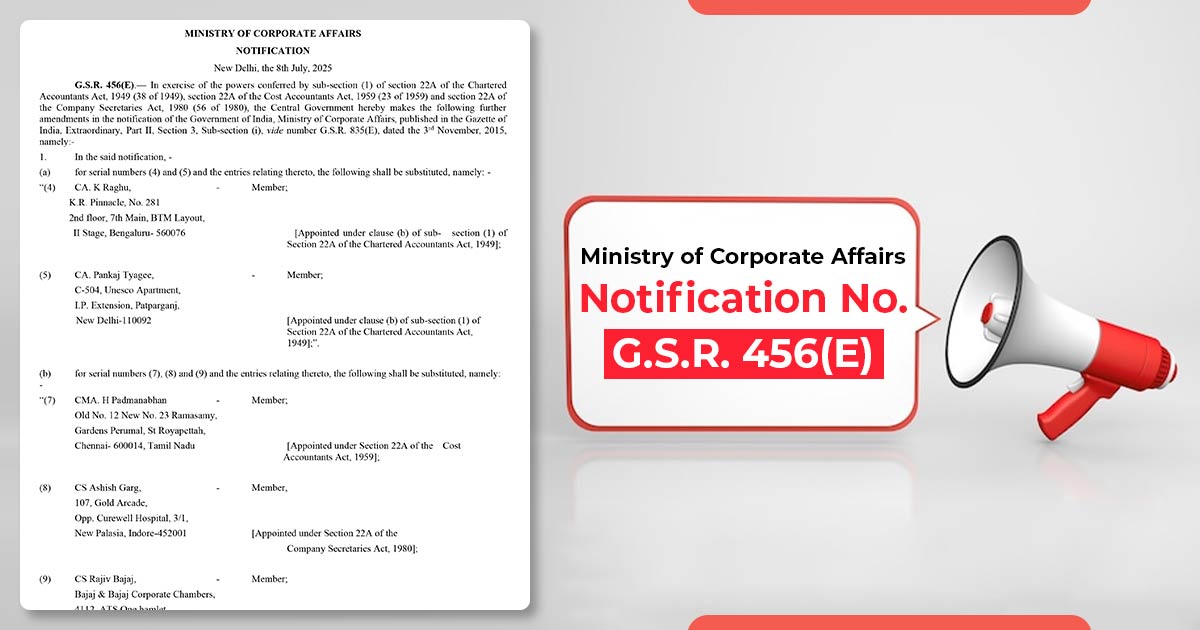

On July 8, 2025, the Ministry of Corporate Affairs (MCA) released Notification No. G.S.R. 456(E), which details the appointment of new part-time members to the Appellate Authority. This group comprises two Chartered Accountants, one Cost Accountant, and two Company Secretaries.

Their roles are defined by Section 22A of the Chartered Accountants Act of 1949, the Cost Accountants Act of 1959, and the Company Secretaries Act of 1980.

- CA K. Raghu, Bengaluru

- CA Pankaj Tyagee, New Delhi

- CMA H Padmanabhan, Chennai

- CS Ashish Garg, Indore

- CS Rajiv Bajaj, Noida

For regulatory, disciplinary, or examination matters, these appointed professionals will now be part of panels managed via-

- Institute of Chartered Accountants of India (ICAI)

- Institute of Cost Accountants of India (ICMAI)

- Institute of Company Secretaries of India (ICSI)

The panel confirms updated, regionally balanced, and experienced representation towards professional statute. The same amendment maintains the statutory framework of CA, CMA, and CS in India active and up to date, with qualified professionals in decision-making panels.

Read Also: MCA to Merge 1,270 Multiple IDs in V3 for CA and CS Organisations

Inder Deep Singh Dhariwal, Joint Secretary, MCA, signs the notification.

Read the Notification