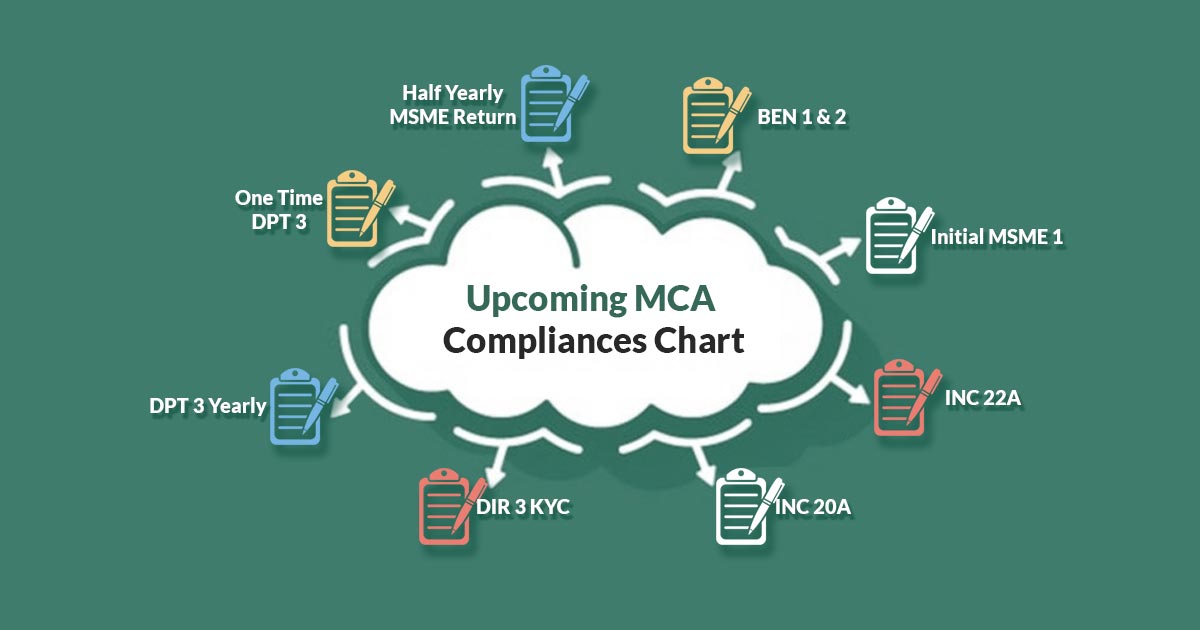

The Ministry of Corporate Affairs has released a mandatory complete MCA compliance chart for the mandatory forms coming under the MCA rules and regulations. A strategic visual roadmap for ensuring adherence to regulatory standards of the Companies Act, 2013 to discover clarity in compliance.

There are multiple forms that have been released specifically for the purpose under the company’s law and have been included for compliance management.

The MCA Compliances Chart for Companies has a number of forms including MSME-1, Half-yearly, DPT-3 Yearly, DIR-3 KYC, BEN-2, AOC-4, MGT 7, MGT 14, CRA 4, etc.

This user-friendly tool distils complex compliance frameworks into a streamlined guide, empowering businesses to effortlessly meet and exceed regulatory standards. Simplify your compliance journey and elevate your organization’s commitment to best practices.

MCA Compliance Via Gen CompLaw Software, Get Demo!

The table below provides complete details of the forms in the MCA compliance chart. Now let us understand all those forms with their purpose, due date and applicability.

| Name of E-Form/Return | Purpose of E-Form/Return | Due Date of Filing | Due Date for FY 2025-26 |

|---|---|---|---|

| DIR-3 KYC/ WEB KYC | Any Person Having Din as On 31 March Is Required To File DIR-3 KYC/WEB KYC | 6 months from The Closure of Financial Year | 30th September 2026 |

| DPT-3 | Annual Return of Deposit And Exempted Deposit | 3 Months From The Closure of Financial Year | 30th June 2026 |

| MSME | Half-yearly return filed with the registrar in respect of outstanding payments to Micro or Small Enterprise. | Within a month for each half of the year, exceeding 45 days | 30th April 2026 (October- March Period) & 31st October 2026 (April-September) Period |

| BEN-1 | Every individual, who subsequently becomes a significant beneficial owner, or where his significant beneficial ownership undergoes any change shall file a declaration in Form No. BEN-1 to the reporting company regarding such significant beneficial ownership or any change therein. | (Return to the Registrar in respect of declaration under section 90 and Rule 4 of companies Significant Beneficial owners Rules 2018) | Within 30 days on becoming significant the beneficial owner or from change thereof |

| BEN-2 | Return to the Registrar in respect of declaration under section 90 (Declaration of Beneficial Owner) | Every Company shall file a return of significant beneficial owners of the Company and changes therein with the Registrar containing names, addresses and other details. | 30 days from the receipt of Declaration in form BEN-1 |

| ADT-1 | Appointment of Auditor | (if applicable) 15 days of the meeting in which the auditor is appointed | 14.10.2026 (*If appointed in AGM and date of AGM is 30.09.2026) |

| Form AOC-4 / Form AOC-4 (XBRL)* (*As Applicable) And Form AOC-4 CFS (in the case of Consolidated financial statements) | Filing of Financial Statement | 30 days from the conclusion of the AGM (In case of OPC within 180 days from the close of the financial year) | 30.10.2026 (*If AGM is 30.09.2026) |

| MGT-7/MGT7-A | Filing of Annual Return | 60 days from the conclusion of AGM | 29.11.2026 (*If AGM is 30.09.2026) |

| PAS-6 | Reconciliation of Share Capital Audit Report | 60 days from the end of each half-year | 30 May 2026 (October-March) & 29 November 2026 (April – September) |

| CRA-4 | Filing of Cost Audit Report | 30 days from the receipt of Cost Audit Report | 30 days from the receipt of Cost Audit Report |

| MGT-14- For Approval of Annual Accounts (For Public Companies) | Filing of resolutions with MCA regarding Board Reports and Annual Accounts | 30 days from the date of the Board Meeting | 30 days from the date of the Board Meeting |

| MGT-15 (For Listed Public Companies) | Report on Annual General Meeting | Within thirty days of the conclusion of the annual general meeting | 29.10.2026 (*If AGM is 30.09.2026) |

Read Also: All About MSME Form 1 (MCA) with Due Dates & Filing Procedure

While filing DPT-3 for FY 2020-21, which date shall be mentioned for the closing of accounts and which FY data will be enclosed in point 15 by selecting option 3 of DPT-3?

Because for FY 2020-21, an audit is not done till date.

Hi, DIR 3 KYC Date is 30.09.2021. Kindly correct your article.