The Criterion for filing the MSME I form (MCA) by those specified companies whose outstanding payment to MSME suppliers exceeds 45 days is discussed below:

- Order Named: Specified Companies (Detailed information regarding payment to micro and small enterprise suppliers) Order, 2019

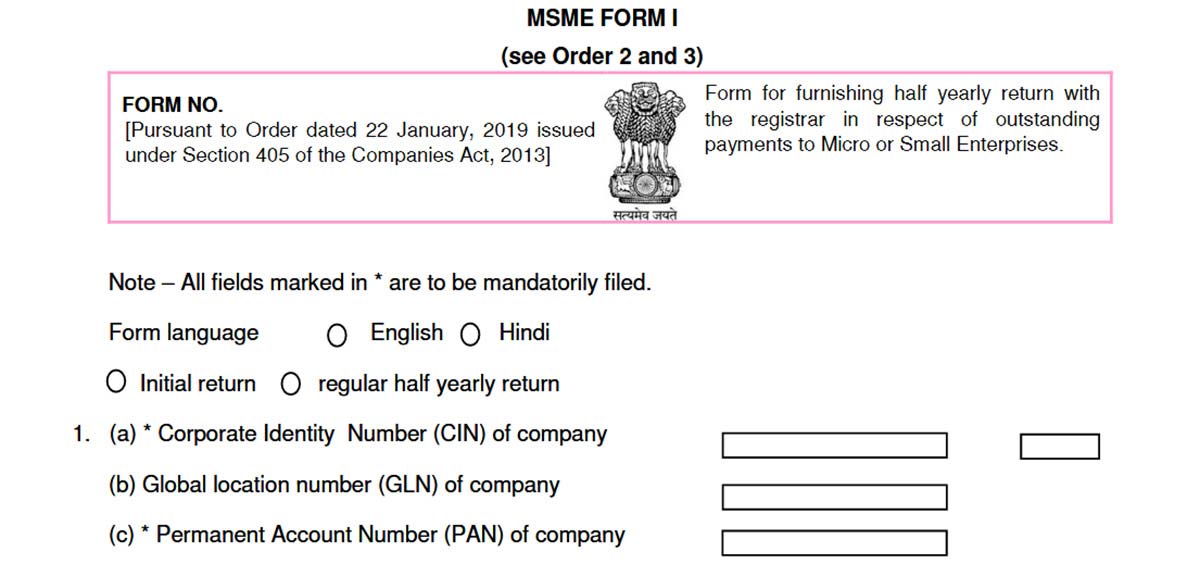

- Date of Notification: In context to the Order dated January 22, 2019, issued under Section 405 of the Companies Act, 2013

- Effective Date: From the Date of Publication in the Official Gazette

Latest Update

- Notification F. No. 16/8/2018/E-P&G/Policy serves as a reminder to submit the half-yearly return for payments exceeding 45 days. Read the Notification

File MSME Form 1 Via Gen ROC Software, Get Demo!

- MSME Form 1

- MSME Form 1 Due Date Half Yearly Return

- Important Definitions

- Micro & Small Enterprise Category

- Late Filing Penalty MSME Form 1

- Procedure for Filing MSME Form 1

- Steps to File MCA MSME Form 1

- FAQs Related to MSME Form 1

What is MSME Form 1 (MCA)?

The MSME I Form is to provide information on a half-yearly basis in the context of the outstanding payments to Micro or Small Enterprises for a period exceeding 45 days with the Registrar of Companies (ROC).

Major changes have been made by the Ministry of Corporate Affairs in the context of protecting the interest of the small group of companies or businesses. He laid emphasis on following compliance by all Specified Companies Whether Public or Private Company, Micro or Small.

Recommended: Due Dates of Filing ROC Annual Return by Companies

A half-yearly return is required to be submitted to the Ministry of Corporate Affairs on a mandatory basis, by all those companies who receive the supply of goods or services from Micro or small enterprises and the payment done to these micro and small enterprises’ suppliers exceeds forty-five days from the date of acceptance (or deemed acceptance) of the relevant good or services.

The following points should be stated in it:

- the amount of payment due and

- the reasons for the delay

Following the provision of section 405 of the Companies Act, 2013, (18 of 2013) the Central Government made it necessary for all the “Specified Companies” to furnish the above-notified information about the payment to micro and small enterprise suppliers.

MSME Form 1 Due Date Half-Yearly Return

In cases where payments are due to MSME more than 45 days after acceptance of services or goods, companies must submit a half-yearly return form. The government has announced the MSME Form 1 due date for the financial year 2025-26 on the official MCA website. Companies are required to file this form twice a year: once for April to September, and once for October to March.

April 2026 to September 2026

The MSME Form 1 due date for the 1st half-year return (April 2026 to September 2026) is October 31, 2026, for all eligible companies.

October 2025 to March 2026

This form can be filed until the last day of the month following the end of the half-year for outstanding payments to Micro or Small Enterprises, i.e., April 30, 2026, for the period October 2025 to March 2026.

Important Definitions:

Specified Companies: As per the provisions of section 9 of the MSME Development Act, 2006, Specified companies are those companies who receive the supply of goods or services from MSMEs, and the payment against these supplies to the suppliers of these MSMEs exceeds 45 days from the date of acceptance (deemed acceptance) of the goods or services

Micro and Small Enterprise: The Micro and Small Enterprise mentioned above means any class or classes of enterprises (including proprietorship, Hindu undivided family, partnership firm, company, undertaking, an association of persons or cooperative society), in which conditions applied as per below:

| Manufacturing Sector | Conditions Applied |

|---|---|

| Enterprises | Investment in plant & machinery |

| Micro Enterprises | Does not exceed twenty-five lakh rupees |

| Small Enterprises | More than twenty-five lakh rupees but does not exceed five crore rupees |

| Service Sector | Conditions applied |

| Enterprises | Investment in equipment |

| Micro Enterprises | Does not exceed ten lakh rupees: |

| Small Enterprises | More than ten lakh rupees but does not exceed two crore rupees |

Note: The Criteria specified above are specified based Micro, Small and Medium Enterprises Development Act, 2006, and the bill to change the criteria of classification and to withdraw the MSMED (Amendment), 2015 is pending in the Lok Sabha.

The MSME Act, of 2006 defines Micro Small and Medium Enterprises.

Read Also: All About of MCA E-Form INC-22A with Step-by-Step Filing Process

MSME Act, 2006, MSME Broadly Classified Into 2 Categories

1) In the First category come those Enterprises which are engaged in the manufacturing and production of goods for any industry.

- Manufacturing Enterprises – As per the first schedule to the Industries (Development and Regulation) Act, 1951, Manufacturing enterprises defined in terms of investment in Plant & Machinery, are those enterprises that are engaged in the manufacture or production of goods for any specific industry

2) In the second category come those enterprises that are engaged in providing or rendering services

- Service Enterprises – Defined in terms of investment in equipment, service enterprises are those enterprises that are engaged in providing or rendering services

Under the MSMED Act 2006, the Micro Small & Medium Enterprises (MSMEs) in India are categorised and defined on the basis of capital investment done in plant and machinery but excluding the investments made in land and building.

Micro & Small Enterprise Category

In the Micro and Small Enterprise category, there are entities that include Proprietorship, Hindu Undivided Family, Partnership Firm, Company, Undertaking, an Association of Persons, or Co-Operative Society.

Applicability on Companies:

As per a notification issued by the MCA, it has been mandated to file disclosures through Form MSME I for every type of Company – Public or Private Company, Micro or Small Companies; the Company that satisfies the following two conditions:

- Condition 1: The Company must have received Goods and/or Services from a Micro or Small Enterprise

- Condition 2: Payment must have been due/not paid, to such Micro and Small Enterprise for 46 days from the date of acceptance

Note: Date of deemed delivery refers to the acceptance of goods and services by the buyer in writing with no objection to the product or services received within 15 days.

Late Filing Penalty for MSME Form 1

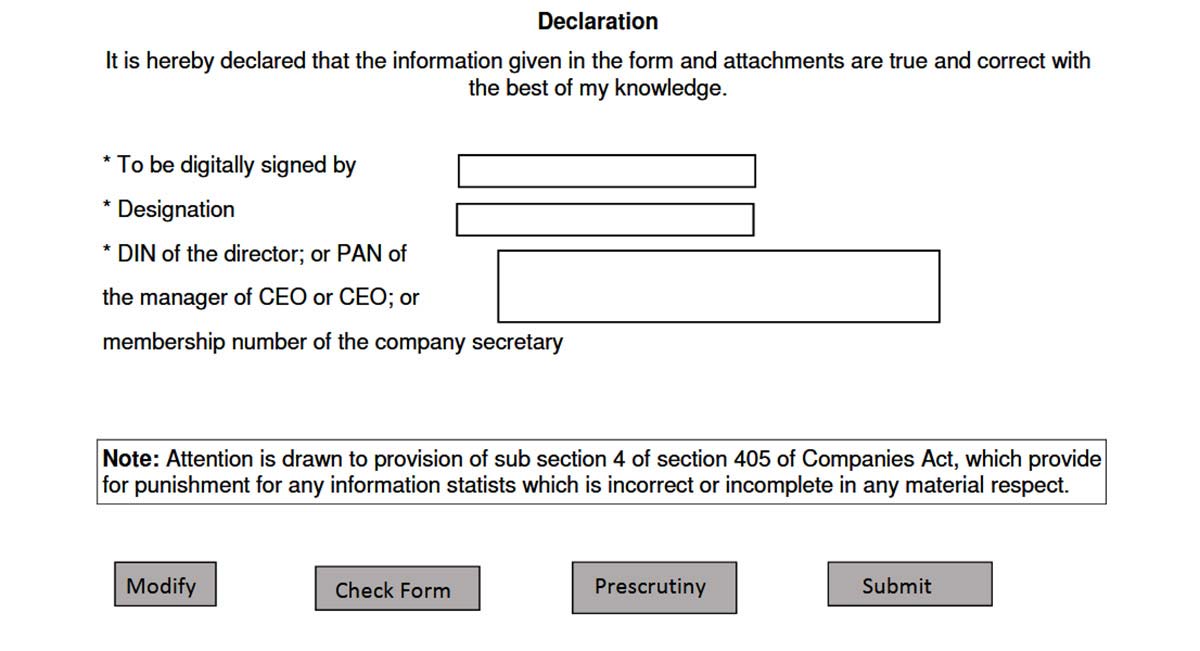

Section 405(4) which includes non-furnishing/incomplete/incorrect information penalty states a fine of up to Rs.25000 (Co.,), Rs.25000/- (Min) & Rs.3 lacs (max) and imprisonment of 6 months for directors or both. Therefore directors must file the MSME form 1.

Procedure for Filing MSME Form 1 (MCA)

The companies should file, the MSME Form I detailing all the outstanding/ dues against the Micro or small enterprises suppliers that are existing on the date of notification of the related order within 30 days from the date of deployment of E-form MSME-1 on the MCA Portal.

“Form MSME I (half-yearly return) has to be filed within 30 days from the end of each half-year in respect of outstanding payments to Micro or Small Enterprise i.e. 30th April 2026 (for October 2025 to March 2026) 31st October 2025 (April 2026 to September 2026)”

- All the Companies falling under the above-mentioned category would be required to file MSME Form I as a half-yearly return by October 31st, for the period from April to September and later by April 30th for the period from October to March and must furnish the below details in it:

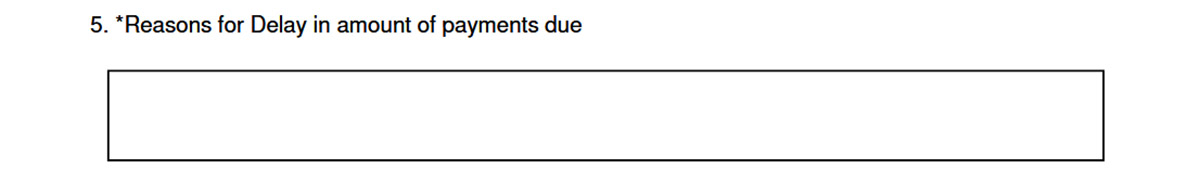

1) the amount of payment due and

2) reasons for the delay

- Thus Concludingly, each Specified Company, public or private, that obtains goods and services from the small and micro-enterprise and whose payment is due with such micro and small enterprise suppliers for 45 days from the date of acceptance, shall be required to file MSME Form as a half-yearly return every year.

Read Also: Free Download ROC Return Filing Software for Companies

Step-by-Step Procedure to File MCA MSME Form 1

Below are the details of the form:

Step 1: Company details such as Corporate identity number, global location number, and the PAN

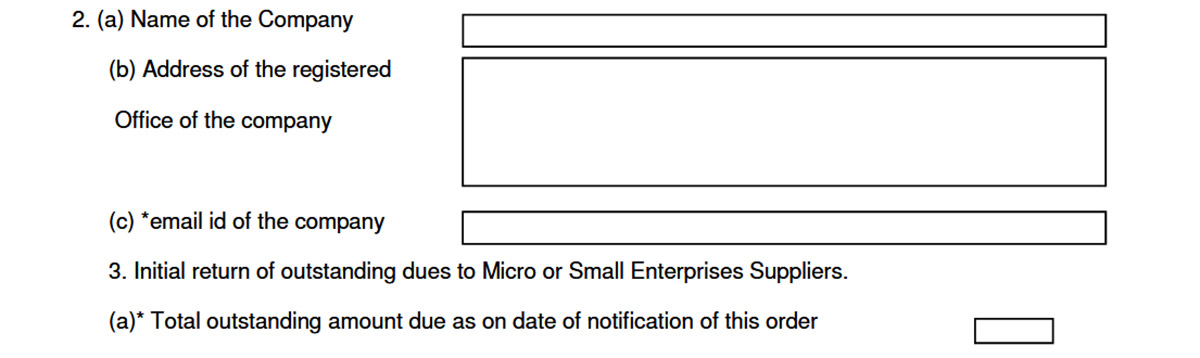

Step 2: Basic details of the company such as name, address, email ID

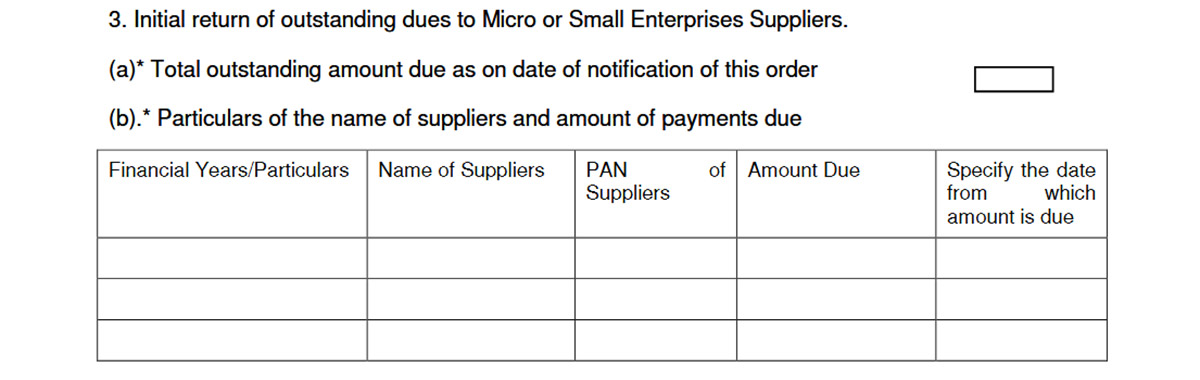

Step 3: Details like initial returns of outstanding dues to the MSE suppliers

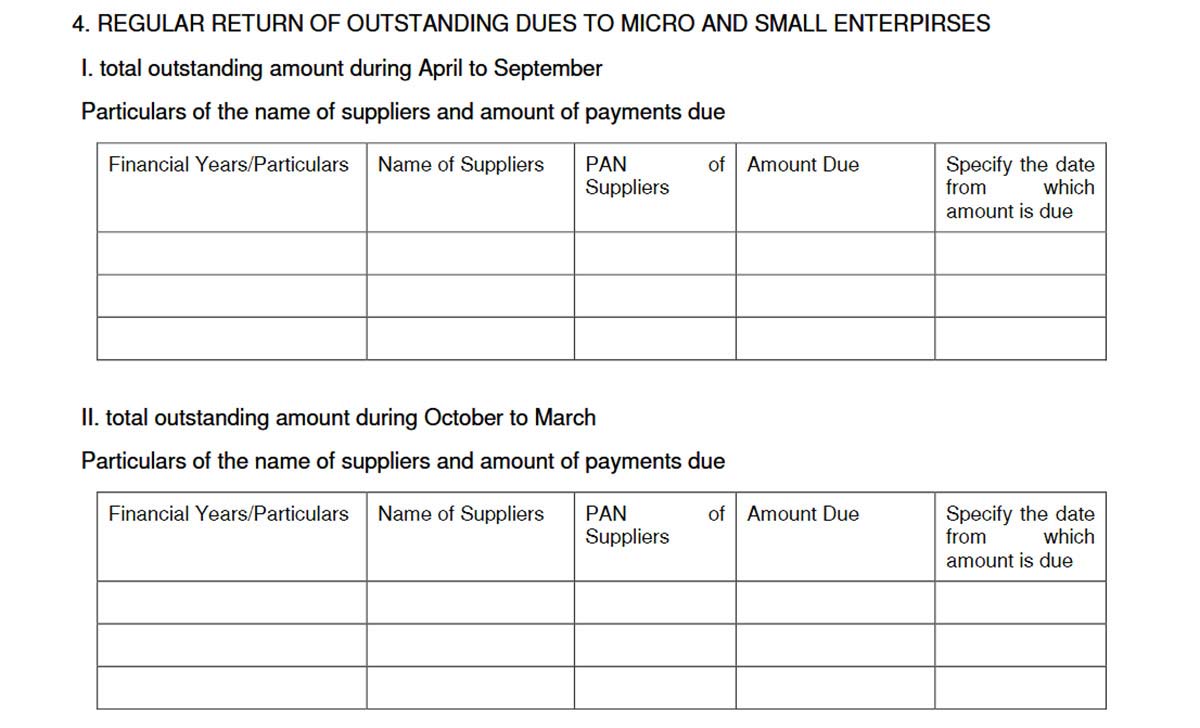

Step 4: Details of regular returns of outstanding dues to the MSE suppliers

Step 5: Details based on the reason for the delay in the payment amount

Step 6: Any particular attachment for the validation

Then there is a declaration by the company director along with a digital signature

Due Date for Filing MSME Form 1 (MCA):

The Half-yearly return

- Every company is required to file the MSME Form I as a half-yearly return by 31st October, effective for the period from April to September and once again by 30th April for the period October to March every year, relating to the outstanding payments to MSMEs.

Who should not file the form? (Exemption to this rule)

- This Rule applies not to all the Companies but only to those Specified Companies whose payment to MSME suppliers exceeds 45 days from the date of acceptance or deemed acceptance of the goods or services as per the provisions under section 9 of the MSME Development Act, 2006.

- If the payment against the supplier exceeds 45 days, the supplier/Creditors give a declaration that they do not fall under the category of Micro or small Enterprises.

Some FAQs Related to MSME Form 1:

Q.1 – Why was the MSME-1 Form introduced by the MCA?

MSME-1 Form has been introduced for companies, who received supplies of goods or services from micro and small enterprises and whose payments for such supplies are outstanding for more than 45 days by the MCA.

Form MSME 1 introduction by MCA will help specified companies submit a half-yearly return to the MCA disclosing details like the amount of payment due, the reasons for the delay, etc.

Q.2 – Who are Micro, Small & Medium Enterprises?

| Manufacturing Sector | Service Sector | ||

|---|---|---|---|

| Enterprises | Investment in plant & machinery | Enterprises | Investment in equipment |

| Micro Enterprises | Below INR 25 Lakh | Micro Enterprises | Below INR 10 lakh |

| Small Enterprises | Above INR 25 Lakh but less than INR 5 Crore | Small Enterprises | Above INR10 lakh, but less than INR 2 crore |

| Medium Enterprises | Above INR 5 Crore but does not exceed INR 10 Crore | Medium Enterprises | INR 2 crore above, but less than INR 5 crore |

Q.3 – What details need to be furnished by companies in Form MSME-1?

Companies must furnish the following details to their concerning ROC via Form MSME-1:

- The amount of payment due

- The reasons for the delay

- Supplier Name

- PAN of supplier

- Date from which amount is due

Q.4 – What do you mean by a Specified Company under MSME Form-1?

A specified Company under MSME Form-1 refers to a Public or Private company that:

- Receives goods/services from Micro or Small Enterprises (MSME)

- The payment for such services is still outstanding from the company side for more than 45 days

Q.5 – What are the steps to file the initial return, i.e., MSME Form I by specified company?

- In the first step, the specified company must rectify its suppliers whose payments are due for more than 45 days as on 22nd January 2019

- Now, the company must obtain a Micro or Small Enterprises Registration Certificate from the same suppliers rectified in step 1

- Finally, the company must settle all dues pending for more than 45 days with suppliers registered under MSME Act 2016 in order to avoid filing MSME Form I

Q.6 – What is the initial return date of Form MSME-1?

Based on the MCA general circular dated 21.02.2019, the initial return filing of MSME Form 1 must be done within 30 days, starting from the date of said e-form deployment on the MCA 21 portal.

Q.7 – What is the due date of regular half-yearly return of MSME Form I:

List of documents needed adjacent to form MGT 7:

MSME Form I is filed on a half-yearly basis, the due date for which is given below:

| Time Period | Half-year return date of MSME Form I |

|---|---|

| October to March | 30th April |

| April to September | 31st October |

Q.8 – What is the Penalty Fees against the non-filing of Form MSME-1?

| Entities | Penalty Fees |

|---|---|

| For Specified Companies | INR 25000 |

| Defaulting Officer (related to company) | Imprisonment up to 6 months or a penalty of INR 25000 to INR 3 lakh or both. |

Dear Sir,

As per MSME act 43B(h) we can conclude that the payments to the MSME should be made maximum within 45 days and too after a formal written agreement or else within 15 days. Please suggest format for formal written agreement.

Thanks

Rakesh Shrivastava

What should be the financial year from and to should be mentioned in column 4(b) in Form MSME in case of Oct-March 22 return

Is there a provision for filing a revised return in case if we have by mistake mentioned an inflated amount? I have inadvertently mentioned an incorrect amount. Please help.

If the payment is due for 15 days from the date of acceptance of goods but the other company got registered 45dys prior.. is it required to file msme1?

our company provides software services and I have registered my co. in MSME in November 2019. Do I have to file any return? AFTER REGISTRATION I have not filed anything on the MSME portal.

if you have dues for more than 45 days for the creditors registered in MSME then you are required to file MSME form

Thanks for all the above valuable information, but I have filled the form for registration 10 days back I just got one mail regarding that you received my request for registration after that no response from your side. your representative not received any of my calls. I am still waiting for my registration no .can you plz tell me much longer it will take to finally get registered

I have registred under Udayam as micro enterprice. I provide short term accommodation facility in my flats. We collect rental through airbnb and booking.com and receive money from the customers. No goods are involved. Shoul i send any return anf so what?

Hello..

Need clarification for half yearly return (31/03).

Should we consider (cut-off date as 31/03) – for finalizing the list of pending invoices as of date OR

shall we consider all invoices in period of Oct-March 2020 which are unpaid for the total period of 45 days?

Please reply.

As per notification all the invoice o/s for the more then 45 days as on 31.03.2020 will have to be reported irrespective date of invoice.eg if invoice dt 01.04.19 and it is o/s as on 31.03.20 same shall be reported

YES, it is required to be shown in return as it is still outstanding

But as per the instruction kit provided by MCA “Total outstanding amount due FOR THE PERIOD. (Page no. 6 point 4(a)

Ma’am,

Is there a provision for filing revised return in case if we have by mistake mentioned an inflated amount? I have inadvertently mentioned an incorrect amount. Please help.

Is there a provision for filing a revised return in case if we have by mistake mentioned an inflated amount? I have inadvertently mentioned an incorrect amount. Please help.