An LLP, or Limited Liability Partnership, blends characteristics from both traditional partnerships and corporations. In the realm of ROC filing, LLP software is tailored to aid LLPs in meeting their filing needs and ensuring compliance with Registrar of Companies standards.

ROC filing entails submitting an array of documents and forms to the Registrar of Companies, ensuring adherence to regulatory standards and the continual upkeep of a company’s information. These ROC filing prerequisites may fluctuate depending on the jurisdiction, underscoring the crucial necessity for businesses, including LLPs, to strictly observe these guidelines to uphold legal compliance.

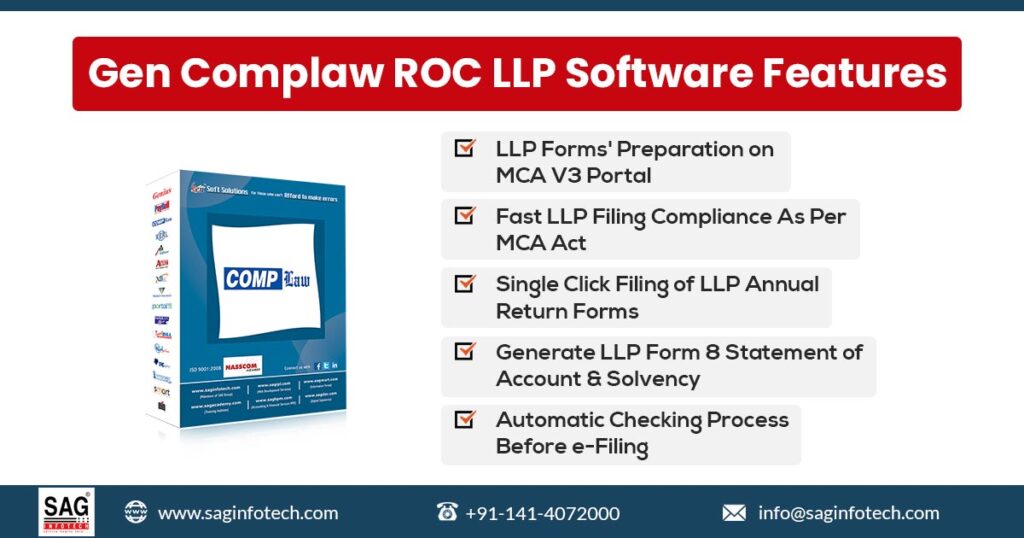

Main Features of LLP Software

LLP software designed for ROC filing often encompasses functionalities like document preparation, e-filing options, compliance monitoring, and assorted tools that streamline the fulfilment of regulatory duties. Utilizing this software assists LLPs in effectively managing their legal and statutory obligations.

It’s crucial to acknowledge that the specifics regarding LLP software and ROC filing requisites are subject to change. Therefore, it’s prudent to verify the most recent regulations and employ software aligned with the prevailing legal framework in your jurisdiction. For the most precise and up-to-date guidance, considering a specific jurisdiction or time frame, it’s advisable to verify the latest information or seek counsel from a legal professional.

LLP Software Advantages

The nature of LLP software for ROC filing can differ based on the service provider and the jurisdiction where the Limited Liability Partnership functions. Nevertheless, I can outline some common functionalities such software often encompasses:

Document Preparation

LLP software commonly aids in preparing an array of documents necessary for ROC filing. These documents might encompass the LLP agreement, annual returns, financial statements, and other pertinent forms.

E-Filing Capabilities

Numerous LLP software solutions provide electronic filing (e-filing) features, enabling users to electronically submit their required documents and forms to the Registrar of Companies. This streamlined approach minimizes manual paperwork and enhances the efficiency of the filing procedure.

Compliance Tracking

Limited Liability Partnerships (LLPs) must adhere to diverse statutory and regulatory mandates. Typically, LLP software incorporates functionalities aimed at monitoring compliance deadlines and facilitating timely filings. This often includes issuing reminders for approaching due dates.

Audit and Accounting Features

Certain LLP software solutions might integrate audit and accounting tools, aiding LLPs in overseeing their financial documentation and guaranteeing alignment with accounting norms. This proves pivotal in generating precise financial statements.

Annual Return Filing

The submission of annual returns stands as a pivotal obligation for LLPs. LLP software can streamline this recurring task by assisting in the preparation and filing of annual returns with the Registrar of Companies, streamlining this crucial process.

Communication with Authorities

The software might enable communication between the LLP and regulatory bodies, encompassing updates on regulatory shifts, alerts regarding compliance prerequisites, and aiding in any correspondence with the Registrar of Companies.

Data Security and Privacy

Due to the sensitive nature of information in ROC filing, LLP software places significant emphasis on data security and privacy. Encryption and secure data transmission stand as prevalent features, safeguarding the confidentiality of the LLP’s information.

It’s essential to recognize that the functionalities and capacities of LLP software can evolve with time, potentially incorporating new developments or adapting to regulatory changes. Therefore, confirming compliance with the latest regulations in your specific jurisdiction is wise, either by consulting relevant authorities or seeking advice from legal experts.

For the most current and precise information, exploring available LLP software solutions in your region or engaging professionals specialized in corporate compliance and filing can be beneficial.

The specific documentation needed for ROC filing by a Limited Liability Partnership (LLP) can differ based on jurisdiction, with each country maintaining its distinct set of forms and filing prerequisites.

LLP Forms

Below are examples of forms that LLPs may use for filing with the Registrar of Companies (ROC):

LLP Form 3: For filing details of the LLP agreement, including any changes made to it this form is been utilised.

LLP Form 5: If an LLP wishes to revise its name, Form 5 is often used to notify the Registrar of Companies of the change.

LLP Form 8: The same form is been used to file the statement of account and solvency that furnishes the information for the financial position of the LLP.

LLP Form 11: LLPs typically must submit an annual return, often using Form 11 for this task. This annual return offers a summary of the LLP’s activities throughout the financial year.

LLP Form 15: When an LLP alters its registered office address, it frequently employs Form 15 to inform the Registrar of Companies about this update.

LLP Form 22: If a court or tribunal order is affecting the LLP Form 22 that might be utilized to notify the Registrar regarding the order.

LLP Form 23: If the Registrar or a competent authority issues a directive to alter the LLP’s name, Form 23 can be employed for this specific task.

It’s crucial to acknowledge that the names and particulars of forms can differ, and jurisdictions might revise their forms and criteria periodically. Moreover, certain jurisdictions may offer distinct forms for various filings or modifications in LLP structures.

For the most precise and current information, it’s recommended to visit the official website of the pertinent Registrar of Companies in your jurisdiction or seek guidance from a professional well-versed in local corporate legislation.

Gen CompLaw ROC differentiates itself from other tax software by offering an easy online e-filing experience that benefits taxpayers and businesses. It transcends traditional tax software with the addition of ROC/MCA and LLP filing options. If you’re looking for LLP filing software, take advantage of the ideal opportunity to investigate your options; Use Gen CompLaw which is available for professionals and company secretaries.