Simple Definition of LLP Form No. 3

LLP Form 3 is used for filing the Limited Liability Partnership Agreement in the case of a newly formed Limited Liability Partnership and for making changes to an existing Limited Liability Partnership. In order to submit Form 3, an LLP agreement must be signed. It is required that an LLP Agreement be printed on stamp paper of the specified value and notarized.

Due Date for the LLP Form No. 3

Limited Liability Partnerships must pass a resolution authorising a partner to act on behalf of the LLP. It is essential that the designated partner digitally sign Form 3 along with the DPIN number. It is necessary to submit the same form within 30 days of the incorporation of a Limited Liability Partnership or 30 days of such change in the LLP agreement.

Documents Attachment for LLP Form 3

There are a number of documents that must accompany the LLP Form 3.

- Additions/supplements to the LLP agreement ( PDF Format)

- LLP Contract ( PDF Format )

- Form 3 requires the Digital Signature of the Designated Partner.

- Be sure to include the partner’s DPIN (Designated Partner Identification Number) and the member’s DSC (Digital Signature Certificate

- Additional optional documents (If needed)

Is It Better to File the LLP 3 Form By Gen Complaw?

Gen Complaw software is designed by SAG Infotech, and it is used by professionals (Company Secretaries & Chartered Accountants) who wish to file e-forms with MCA, such as MGT-7, AOC-4, ADT-1, DIR3-KYC & Web, DIR-12, LLP 8, CHG-1 & 4, DPT 3 and 4, LLP-3, LLP- 4 & 11, etc. As per Accounting Standards and Indian Accounting Standards taxonomy, this software can prepare balance sheets, profit and loss statements, and income statements in XBRL format as well.

With this software, Professionals can do company law work very easily and smoothly. By using the current and previous year’s database, users can create XBRL financial data. A real-time backup and restore facility is also included in the Complaw software. Additionally, the software is a simple electronic format for business reporting that has changed the way businesses report. Over the years, the software has been used by many satisfied clients in India. A trial version of the software is available, so you can evaluate whether it is suitable for compliance-related work.

Steps-by-Step Procedure of LLP-3 Form via Gen Complaw Software

Step 1: First Install, ‘Gen Complaw software’ on your desktop and laptop.

Step 2: After installing the software, move the cursor towards the ‘LLP button’.

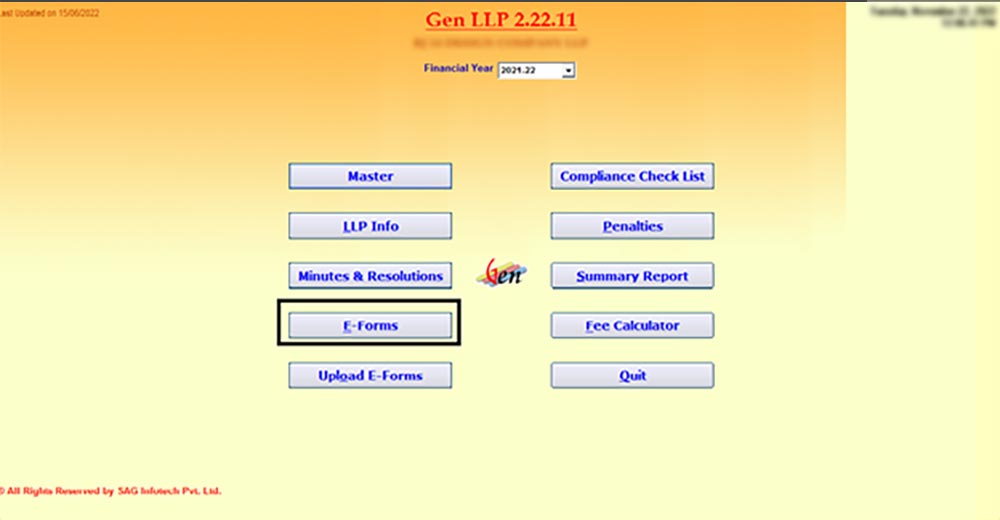

Step 3: Select the applicable financial year and then the ‘E-forms’ option’.

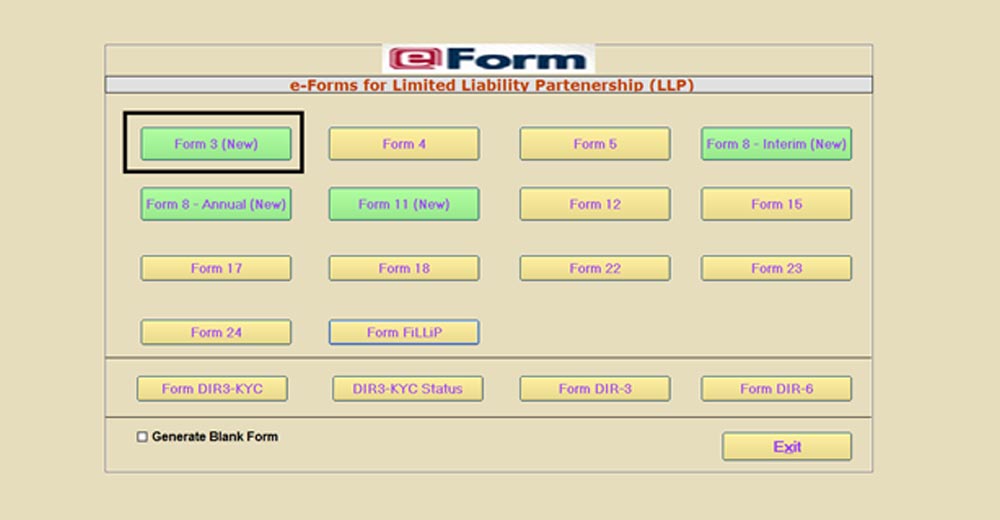

Step 4: After clicking on the ‘E-forms option’ then select ‘Form 3’ in a particular list.

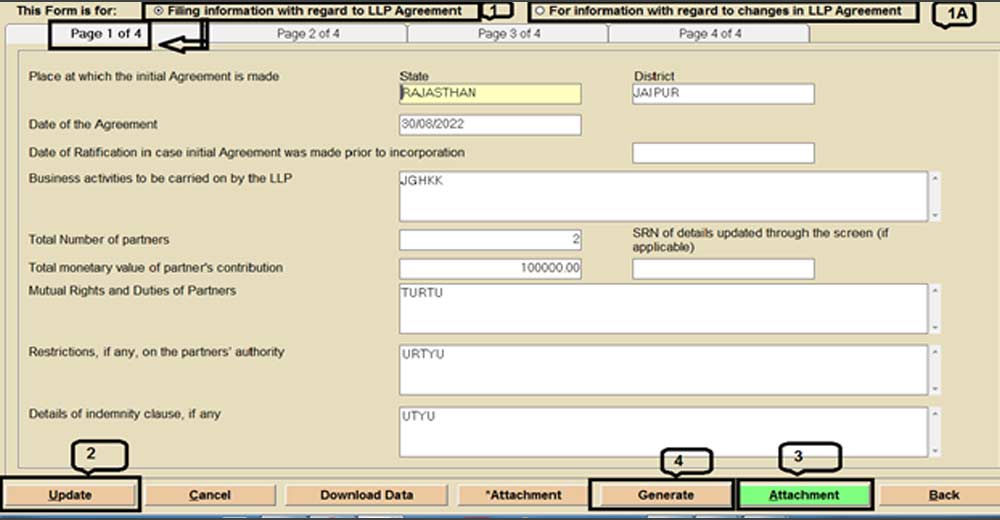

Step 5: Move on next step, if you are filling form-3 first time, i.e. entering into initial LLP agreement, then select the desired option as shown in point 1 I.E

- Filing Form with Regard to LLP Agreement: if it is initial LLP agreement

- For Information with Regard to Changes in the LLP Agreement: modification in the existing

- LLP agreement.

Step 6: After selecting option 1 filing form with regard to the Initial LLP agreement

- Fill in the details such as place where agreement is made, date of agreement, business activities, total no. of partners there contribution, rights and duties of partner, Mutual rights & duties of partners, Restriction, if any on the partner’s authority as it is compulsory details to be filled. on page 1 as shown and select update to save the details

- After selecting update go to page 2

Step 7: Now fill in all the details of page 2 such as Acts, matters or things, if any, which can be done only with the consent of all the partners/consent of requisite number or percentage of partners, Procedure for calling, holding and conducting meetings, (where the decisions are to be made at meetings of partners), Details of agreement relating to admission of partner, retirement of partner cessation of partner, expulsion of partner& resignation of partner and then click on the update button to save the details.

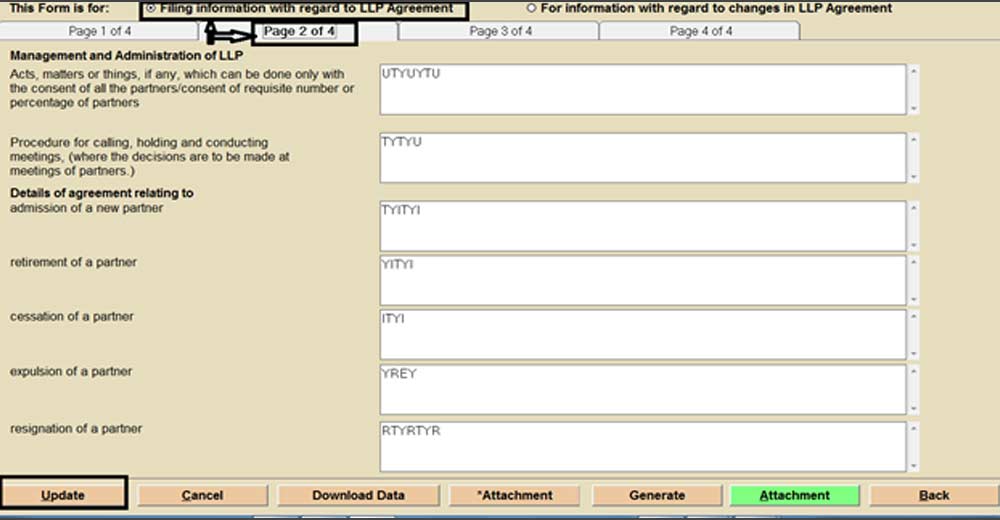

Step 8: After that select page 3 from the given options. Fill in the details of page 3 such as clause relating to disputes between the partners, between the partner and llp, if any, Information relating to voluntary winding up and information of clauses in the agreement relating to rule 16(2), 17(1), 20 (1), 24(18) (a) and any other information or clause relating to LLP agreement not covered above (optional), select update to save the details after that select page 4

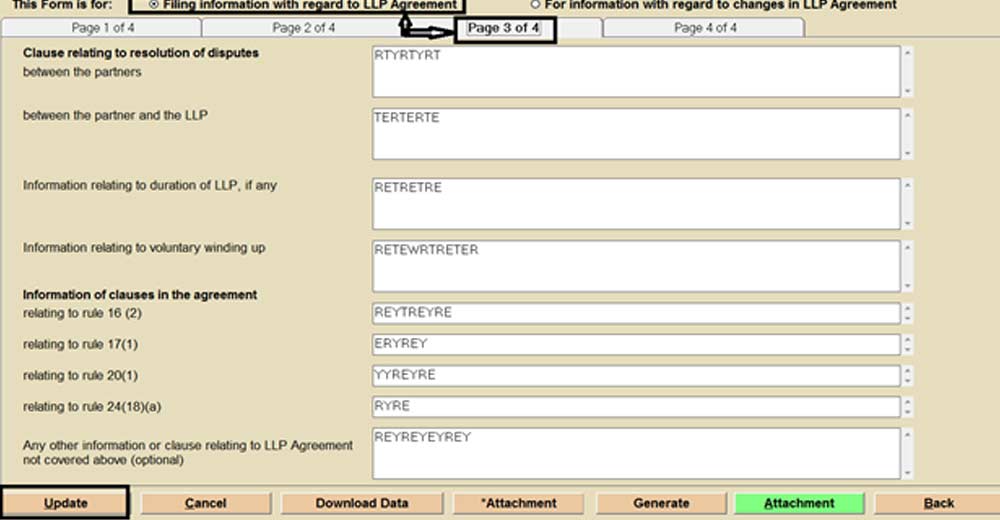

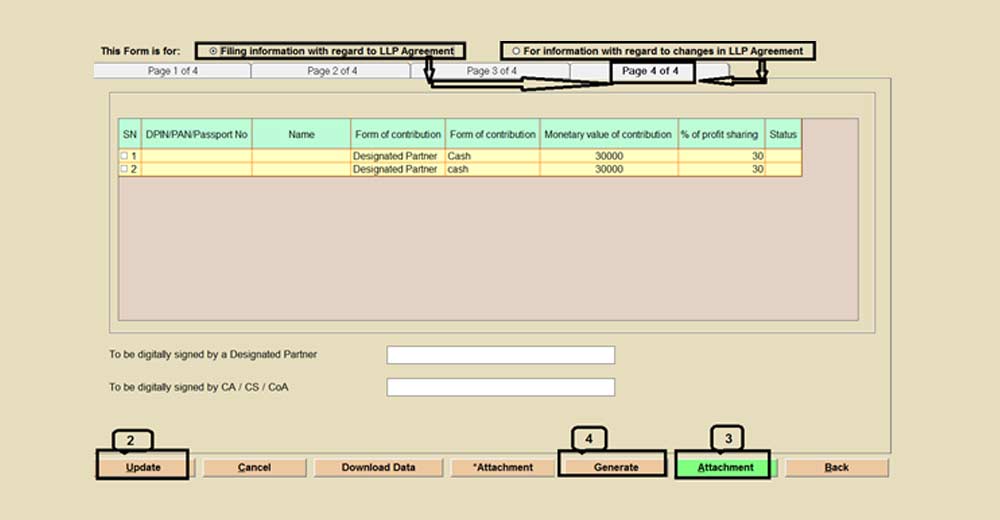

Step 9 On page 4 details of designated partners will be shown which you have provided in the software

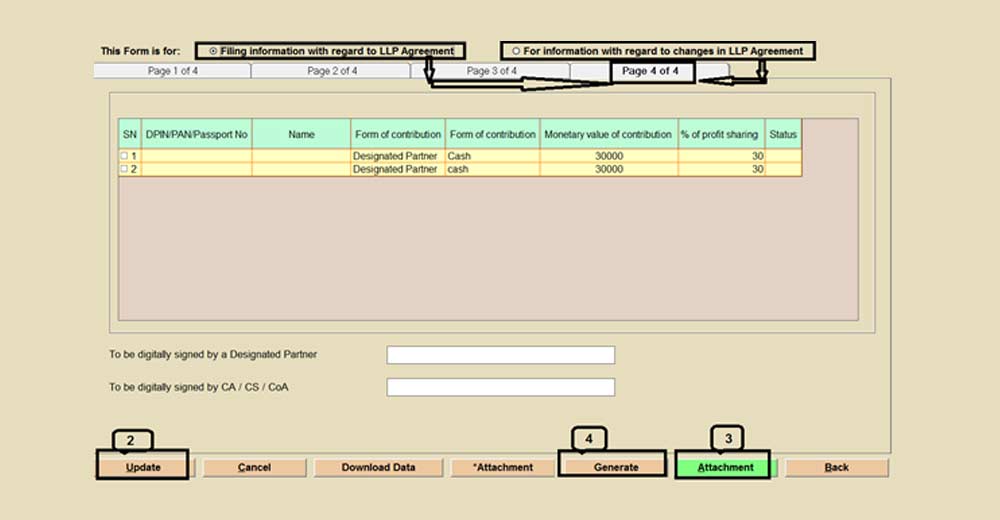

- Select the designated partner and the professional whose DSC is required to be attached to the form

- Select the update option to save the details

- Attach the required attachment by selecting the attachment option,

- Select the generate option to upload the form details on the MCA portal

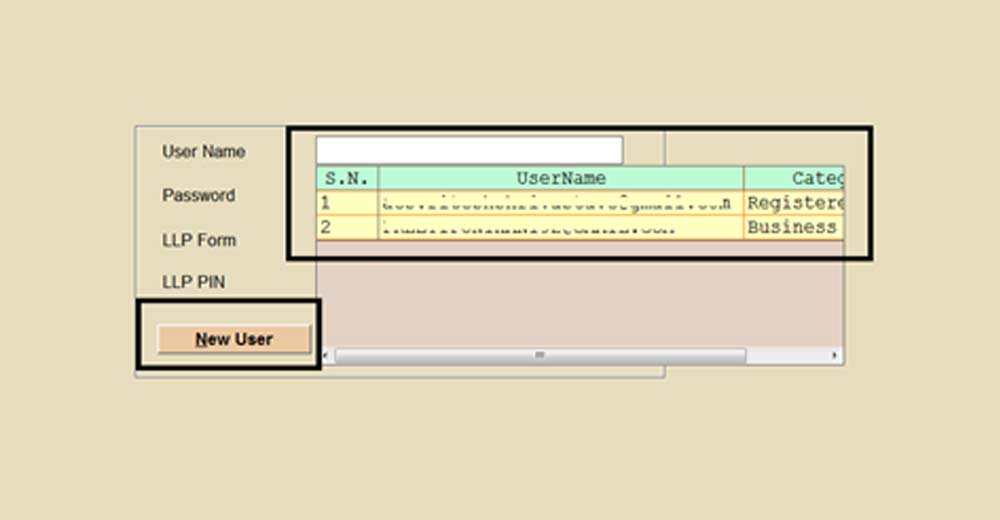

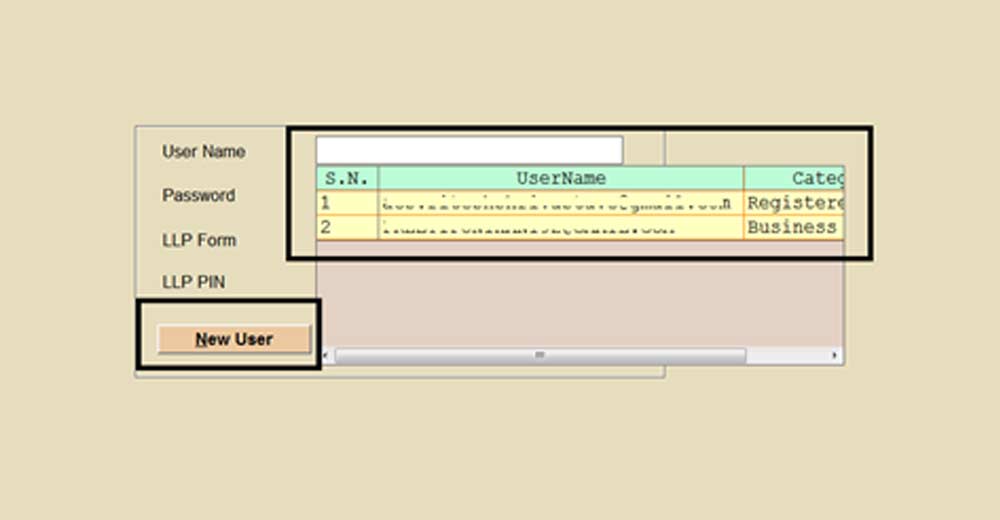

Step 10: Select the MCA login ID from whom you want to upload the form it will upload all the details of the relevant form on the MCA portal.

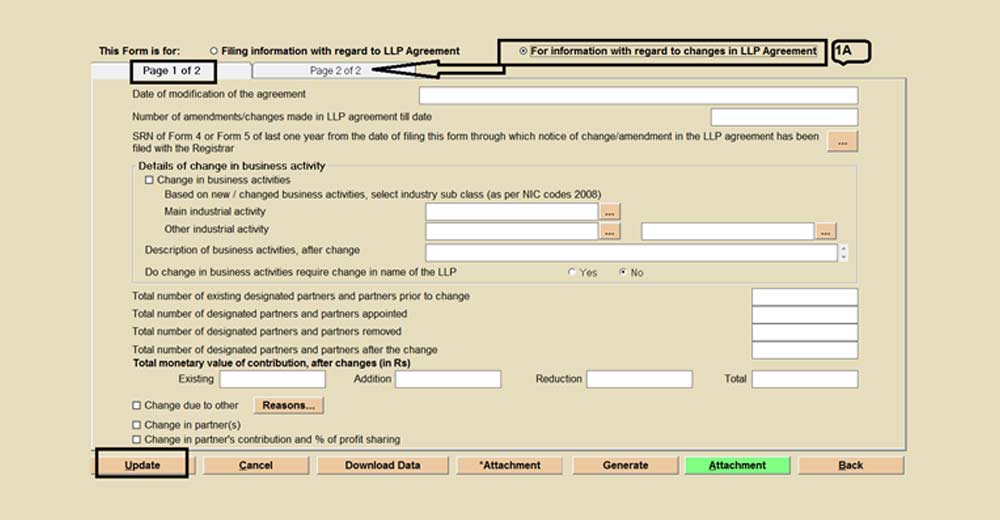

Step 11: After selecting option 1 A for information with regard to changes in the LLP agreement

- Select page 1 and provide the details as Date of modification of the agreement, no. of amendments / changes made in LLP agreement till date , select the reason for which form -3 is to file such as Details of change in business activities, change in partner, change in partners contribution and % of profit sharing, or select change due to other reason if reason is not covered in the above option and select the update option to save the details

- After that select page 2 in the option

Step 12: On page 2 details of designated partners will be shown which you have provided in the software

Step 13: Select the designated partner and the professional whose DSC is required to be attached to the form

- Select the update option to save the details

- Attach the required attachment by selecting the attachment option,

- Select the generate option to upload the form details on the MCA portal

Step 14: Select the MCA login ID from whom you want to upload the form it will upload all the details of the relevant form on the MCA portal.

Step 15: Our software will redirect you to the MCA V3 Login page after uploading the same from the software by saving it on the portal. Afterwards, you have to edit the form and check and submit to proceed further.

Step 16: Once the form is submitted on the MCA portal SRN will generate. You can further download the form, affix DSC and upload in the MCA V3 portal and proceed for payment.