An order was set aside by the Kerala High Court in reassessment proceedings that were furnished without furnishing the taxpayer a chance to answer to the show cause notice.

The Bench of Justice Gopinath P. marked that “the show cause notice was issued on 12-03-2024, giving only three days’ time to the assessee to respond, and the order was issued on 20-03-2024……… one final opportunity can be given to the assessee to respond to the show cause notice”.

It was claimed by the taxpayer/ applicant that a show cause notice was furnished dated 12-03-2024, with a due date to answer by 15-03-2024. The order was passed dated 20-03-2024 before the taxpayer had the chance to furnish a response.

The taxpayer claimed that the shows the undue haste on the end of the assessing authority, exhibiting that the case was not regarded effectively. The taxpayer argued that the order in reassessment proceedings for the assessment year 2018-19 to the Kerala High Court.

It was furnished by the income tax department that the SCN was not the first one issued before the taxpayer and it was the final SCN furnished before the taxpayer. It was also mentioned that distinct chances had been allotted to the taxpayer previously and the same could not be mentioned that the order was one issued rapidly and without taking into account the response furnished by the taxpayer.

It was marked by the bench that “while the Income Tax Department may be right in contending that the show cause notice was not the first opportunity given to the assessee and several earlier opportunities have been given to the assessee, it remains the fact that show cause notice was issued on 12-03-2024, giving only three days’ time to the assessee to respond, and the order was issued on 20-03-2024”

However, considering the previous chances provided to the assessee, it cannot be claimed that the order was made hastily; nonetheless, the bench stated that one final opportunity should be granted to the assessee to reply to the show cause notice.

Read Also: Kerala HC: Re-assessment Order U/S 148 A(b) Without Personal Hearing is Not Valid

Considering the aforementioned points, the court annulled the reassessment order and instructed the Assessing Authority to finish the assessment after giving the assessee one final chance to reply to the show-cause notice and an opportunity to be heard.

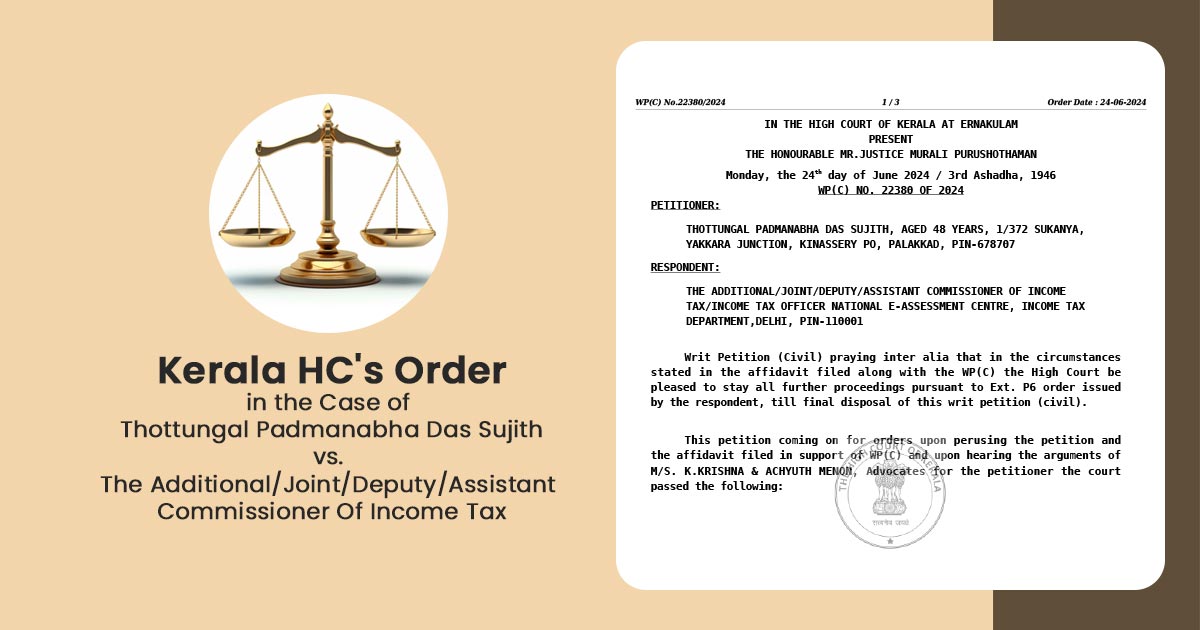

| Case Title | Thottungal Padmanabha Das Sujith vs. The Additional/Joint/Deputy/Assistant Commissioner Of Income Tax |

| Citation | WP(C) NO. 22380 OF 2024 |

| Date | 24.06.2024 |

| Counsel For Petitioner | M/s. K.krishna and Achyuth Menon |

| Kerala High Court | Read Order |