The Karnataka High Court in a ruling has quashed the income tax assessment proceedings u/s 148A (b) of the Income Tax Act, 1961 as of the non-service of the show-cause notice.

The applicant Sithappana Halli Bychappa Padmanabha Gowda contested the validity of distinct notices and orders issued via the income tax department specifically the notice u/s 148A(b) of the Income Tax Act for the assessment year 2016-17.

The counsel of the applicant furnished that the notice u/s 148A(b) of the Income Tax Act was not served which breaches the procedural needs for the reassessment. It was claimed by the applicant that they did not know the proceedings till they obtained the notices pertinent to the penalty showing that they did not get permitted to answer to the SCN.

It opined that if the applicant has been furnished with the chance then they can have elaborated on the source of the Rs 63,70,000 deposit and requested to furnish a chance to reply to Section 148A(b) notice.

Justice S Sunil Dutt Yadav learned that the claim of the applicant for the non-service of the SCN u/s 148A(b) stayed uncontroverted from respondents. The court remarked that the assessment order was passed on the grounds of an assumption drawn from the failure of the applicant to furnish a return or answer to the SCN.

The court determined that the petitioner was not adequately served with the notice, which resulted in the petitioner missing the chance to present their case and clarify the origin of the cash deposit.

Read Also: Kerala HC Deletes a Tax Order as an IT Officer Didn’t Fulfill Their Responsibility

Hence the court set aside the impugned notices and orders. The court restored the case to the phase of the answer to the Section 148A(b) notice, permitting the applicant a chance to clarify the cash deposit source.

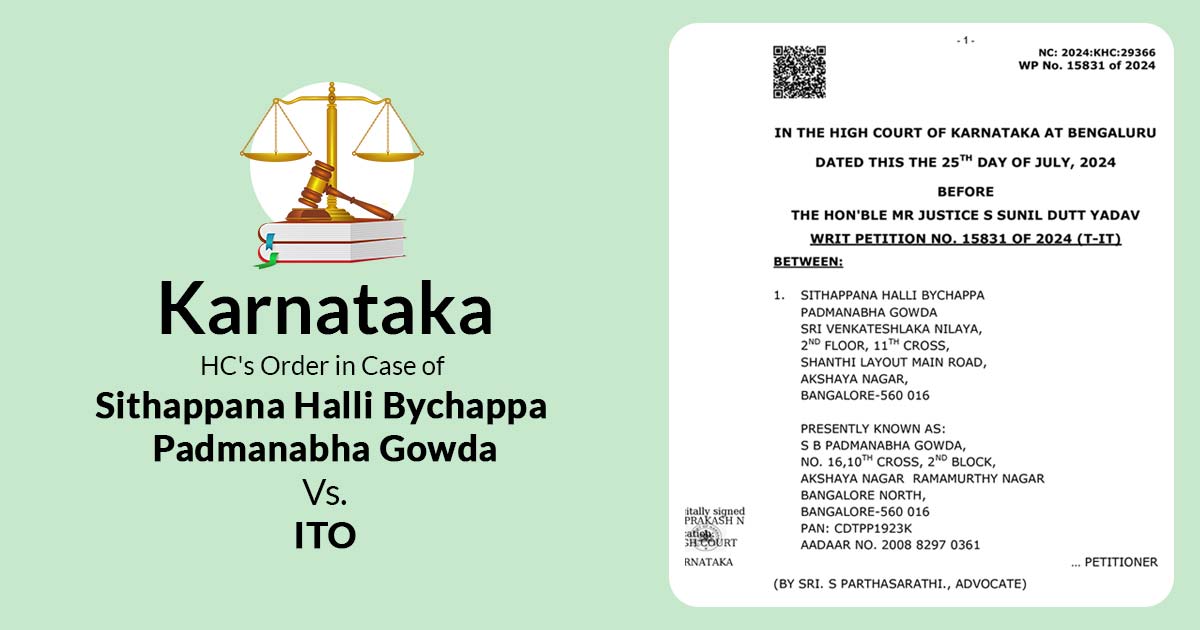

| Case Title | Sithappana Halli Bychappa Padmanabha Gowda Vs. ITO |

| Citation | WP No. 15831 of 2024 |

| Date | 25.07.2024 |

| For Petitioner By | Sri. S Parthasarathi |

| For Respondents By | Sri Sanmathi E.I. |

| Karnataka High Court | Read Order |