It was mentioned by the Kerala High Court that any assessment order furnished before the permitted time for filing a response has no legal validity and can be overturned.

The Bench of Justice Gopinath P. marked that “…….the assessee had filed an appeal against the order is no ground to refuse relief to the assessee as the original order was clearly issued in violation of principles of natural justice…….”

A show cause notice for the matter on June 20, 2023, has been granted before the taxpayer till July 21, 2023, to furnish a response. But on July 11, 2023, an assessment order was issued before the expiration of the provided time for the taxpayer to answer.

A writ petition was been furnished by the taxpayer contesting the assessment order furnished under the provisions of Section 73 of the CGST/SGST Acts.

It was furnished by the department that the taxpayer has taken the remedy of appeal filing against the order, asserting the advantage of notification (furnished in the case of limitation for appeal filing) which on its terms was not applicable for the taxpayer. It was furnished that the filing of the appeal by the taxpayer was indeed rejected via another order discovering that the same was barred under the limitation.

It was marked by the bench that the taxpayer may have filed an appeal against the order of assessment (which was rejected by another order because of time restriction), but the facts stated that in breach of the principles of natural justice, another order was passed.

The bench said that “……..it is clear from show cause notice that the assessee was given time till 21.07.2023 to reply to the show cause notice. The order appears to have been passed on 11.07.2023, even before the time for filing a reply had expired. Therefore, the order is liable to be set aside………..”

Since the order was being furnished in breach of the principles of natural justice the fact that the taxpayer filed a petition against the assessment order is no reason to deny the relief to the taxpayer, the bench mentioned.

Read Also: Kerala HC: Downloading Assessment Orders From the Common Web Portal is a Valid Service

The bench for the above-said permitted the petition and set aside the assessment order.

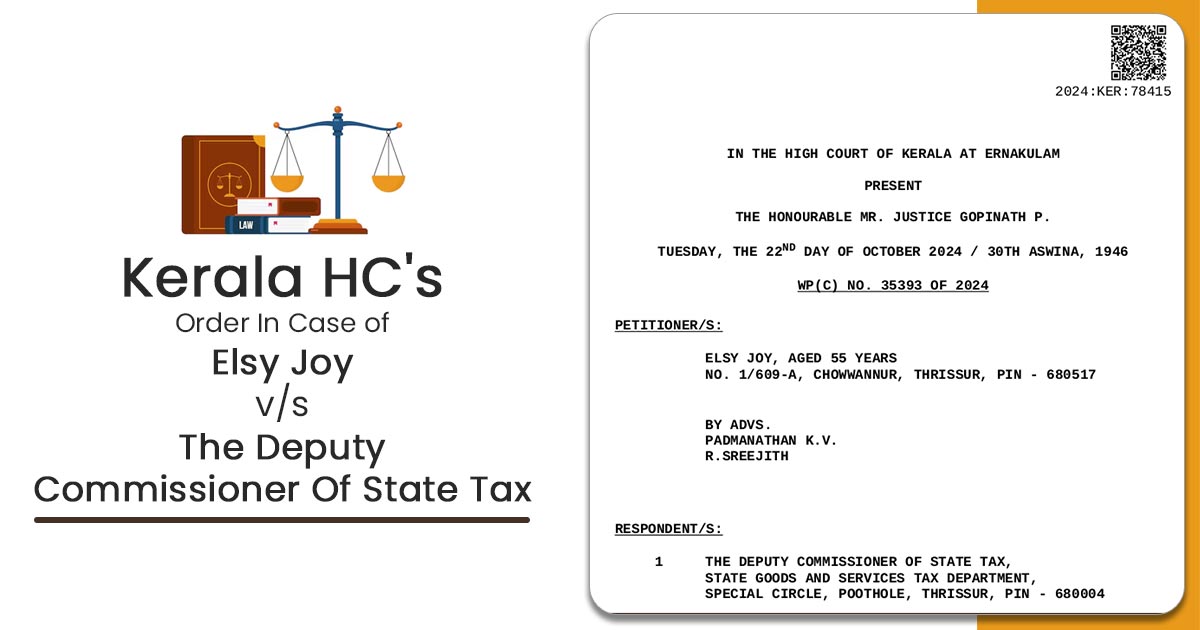

| Case Title | Elsy Joy vs. The Deputy Commissioner Of State |

| Citation | WP(C) NO. 35393 OF 2024 |

| Date | 22.10.2024 |

| Counsel For Appellant | Padmanathan K.V. R.Sreejith |

| Counsel For Respondent | By Adv Dayasindhu Shreehari N.S., CGC Smt. Jasmin M.M, GP |

| Kerala High Court | Read Order |