Under the Central Goods and Services Tax Act (CGST Act 2017), the Kerala High Court has ruled that an appellate authority is required to consider the merits of an appeal even when there is no appearance on behalf of the appellant.

It was mentioned by the court that the order is required to be passed on the merits and that the dismissal could not be only for default.

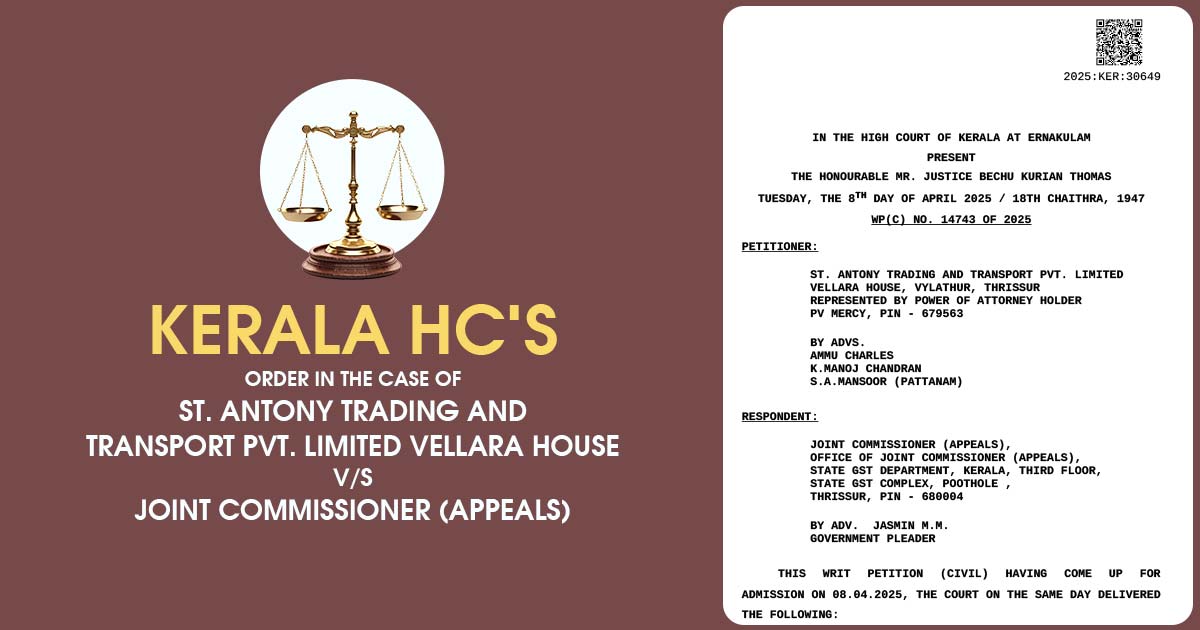

Justice Bechu Kurian Thomas acknowledged the writ petition furnished by a taxpayer contesting an order passed by the Joint Commissioner (Appeals) dismissing the appeals without any determination, only based on the non-appearance even after three adjournments.

The court, disapproving of the order of the appellate authority, noted that-

“Section 107(12) of the CGST Act specifically states that the order of the Appellate Authority disposing of the appeal shall be in writing and shall state the points for determination and the reasons for the decision. In the light of sub-clause (12) of Section 107 of the CGST Act, it is evident that the Appellate Authority has to consider the matter on merits and is not entitled to dismiss an appeal merely for non-appearance.

Of course, when there is failure of the appellant to appear, the Appellate Authority shall not grant more than three adjournments to a party during the hearing of the appeal. Despite the failure of an appellant to appear, the Appellate Authority has to pass an order after determining the points for consideration, and the decision should be on merits.”

On the ruling of the Patna High Court in Purushottam Stores vs. State of Bihar, reference was made.

The Court set aside the impugned order, deeming it “perverse” because it was issued without merit or points for determination.

Recommended: Kerala HC Upholds GST Penalty U/S 74, Cites Delay and No Jurisdictional Error

After allotting a fresh chance of hearing to the applicant, the authority was asked to reconsider the case afresh.

Appearances: Advocates Ammu Charles, K. Manoj Chandran, S A Manzoor (Pattanam) for the applicant, Govt Pleader Jasmin MM for the State.

| Case Title | ST. Antony Trading and Transport Pvt. Limited Vellara House vs. Joint Commissioner (Appeals) |

| Citation | WP(C) NO. 14743 OF 2025 |

| For Petitioner | Ammu Charles, K. Manoj Chandran, and S.A. Mansoor (Pattanam) |

| For Respondent | Jasmin M.M.Government Pleader |

| Kerala High Court | Read Order |