The High Court of Himachal Pradesh has cancelled an assessment order issued by an officer in Baddi for the financial year 2009–2010. The court decided that the process for changing jurisdiction was not followed correctly, as required under section 127 of the Income Tax Act of 1961.

Deluxe Enterprises, founded by Mr. Vivek Bhalla in 1997, is based in Delhi with its registered office in Dwarka, New Delhi. In 1999, Mr. Bhalla established a manufacturing unit in Nalagarh, Himachal Pradesh, which began operations in December of the same year. The income for previous years was assessed by the Delhi officer under Section 143(3).

In September 2010, the Income Tax Officer in Baddi issued notices for the assessment year 2009-10 and later passed an assessment ruling under section 144 in December 2011, without addressing the jurisdictional question or considering the written response provided.

It was claimed by the applicant that he has been submitting the returns in Delhi for various years and was computed there, therefore, the Baddi officer cannot take over the matter without an appropriate transfer u/s 127 of the Act.

He submitted appeals to the Commissioner of Income Tax(Appeals), Shimla, and thereafter to the Income Tax Appellate Tribunal(ITAT) Chandigarh, but both were dismissed.

It was mentioned by the department that the PAN was issued in 1999 with the address of Himachal Pradesh and comes under the jurisdiction of ITO, Parwanoo. Consequently, scrutiny was accomplished based on the PAN, and there was no requirement to issue a transfer notice.

The applicant, in answer, has asserted that the jurisdiction was amended without notice and repeated that he had submitted the returns from the address of Delhi and was computed by the Delhi officer before.

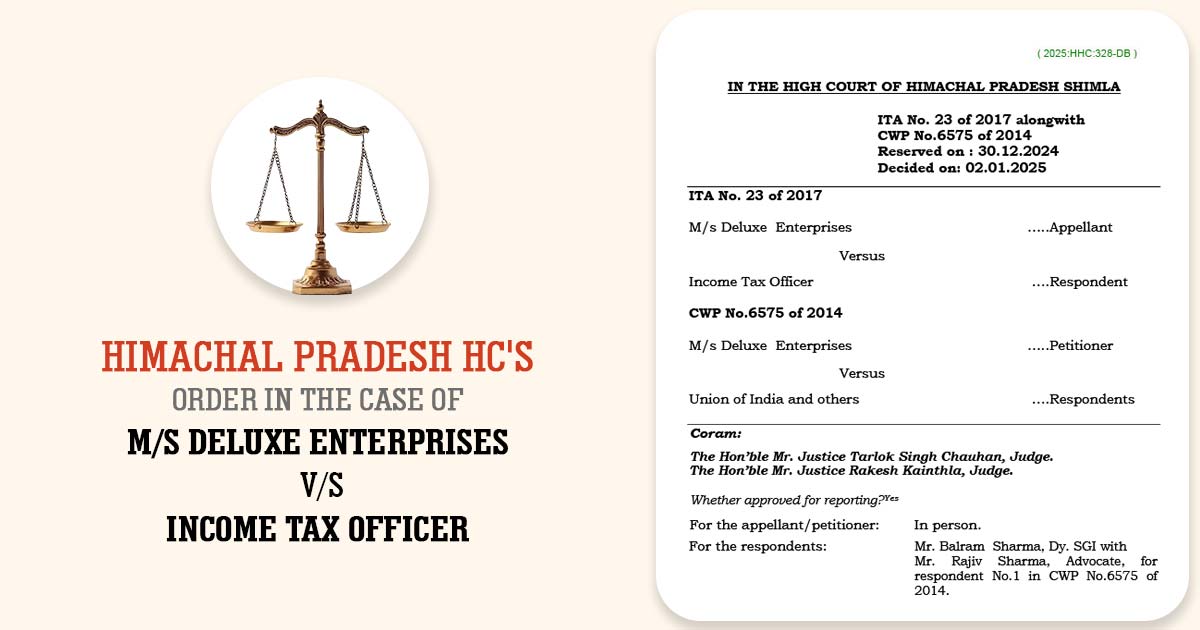

The Division Bench, comprising Judges Tarlok Singh Chauhan and Rakesh Kainthla, reviewed the case by hearing both parties and examining the case records. They found that the applicant had consistently filed Income Tax Returns (ITRs) with the same officer (Respondent No. 4) from the outset. Assessments, including for the fiscal year 2003–04, had also been completed by this officer.

Thereafter, the case was managed by a different officer (respondent No. 5) without following the process u/s 127 of the Income Tax Act. The same section mandates to provide the taxpayer be provided a hearing and recording reasons for transferring the case. The department considered that the same does not comply with this procedure.

Read Also: Notable HC Cases on Condonation of Delay in GST Appeals

The department’s claim has been rejected by the court that the new officer alone had the authority. It ruled that the change of officer and the transfer of records needed an effective statutory process, which was not performed. The court stresses that overlooking the same process breaches natural justice.

As the applicant has objected to the jurisdiction, the problem must have been addressed post-hearing the applicant and providing the reasons for the transfer.

The appeal and writ petition were allowed by the Himachal Pradesh High Court, and the assessment orders were quashed. However, it mentioned that the fresh proceedings can still be started by following the appropriate legal route.

| Case Title | M/s Deluxe Enterprises vs. Income Tax Officer |

| Citation | ITA No. 23 of 2017, CWP No.6575 of 2014 |

| For Petitioner | Mr. Balram Sharma and Mr. Rajiv Sharma |

| For Respondent | Mr. Ishan Kashyap |

| Himachal Pradesh High Court | Read Order |