The Central Board of Direct Taxes in accordance with the powers conferred in section 138(1)(a) of Income Tax Act, 1961, has ordered in F.No. 225/136/2020/ITA.II dated 31.08.2020, for developing the data for IT return filing status

The person has a lot of cash in the amount that has withdrawn it in huge amounts and has never filed the income tax returns. the Finance Act, 2020 w.e.f. 1st July 2020 will keep an eye on the filing return by the individual and also track their cash withdrawals through the non-filters and to trap the black money the section also amended income tax act 1961 below the threshold of cash withdrawal to Rs. 20 lakh for the applicability of TDS for the non-filers and also mandated TDS at the higher rate of 5% on cash withdrawal exceeding Rs. 1 crore by the non-filers.

Recently for the banks and post offices from 1st July 2020 “Verification of applicability u/s 194N” on www.incometaxindiaefiling.gov.in has been given functionality by the income tax department. With the help of this function, the bank and post offices will be the applicable rate of TDS in act 194N

The officials had now launched the latest function “ITR Filing Compliance Check” that is present for scheduled commercial banks (SCB) for checking the IT return filing status of PANs in bulk form. For providing information to the scheduled commercial banks the Principal Director General of Income-tax (Systems) has notified the procedure and format for it. Some properties of using these functions are beneath:

Accessing ITR Filing Compliance Check

The Principal Officer & Designated Director of SCBs, who are enrolled through the Reporting Portal of Income-tax Department (https://report.insight.gov.in) can avail for using the functions after logging in the Reporting Portal using their documents. After completion of logging in link to the functionality “ITR Filing Compliance Check” will be displayed on the home page of the Reporting Portal.

Arrangement of Request (Input) File Carrying the PAN Numbers

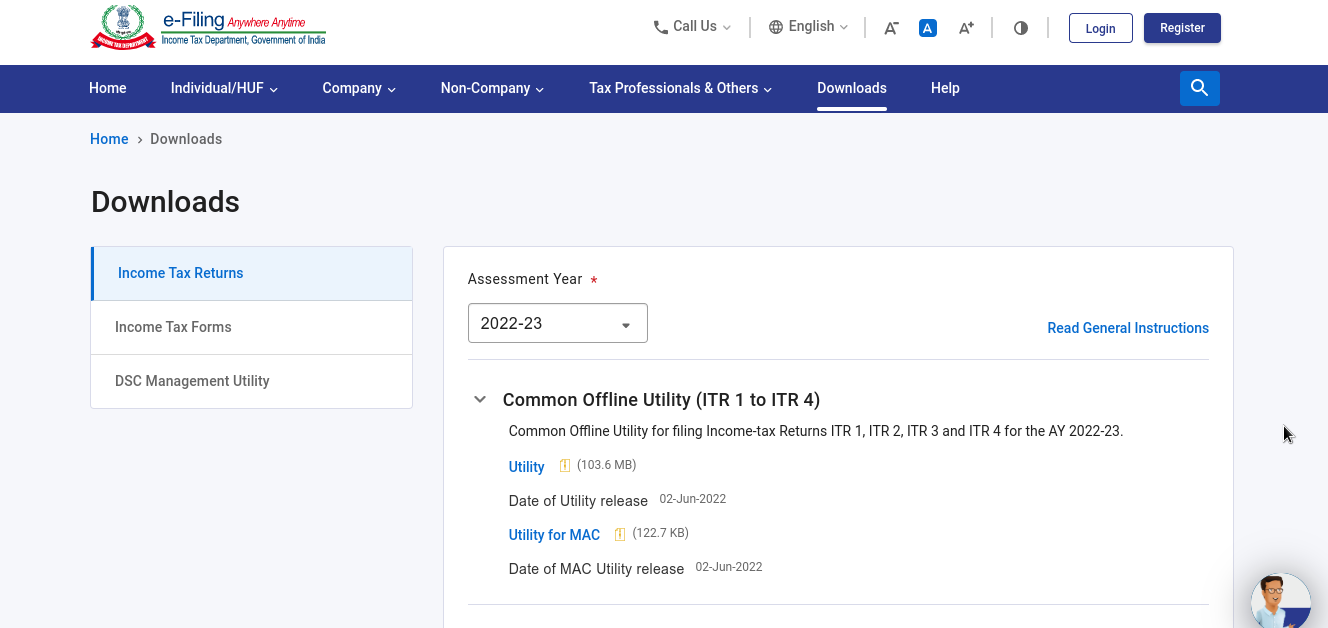

PAN information could be downloaded by clicking on the “Download CSV Template” button on the “ITR Filing Compliance Check” page. The PAN for the income tax return filing

Uploading the Input CSV File

On clicking the CSV button the input CSV file might get uploaded While uploading, “Reference Financial Year” is required to be selected. Reference Financial Year is the year because the outcome is needed. If the chosen Reference Financial Year is 2020-21 then the outcome will be present for Assessment years 2017-18, 2018-19, and 2019-20. The uploaded file will begin showing with Uploaded status.

Downloading the Output CSV File

Post-processing of the CSV file that has IT return filing status for which the PAN filled will be obtained for downloading and the alteration in the initial status will be obtained. The output CSV file will have PAN, Name of the PAN holder (masked), IT Return

The API exchanges will be used for controlling the scheduled commercial banks and integrate the process of banks’ core banking resolutions. Scheduled commercial banks are needed to do the appropriate information security strategies and process with definite guidelines for securing the information.