The Income Tax Appellate Tribunal (ITAT), Jodhpur bench, dealt with the disallowance of an Input GST claim of ₹37.92 lakh that had emerged because of an incorrect entry made by the Chartered Accountant (CA) of the taxpayer in Form 3CB. The Tribunal ruled that, as the claim had failed for the desire of external verification, the case must be remanded to the jurisdictional Assessing Officer for fresh examination.

The tribunal didn’t state anything towards the merits of the IGST disallowance, remanding the case back to the jurisdictional Assessing Officer (AO) for reassessment after furnishing the taxpayer a reasonable chance of hearing.

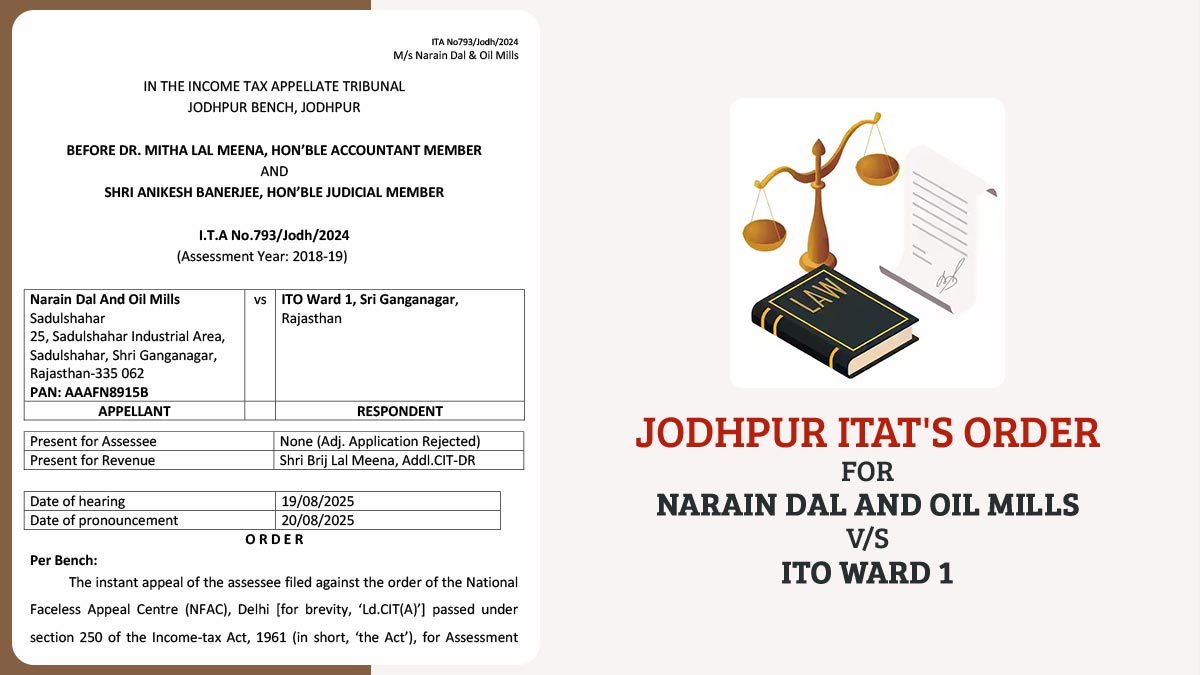

The appellant, Narain Dal and Oil Mills, Sadulshahar, Rajasthan, is against the order passed by the National Faceless Appeal Centre (NFAC), Delhi [CIT(A)], for AY 2018-19. Under Section 139(1) of the Act, the taxpayer has submitted its return, which was processed u/s 143(1). Thereafter, the taxpayer has asked for the rectification u/s 154.

The Centralised Processing Centre (CPC), Bengaluru, confirmed additions regarding TDS adjustments of ₹3,96,118 and ₹53,279, along with the disallowance of IGST of ₹37,92,383. The taxpayer was not satisfied with the CPC order and approached NFAC, which deleted the TDS additions. However, CIT(A) kept the disallowance of the IGST claim.

The taxpayer claimed that the addition of Rs 37,92,383 under IGST was incorrectly shown in Form 3CB of the tax audit report because of an accidental error via its CA. Unfortunately, the required supporting documents were not available during the appellate stage.

Brij Lal Meena, Additional CIT-DR, representing the Revenue Authorities, cited in support of the lower authorities’ order and stressed that the taxpayer has not been able to produce any third-party verification or proof from the GST department to confirm the IGST claim.

The Bench, including Accountant Member Dr. Mitha Lal Meena and Judicial Member Anikesh Banerjee, said that the CIT(A) had rightly removed the TDS-related additions since the taxpayer had provided pertinent payment challans u/s 194A and Section 194H.

The tribunal for the IGST claim said that the taxpayer has not been able to file the corroborative proof. The tribunal, in consideration of the grounds of the appeal and the claim of the incorrect reporting in Form 3CB, had remanded the case to the jurisdictional AO for fresh verification.

Therefore, for statistical purposes, the appeal was permitted.

| Case Title | Narain Dal And Oil Mills vs ITO Ward 1 |

| Case No. | I.T.A No.793/Jodh/2024 |

| For Petitioner | None (Adj. Application Rejected) |

| For Respondent | Shri Brij Lal Meena, Addl.CIT-DR |

| ITAT Jodhpur | Read Order |