The Ahmedabad Bench of Income Tax Appellate Tribunal (ITAT) asked for a fresh assessment for a matter that engages the disallowance of commission payments for non-deduction of TDS u/s 40(a)(ia) of the Income Tax Act,1961, acknowledging the proof furnished under rule 29 of the ITAT rules which was unavailable as of the financial issues along with statutory proceedings pertinent with the loan defaults.

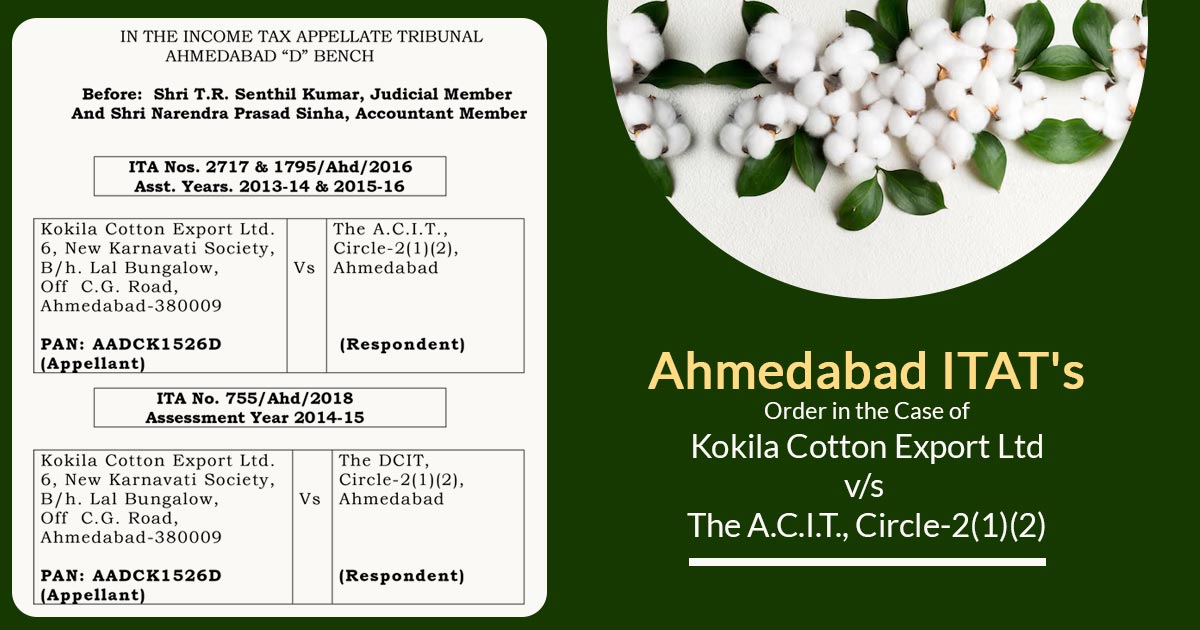

The taxpayer Kokila Cotton Export Ltd has submitted the pleas against the ex-parte appellate orders for the Assessment years (AY) 2013-14, 2014-15, and 2015-16.

As to the liquidity problems and statutory proceedings pertinent to the loan defaults with the State Bank of India, the taxpayer was not able to showcase the pertinent documents at the time of the assessment.

The statutory case was settled and a No due certificate was furnished in 2018. The taxpayer has furnished the other documents under rule 29 of the ITAT rules, asking for their admission in the interest of justice quoting a ruling of the Gujarat High Court.

The counsel of the taxpayer cited that for the AY 2014-15 the commissioner of Income Tax (Appeals)[CIT(A)] does not regard the documents directing to the confirmation of the additions. The counsel sought for the other opportunity to show the matter to the Assessing Officer (AO), including another two years.

To send the case back to the Assessing Officer to review the additional proof, the Senior Revenue Counsel, Shri Rignesh Das, had no objection.

The submissions have been regarded by the tribunal and analyse the shown documents. The problem was the disallowance u/s 40(a)(ia) for non-deduction of TDS on the commission payments to the foreign agents. It was regarded that the taxpayer had been engaged in the export business for various years and the commission payments were recurring.

As of the financial issues and loan recovery measures from the State Bank of India, the taxpayer cannot attend the appellate hearings. However, the needed documents like ledger accounts, sales contracts, Chartered Accountant certificates, bank advice, invoices, debit notes, and bank statements were now provided under Rule 29 of the ITAT Rules.

On the principles set by the Gujarat High Court, the appellate tribunal has directed the principles in the Pari Mangaldas Girdhardas case for admitting the additional proof. It accepted the taxpayer’s furnished explanation for the financial problems and permitted the updated documents.

The two-member bench comprising T.R.Senthil Kumar (Judicial Member) and Narendra Prasad Sinha (Accountant Member) wished to remand the matter before the Assessing Officer (AO) asking them to analyse the additional documents and pass a new assessment order as per the statute providing a fair chance to be heard. The taxpayer was asked to cooperate and furnish all the pertinent documents for an effective decision.

Therefore the taxpayer’s filed plea was permitted for statistical objective.

| Case Title | Kokila Cotton Export Ltd vs. The A.C.I.T., Circle-2(1)(2) |

| Citation | ITA Nos. 2717 & 1795/Ahd/2016 Asst. Years. 2013-14 & 2015-16 |

| Date | 29.11.2024 |

| Assessee | Shri Mehul K. Patel |

| Represented | Shri Rignesh Das |

| Ahmedabad ITAT | Read Order |