ITAT Delhi In the matter of Cheil India Private Limited vs. DCIT, addressed the disallowance of a ₹2.57 crore deduction asserted u/s 80G of the Income Tax Act, 1961, for CSR expenditures.

The deduction has been refused by the National Faceless Assessment Centre (NFAC) reasoning that CSR expenses as obligated u/s 135 of the Companies Act 2013 do not have the voluntary nature needed to be entitled as a donation. Therefore these expenses were counted as legal obligations instead of the donations qualified for the tax deductions.

The taxpayer claimed that the incurred payments for CSR objectives were donations to the eligible trusts and institutions, entitled under Chapter VIA for deduction. But both the NFAC and Commissioner of Income Tax (Appeals) kept the disallowance interrupting the legislative objective behind the CSR expenditures as the application of income instead of the business expenses or voluntary donations.

The ITAT has analyzed precedents along with the rulings favouring deductions for the identical CSR-linked donations u/s 80G, even when the disallowed u/s 37(1). It was noted by the tribunal that CSR expenditures can entitled as donations when filed to approved institutions varying from the direct cost of CSR projects.

Delhi ITAT by reaffirming the interpretation that section 80G deductions applied to these contributions aligned with previous rulings assisting the assessees stance. The same decision specifies the treatment of CSR expenditures as per the income tax balancing the legal obligations with the tax advantages eligibility.

Advocate Ananya Kapoor represents the taxpayer.

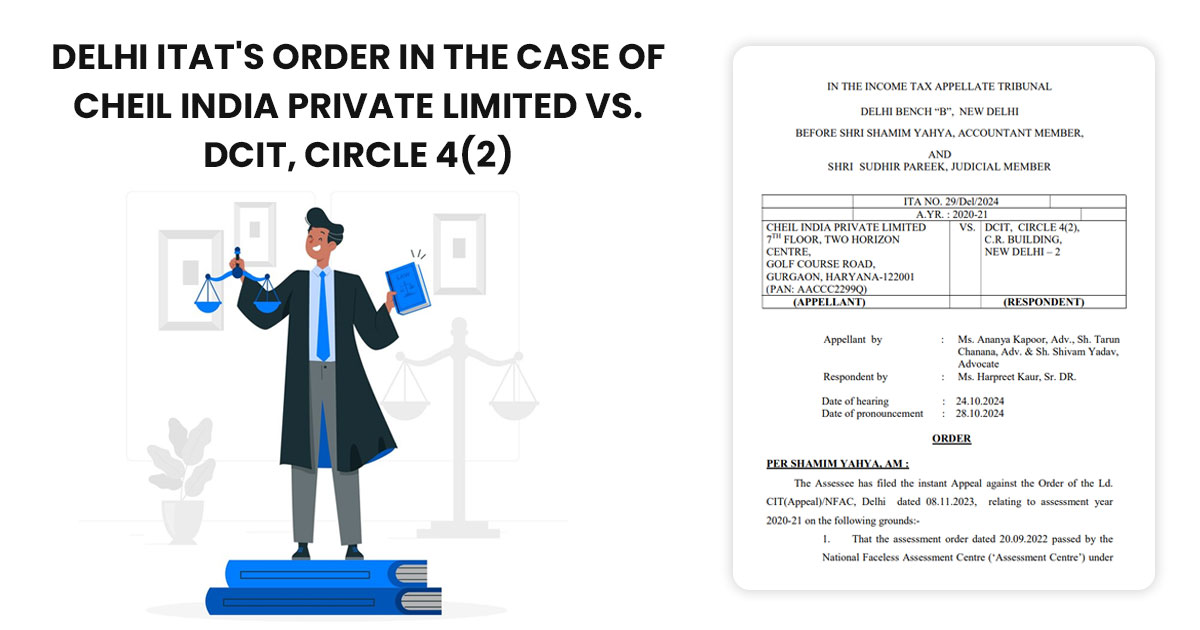

| Case Title | Cheil India Private Limited vs. DCIT, CIRCLE 4(2) |

| Citation | ITA NO. 29/Del/2024 |

| Date | 28.10.2024 |

| For the Appellant by | Ms. Ananya Kapoor, Sh. Tarun, Chanana, and Sh. Shivam Yadav |

| For the Respondent | Ms. Harpreet Kaur |

| Delhi ITAT | Read Order |