The Karnataka High Court has ordered the GST department to set up a system that lets it keep track of the notices it sends to taxpayers through email. This means that when notices are sent, there will be a way to confirm that they were delivered and received.

The department must develop a system to authenticate delivery of e-mail notices, when the said e-mail was opened, and when the e-mail was read, Justice Suraj Govindaraj mentioned.

The adjudication orders under Section 73 of the CGST Act, 2017, for the period April 2020- March 2021 have been contested by the applicant/taxpayer. Taxpayer, the orders have been passed without the issuance of any notice before them.

The e-mail notice was sent dated 29.11.2024, and a reminder was sent on 30.12.2024, even after which the taxpayer did not appear, and as such, the orders were passed, the department claimed.

Read Also: Email Notice or Personal Delivery of GST Order Mandatory Before Publication on Portal or Newspaper

As per the department, no system exists that specifies an acknowledgement for the delivery of the e-mail.

The bench cited that “This is a case where, though e-mail is claimed to have been sent by Revenue, the petitioner contends that the email has not been received. It would therefore be required for the respondents to establish a system to ascertain delivery of e-mail notices, when the said e-mail was opened and when the e-mail was read, so that these kinds of situations could be avoided.”

The bench, given the above, permitted the petition and quashed the impugned orders.

Further, the bench remanded the case before the Assistant Commissioner of Commercial Taxes for fresh consideration and asked the taxpayer to appear before the Assistant Commissioner and file a response.

What is Section 73?

Section 73 of the CGST Act defines a case where a taxpayer has not paid any right tax amount, has spent less than they should have, and incorrectly proclaimed a tax refund, or has claimed more GST ITC than authorised without any intent to defraud the system. This section is used to manage honest errors that companies might make when they file GST returns or pay their taxes.

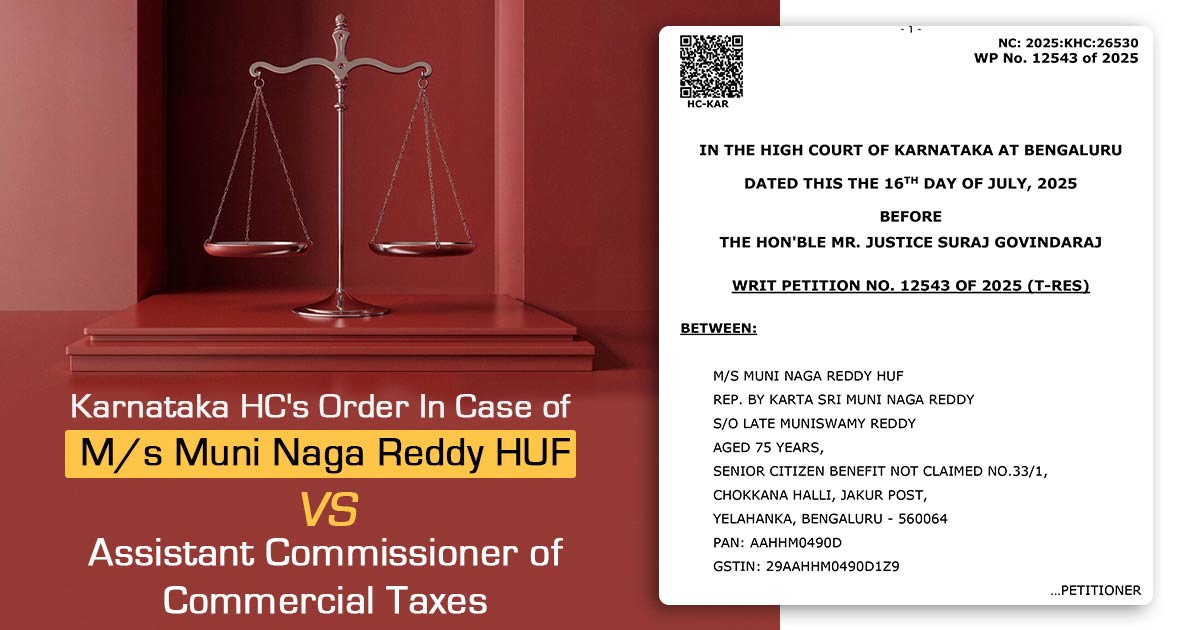

| Case Title | M/s Muni Naga Reddy HUF vs. Assistant Commissioner of Commercial Taxes |

| Case No. | WP No. 12543 of 2025 |

| For the Appellant | Sri. Nagabushana M |

| For the State | Sri. K. Hemakumar |

| Karnataka High Court | Read Order |